Summary

- Copper futures price is gaining momentum and has crossed the 8-year high mark.

- The fear of supply disruption is fuelling the price gain apart from the demand and supply ratio.

- Mines in Peru and Chile are still struggling to operate at the pre-COVID levels.

One of the most remarkable stories in the recent past, the recovery of copper price has been in the limelight for the past few months. The coronavirus-led global economic crisis substantially hit the prices of various commodities. Copper fell to US$ 4,617 per tonne at the London Metal Exchange (LME), the lowest in four years, during the lockdown period in many countries.

On Wednesday, 6 January 2021, copper prices reached US$8,039.50 a tonne, their highest level since February 2013.

Image Source - ©Kalkine Group 2020

Also Read: Copper Tops USD 8,000, Commodity Supercycle at Play?

What’s Adding Fuel to the Copper Price Momentum?

1. China’s speedy recovery and economic bounce back

The price bottomed to its four-year lowest due to the lockdown and shut down of manufacturing units in China. However, as the Chinese economy jumped back towards normalcy, it pulled the demand and price of copper.

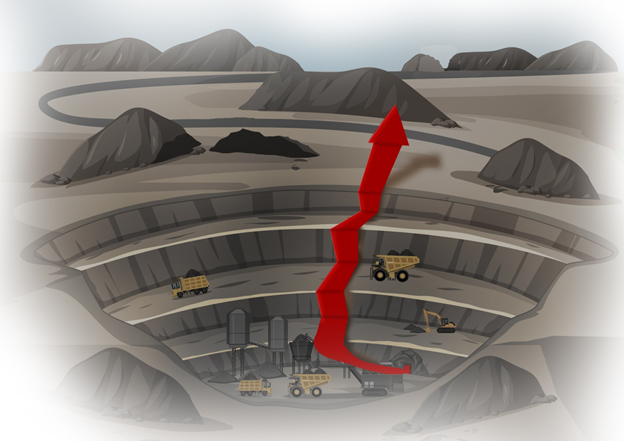

2. Production Disruption

The rising cases of COVID-19 led to the closure of mining operations in Chile, Peru and Panama. World’s largest producer of copper, Chile caters to 32% of the global copper export market. As the mines reopened in August, production took a hit during September quarter. Similarly, for Peru, production dipped by 20% in 1H 2020 due to lockdowns.

Image Source - ©Kalkine Group 2020

3. Dollar Depreciation and Economic Stimulus

The US dollar depreciation and the stimulus packages by various economies to recover from the recession have helped in the price rise since August. Economic activities are gradually picking up in the US and Eurozone that are also increasing the demand for the metal.

Important Update: China to tighten its grip on world’s copper market: Floats Cu Futures

In the backdrop of rising copper prices, let us discuss a few of the ASX-listed copper mining stocks.

1. OZ Minerals Limited (ASX:OZL)

South Australia-based copper miner OZ Minerals Limited has copper and gold assets in Australia and Brazil. The Company produced 23,873 tonnes of copper during the September quarter.

The Company operates three mines - Prominent Hill, Carrapateena and Carajas. Out of these three, Prominent Hill produces nearly 60% of the entire Company’s copper.

OZ Minerals upgraded the reserve estimate of its under-development mine, West Musgrave, in December. The total ore reserve estimate has been increased by 33 million tonnes while copper reserve increased by 100,000 tonnes.

The Company has also ramped up the production at Carrapateena to 4.25 Mt annually.

OZL stock traded at A$ 20.34 with a market cap of A$ 6.476 billion as on 7 January 2021 (AEDT 12:32 PM).

2. BHP Group (ASX:BHP)

Global mining giant BHP Group Limited has reported copper production of 413kt during September quarter. Higher production at the Olympic Dam helped to offset the production loss due to COVID-19 related lockdowns.

BHP has successfully completed the third phase of the exploration drilling at Oak Dam in South Australia. The company has reported high-grade of copper mineralisation intercepts.

BHP has announced copper production guidance of 1,480-1,645kt for FY21.

BHP stock traded at A$ 46.480 with a market cap of A$ 130.2 billion as on 7 January 2021 (AEDT 12:38 PM).

3. Rio Tinto Limited (ASX:RIO)

Diversified mineral explorer Rio Tinto reported 129.6kt of mined copper production in September quarter, 2% lower than the previous quarter. The lower production during the quarter was attributed to the pit sequencing at Kennecott to facilitate the extended smelter shutdown.

Refined copper production dropped by 57% during the quarter to 24.8kt.

RIO has given production guidance of 475-520kt of mined copper and 135-175kt of refined copper production for 2020.

On 7 January 2021 (AEDT 12:41 PM), RIO stock traded at A$ 122.220 with a market cap of A$ 42.96 billion.