Highlights

- The cost of living has skyrocketed in many nations due to inflation

- In Australia, the annual Consumer Price Index (CPI) of food and non-alcoholic beverages rose 4.3% from March 2021 to March 2022

- Food stocks tend to be a hedge during market downturns as their products are always in demand

With inflation skyrocketing across the global economy, the costs of living in many nations have soared. A mix of factors like COVID-19-related supply chain disruptions, labour shortages, and Russia's invasion of Ukraine have inflicted pain on the economy and threatened the global food supply.

In Australia, the annual Consumer Price Index (CPI) of food and non-alcoholic beverages rose 4.3% from March 2021 to March 2022. Amid rocketing grocery prices and strong demand, one must look for stocks whose prices might increase with inflation. Further, food stocks tend to be a hedge against plummeting markets as their products are always in demand.

Also read: AAC, GNC, RIC: How are these ASX food stocks performing?

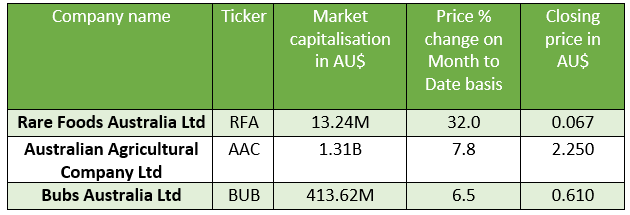

On that note, let's have a quick glance at three ASX food stocks that have provided decent price returns on a month-to-date basis.

Data source: Refinitiv as of 20 June

Rare Foods Australia Ltd (ASX:RFA)

Rare Foods Australia supplies premium, wild-harvested, Greenlip abalone (a marine snail) to local and overseas customers. The company has developed the world's first commercial Greenlip abalone sea ranching business and has constructed proprietary, purpose-built artificial abalone reefs.

Recently, Rare Foods received a certification from the Marine Stewardship Council (MSC) as a fully accredited and internationally recognised Wild Enhanced and Sustainable Fishery for Greenlip Abalone. Also, on 01 June 2022, the company launched its direct-to-customer eCommerce channel.

Australian Agricultural Company Limited (ASX:AAC)

Image source: © 2022 Kalkine Media®

In the half-year ended 31 December 2022, AAC drastically increased its Statutory Net Profit after tax to AU$136.9 million vs AU$45.5 million of the previous corresponding period (pcp).

According to the company, the key driver behind improved results is its sales in the USA. Its branded meat sales value grew by 56% in North America, and sales volume increased by 21%.

Bubs Australia (ASX:BUB)

Bubs Australia deals in a range of premium Australian infant nutrition and goat dairy products. It also includes speciality and nutritional milk powder products for the whole family. The company offers a range of products for feeding times as well as stages of development from newborn through to childhood.

Last week, BUB upgraded its FY22 revenue and earnings expectations. Now the company is anticipating gross revenue to be more than AU$100 million for FY22, subject to scheduled operations occurring without disruption, with at least a 100% increase on the AU$1.2 million underlying EBITDA (excluding non-cash equity compensation expenses).

Related read: Bubs (ASX:BUB) expands US presence, becomes supplier to Walmart