Summary

- Insider Selling is the process of selling securities by an insider of a company.

- Insiders must record their sales openly so that every investor can see when a particular insider is selling.

- Insiders often have more knowledge of a corporation than the general public.

Insider selling takes place by the insiders of a company. These people can be a manager, an executive or beneficiary of the company with more than 10 per cent of the stock. It can also be an employee of the company who knows of the important activity of the company.

Because an insider has a very deep awareness of a firm's position and outlook in the market, insider buying and selling can be an excellent indicator of whether a firm will start a bullish or bearish trend. In addition, insider buys and sells are made public to maintain market transparency, and outside investors frequently use these trades as predictors of future price changes.

Image source © Skypixel | Megapixl.com

How are Insiders Trading different from Insiders Buying & Selling?

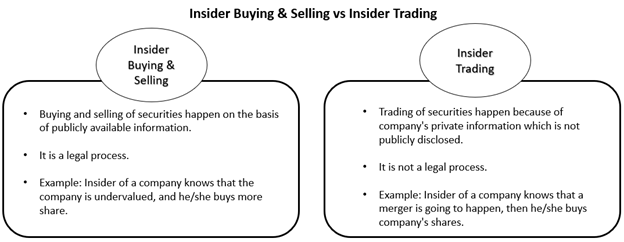

There is another term called 'insider trading'. It refers to the sale and purchase of a public-listed company's stock when the material information is not publicly available.

There is a difference between insiders buying & selling and insiders trading. Trading is illegal and monitored by the respective Securities Exchange Commission (SEC) of a country. It occurs when an insider of a company does transactions based on information that is not publicly available. For instance, an upcoming product announcement or unreleased news of a data breach.

On the other hand, Insiders buying & selling happen based on publicly available information. Therefore, it is a legal process as long as it is reported to the SEC.

Source: Copyright © 2021 Kalkine Media

Are all Insider Trading illegal?

No, not all insider trading is illegal. The majority shareholders, including directors and staff of the company, sell and buy stocks and securities of a publicly traded organisation regularly. All transactions involving the company's ‘insiders’ must be reported to the regulators within a certain time range. The same should be made available on the firm's website.

Where to find Insider Transactions?

One can find the information under the stock exchange announcements of the company.

In the US, SEC Form 4 is required for institutional investors and insiders. For insider and institutional stock trading reporting, the Securities and Exchange Commission (SEC) issued Forms 3, 4, and 5. This is because people in those positions have a significantly better chance of gaining access to inside knowledge.

Before placing your buy and sell orders, it is an excellent idea to analyse insider trades. However, when it comes to investing, it is better to have more knowledge. The EDGAR system (the Electronic Data Gathering, Analysis, and Retrieval system) was designed by the SEC to provide public access to a wide range of public disclosures, including Form 4. Additionally, the NASDAQ website has a search option that allows you to look up Form 4 filings.

What does it mean when an insider does a lot of selling?

What if one executive does a lot of selling while the others keep their stock? This is not always a warning sign. It is also not a massive problem if you notice a pattern of executives receiving stock option awards and then selling a portion of them.

However, if you notice a pattern of selling across the board without reason, it is time to pay attention. This is a pattern that some investment analysts look for. It is even more noticeable when a comparable amount of purchasing does not accompany it.

Image source © Skypixel | Megapixl.com

For example: When S&P 500 declined, lots of insider selling disproportionate cases happened. In 2014, the ratio broke 8 to 1, and the S&P 500 dropped about 6 per cent, while in 2007, the ratio was larger than 11 to 1, and the S&P 500 dropped a little under 5 per cent

How can you use insider reports of a company?

When you search for insider trades of a company and find many reports, you get an option to sift through the data and look for a trend.

If the insider list of a firm displays a lot of buying activity, it is a solid sign that the firm's leadership believes the stock is rising. They want a piece of those revenues. On the other hand, a selling trend could indicate that executives believe the stock will fall in value soon. They may be trying to sell before the price drops.

Based on these buying and selling trends, you can infer but cannot contact the CEO or top management of the company to check. In that case, what can you do?

The best option is to look at the company’s annual reports, financial statements, and other public information. Both insider transaction and these reports can help you together to decide on an investment.

_01_09_2025_07_01_12_631371.jpg)