Highlights

- Many cryptos, led by BTC and ETH, have gained of late, bringing some cheer to enthusiasts

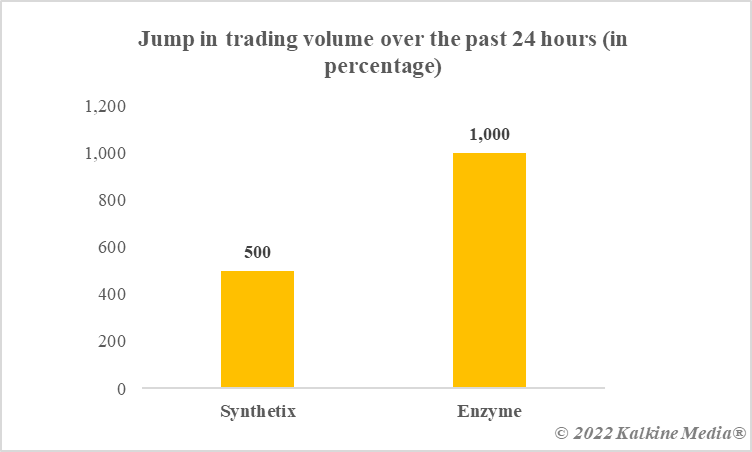

- Altcoins like Synthetix and Enzyme have also appreciated, with rise in their trading volumes

- Enzyme Finance provides asset management services to depositors, with user-controlled vaults

The crypto world has lately rebounded, with its biggest asset Bitcoin (BTC) finding a little stability at US$20,000. Ether (ETH), which dropped below US$1,000 last week, is trading at over US$1,100 as of writing.

Separately, many other altcoins are also gaining. The Synthetix (SNX) crypto has gained more than 50% in the past one day, with its trading volume appreciating nearly 500%. Synthetix is a decentralised finance (DeFi) protocol for trading in “synthetic” assets. A platform titled Enzyme Finance is also buzzing, and the 24-hour trading volume of its token MLN has soared over 1,000%. Let’s explore.

What services does Enzyme Finance provide?

While platforms like Synthetix claim to provide returns through staking of tokens, Enzyme offers a unique vault service, which allows users to build their own vaults to earn returns. Each vault can have a different investment strategy, Enzyme Finance says.

Enzyme can be used in two ways, one as a vault manager, and the other as a depositor. Built using the Ethereum blockchain, Enzyme claims its infrastructure allows depositors to retain the custody of their assets. A vault manager can embed a number of fees into the vault, including asset management fee and entry fee.

Enzyme states it also provides access to multiple DeFi protocols, enabling yield farming for depositors.

Also read: LimeWire set to roll out NFTs and LMWR crypto: What you should know

Enzyme crypto price

The MLN token, also referred to as the Enzyme crypto, is said to be native to the Enzyme Network. It has a market cap of over US$46 million, as of writing, with a price of nearly US$22 per token.

The Enzyme crypto’s 24-hour trading volume has skyrocketed by over 1,000%. This has also translated into its price surging by almost 15% over the past one day. The circulating supply of the MLN token is less as compared to other native tokens. Over two million MLN tokens are said to be trading on exchanges like OKX and Binance.

Why is Enzyme crypto rising?

One possible reason could be the issues with the Celsius Network, a centralised DeFi protocol. Enzyme allows users to have their own investment strategy in the form of a vault, with an option to include other depositors as well. It claims that depositors always retain custody over their assets.

Besides, other cryptos, led by Bitcoin, have also gained of late, which might have supported the price of the MLN token.

Data provided by CoinMarketCap.com

Also read: Render crypto appreciates 30%: Why is RNDR token rising?

Bottom line

Enzyme Finance’s MLN token has witnessed a huge surge in its trading volume. The platform provides vault services and depositors can pick a vault by comparing their investment strategies. One of the reasons behind the surge in the price of Enzyme crypto might be its claim that depositors never lose custody of their assets.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.