Highlights

- Risky assets, including listed stocks, had a muted run in 2022, primarily due to inflationary pressures and a hawkish Fed

- Cryptocurrencies, which though cannot be compared with listed stocks, also lost value, and names like Terra collapsed

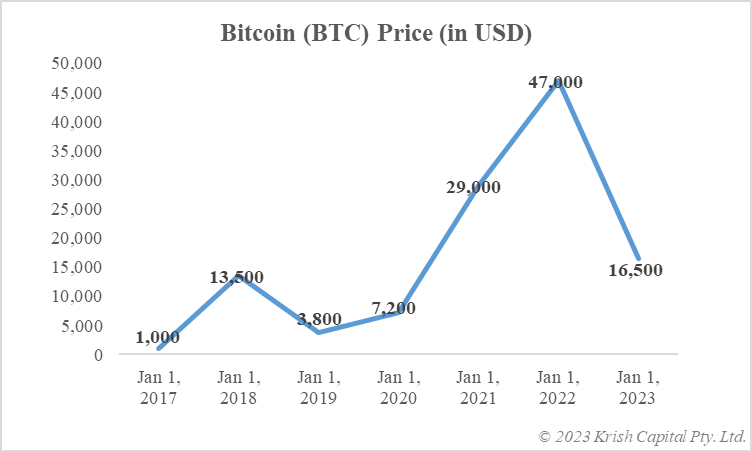

- Crypto winter, the term used to define the dull phase, has not subsided, and Bitcoin’s price is too low as compared to November 2021 highs

To imagine that popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE) would decline so sharply through 2022 would have been improbable when the last year began. The years 2020 and 2021 were quite impressive in terms of returns produced by various cryptocurrencies. Bitcoin shone during the phase, reaching a whopping US$68,000 price level in November 2021.

Altcoins like Solana (SOL) and Axie Infinity (AXS) shone even better than Bitcoin during that period, thereby piquing the interest of many across the globe. The past year was, however, an extremely gloomy phase, described as the so-called ‘crypto winter’. Would this winter trouble enthusiasts in 2023 as well?

2022 and crypto winter

In 2022, it was not only about the constant and steep drop in cryptocurrencies’ prices. The concerns were wide ranging, and the biggest hit to sentiments was the failure of names like Terra (a stablecoin project) and FTX (a cryptocurrency exchange). Others like Voyager and Celsius, companies that promised high returns, filed for bankruptcy. Trouble gripped the entire sector, from Bitcoin to altcoins and non-fungible tokens (NFTs) to exchanges, which helped popularise the term ‘crypto winter’.

Bitcoin was riding high in 2021, and things like its recognition as legal tender in El Salvador and favourable commentary by personalities like Jack Dorsey added charm. This momentum, however, lost ground in 2022. First, the fall of TerraUSD and, then of intermediaries like exchanges dealt a terrible blow.

Data provided by CoinMarketCap.com

2023 and cryptocurrencies

Can cryptocurrencies rise in 2023? This is one of the most prevalent questions being asked in almost every debate and discussion on these speculative assets. There are speculations that Bitcoin and altcoins might bounce back and fears that values may drop even further given the atmosphere of high interest rates. In all, there is little certainty over where cryptocurrencies are headed this year. For now, Bitcoin has yet to show any sign of rebounding, which is why many experts think that the crypto winter is far from over.

Viewpoint

The downfall of many aspects of the cryptocurrency sector, including valuations of BTC and altcoins, the failure of Terra, FTX and other big names, and a dip in interest in NFTs, led to a continual crypto winter through 2022. That said, the crash came during a phase when other risky assets like listed stocks also fell due to central banks’ hawkish posture. One can only ask when Bitcoin and other assets would start to gain, but there is no certain answer.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.