Highlights

- In the cryptoverse, Bitcoin is followed by Ether and Tether in terms of market cap

- Tether, which has multiple stablecoin offerings, is largely understood as a US dollar-pegged cryptocurrency

- A few experts have apprehensions regarding the reserves that Tether holds to back the tokens it issues in the market

The cryptocurrency world is a confusing domain. The broader market has yet to agree on whether Bitcoin, the biggest participant, is a virtual currency, a tradable asset, or both. Whether Ether is a native token confined to the Ethereum ecosystem, or is it a Bitcoin and/or a fiat currency rival is also debatable. And then there is a debate around the third-biggest participant by market cap, the Tether stablecoin project. Tether, in comparison to most other cryptocurrencies, has traded at a stable value thanks to its fiat currency peg.

But one more question about the Tether token has also baffled crypto enthusiasts -- Are Tether and USDT the same thing? USDT, the ticker often used alongside Tether, is a US dollar-pegged stablecoin. Many assume that the terms Tether and USDT are synonymous. However, let us dive a little deeper to understand the thin line between Tether and USDT.

Tether is a broader ecosystem

Tether is not all about the USD-pegged USDT token. It is a blockchain-powered stablecoin project which is looking to penetrate more fiat currencies and assets. Take for example the ‘Tether Gold’ token, which it claims provides easy ownership of physical gold. Tether Gold uses the ticker XAUt, and it is further claimed that redemption in physical gold is available in selected jurisdictions. Similarly, the Tether project has stablecoins pegged to the euro, the Chinese yuan (CNH), and the British Pound. It is a subject of speculation that the project might add more fiat currencies for the issuance of new stablecoins.

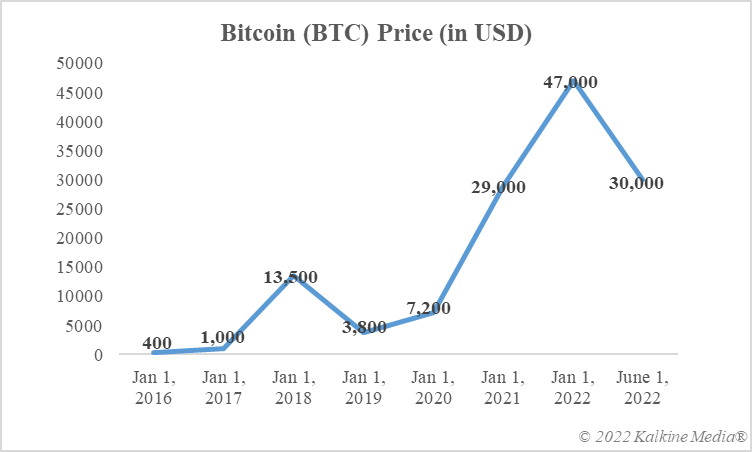

The actual target of Tether seems to provide a stable-value cryptocurrency that uses blockchain for transfer purposes. It claims to have a proper backing of reserves for its stablecoins. That said, the stablecoin category has also encountered troubles, with one popular asset TerraUSD (UST) losing its peg a few months earlier. This event fueled a major selloff in cryptocurrencies, and even Bitcoin lost immense value in the aftermath.

Data provided by CoinMarketCap.com

USDT is one of many Tether products

USDT -- the US dollar-pegged Tether stablecoin -- is the project’s biggest offering, but not the only one. In terms of the market cap within the broader cryptoverse, the USDT token ranks third, with Bitcoin and Ether occupying the first two places. The US dollar is arguably the most powerful fiat currency in the world, which can be the reason why the USDT token is often considered a representative of the Tether ecosystem.

Bottom line

For now, USDT remains the biggest offering of the Tether project. However, other stablecoin tokens of the project highlight the error made when assuming that Tether and USDT are one and the same thing. Whether or not Tether has adequate reserves to back its stablecoin products is a separate debate.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.