Highlights

- Another cryptocurrency lending and borrowing service provider has halted its operations

- Vauld has its corporate office in Singapore, and it promises interest on deposits of native tokens and stablecoins

- Market conditions are to blame for the suspension of withdrawals, the blog post by Vauld states

There is no guarantee that everything will be fine in the crypto market when assets are trading in the green. Bitcoin has gained value lately, and so has Ethereum, but yet-another crypto lending and borrowing platform has declared a halt on withdrawals.

The latest addition to the list -- which already has names like Voyager Digital, Celsius Network, and Three Arrows -- is Vauld. It is also referred to as Vauld crypto within the community. What is Vauld, why has it stopped withdrawals, and when will it resume operations? Let us explore.

What is Vauld?

Vauld claims to be a crypto financial services provider, akin to any traditional institution like a bank. The corporate office is based in Singapore, while the company operates primarily in India. The principal offering of Vauld is fixed deposits of cryptocurrencies, which it states, earn interest.

The depositor can park cryptos like BTC, ETH, and XRP, and even stablecoins like BUSD and USDC, which can earn high interest. The rate of interest varies for each crypto token. Also, there is an option of a basic “savings” account, which earns a little less than the fixed deposit. Separately, crypto borrowers can also avail Vauld services, which seems to be the basic business model just like traditional banks.

Vauld also offers trading and something termed an “automatic investment plan”, which appears to be like systematic investment plans (SIPs) in conventional investment. On its official website, Vauld claims withdrawals are “instant”, with exceptions of only large sums exceeding US$100,000.

Also read: Cryptoqueen Ruja Ignatova on Most Wanted list: What it means for cryptos

Why has Vauld stopped withdrawals?

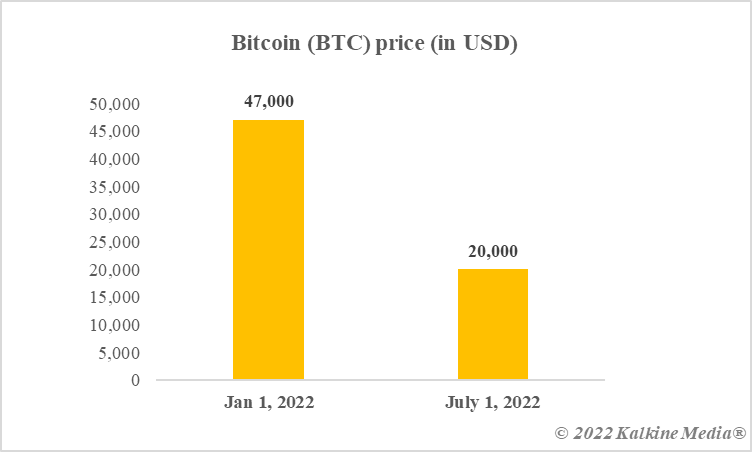

The company has cited “volatile market conditions” as the main reason behind jeopardising interests of depositors.

Vauld also blamed “financial difficulties” of its business partners for its failure in continuing normal operations. Besides, the blog post also mentions the collapse of Terra and names of entities like Celsius and Three Arrows. The exact reason for the failure of Vauld will only become clear with time.

When will Vauld resume operations?

Vauld has only mentioned that it was exploring “possible options”. In the meantime, deposits and withdrawals remain halted. For now, depositors of Vauld seem to be in limbo.

Data provided by CoinMarketCap.com

Bottom line

Vauld is adding more pain and pessimism to the already ailing crypto market. Even though major cryptos have rebounded lately, the Vauld news can severely hit sentiments. Its failure reveals how vulnerable the concept of crypto lending and borrowing is. Market participants tout their services like any traditional bank; however, it has remained a challenge to run smooth operations. For now, there is no certainty over when Vauld will resume withdrawals.

Also read: Understanding basics of cryptocurrency taxation in Australia

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.