Highlights

- Nickel helps in delivering higher energy density and greater storage capacity in batteries.

- Industry experts believe that nickel could reduce the use of cobalt in lithium-ion batteries.

- BHP has announced an initial investment of US$50 million in the Kabanga Nickel Project.

- Tesla Inc. has signed a deal with Talon Metals for securing nickel for its batteries.

- Nickel prices are expected to remain strong in the short-term as inventories are running low amid growing demand.

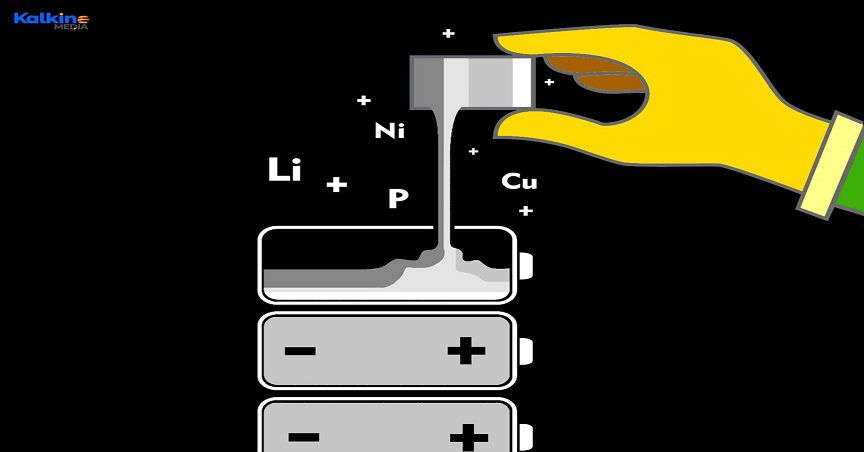

The world is standing at the edge of a new electric era. Green metals including lithium, cobalt, nickel, and copper can be considered as the building blocks of this new era.

The growing demand for electric vehicles and battery storage technologies is pushing the demand for battery metals, leading to a strong price movement for these commodities.

Can nickel be the most sought-after commodity?

2021 was a terrific period for lithium, the lightest metal on earth and the hot metal commodity. The price of lithium more than doubled during the last year.

The Democratic Republic of the Congo is the largest supplier of cobalt, which has wide use in battery applications. The supply of cobalt is already constrained and remains in controversy. The African country has been accused of human rights abuse, child labour and unsafe mining practices. The major world economies or companies do not want to source cobalt from the country, which lacks transparency in the supply chain.

Also, cobalt is the most expensive material used in batteries. Rechargeable batteries come with two most common cathodes- Nickel Cobalt Aluminium (NCA) and Nickel Manganese Cobalt (NMC). With advancements in battery technologies, rechargeable batteries are expected to be available without cobalt, and nickel will replace cobalt in all such batteries.

Must Read: Best battery metal stocks of 2021

Back in 2020, on its Battery Day event, Elon Musk, CEO of Tesla Inc. (NASDAQ:TSLA), announced plans to manufacture cobalt-free batteries. The move to use less or no cobalt would make batteries less costly, but at the same time, increase the demand for another metal in the battery- nickel. Given the situation, last year, Elon Musk urged U.S. mining companies to produce more nickel.

Image source: ©2022 Kalkine Media®

Interesting Read: What's panning out in Australian battery recycling space?

Industry events indicate strong tailwinds for nickel

Recently, two major announcements in the nickel mining sector show a glimpse of the upcoming tailwinds in the industry.

Tesla Inc. has roped in Talon Metals Corp to secure nickel from its Tamarack Mine Project in Minnesota. The US-based company plans to use the nickel supply for manufacturing lithium-ion batteries in its plants in Texas and Nevada. The automaker has already signed nickel supply deals with Australian mining giant BHP Group.

In another major event, BHP Group (ASX:BHP) has announced plans to proceed with US$50 million investment in the Kabanga Nickel Project. Located in Tanzania, Kabanga is considered one of the largest development-ready nickel deposits in the world.

The project is expected to commence production by 2025, targeting annual production of 65,000 tonnes with a life of mine (LOM) of more than 30 years.

To know more, pls watch: Here's why BHP plans to invest in Tanzania’s Kabanga Nickel project?

Nickel price outlook

On 10 January 2022, nickel prices hit a month high as inventories ran low. At the London Metal Exchange (LME), nickel traded 0.9% higher at US$20,915 per tonne. In the last one year, nickel prices have gained nearly 23%.

In the short-term, industry experts and analysts anticipate nickel prices to remain strong and increase further amid dwindling supply and surging demand.