Stuck by the pandemic and a homebody economy, the traditional business models of stock brokers are up for a toss. The accelerated shift towards online channels is forcing the Canadian brokerage industry to adapt digital transformation and faster mode of equity trading.

Top Canadian online stock brokerage firms such as Questrade, Wealthsimple and TD Direct Investing have already reported a steady influx of new traders amid COVID-19. These newbies are mostly DIY (Do It Yourself) traders, driven by lockdown and availability of hot stocks at discounted prices (thanks to the pandemic market crash).

The sudden surge in business has pushed competition among online brokers, with some implementing zero commissions to serve the broad range of new and existing investors.

Benefits of Online Trading

How to Choose Your Online Broker?

The new-age digital brokers offer top-notch trading tools, latest stock reports, educational resources – all combined with the terrific and intuitive user interface, clear portfolio construction tools and good customer support. In short, choosing the right online brokerage is no child’s play. We enlist some factors to help choose your online broker, including but not limited to, cost, investment advice, etc.

Five Prominent Online Brokerage Firms in Canada

Here’s a list of the top online brokerage firms in Canada, along with their key features and pricing.

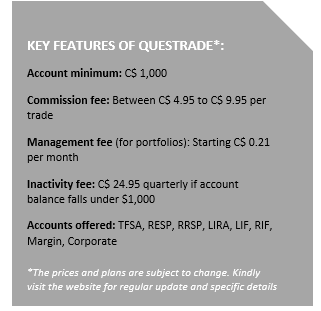

- Questrade

Questrade is among the oldest online brokerage firms in Canada, its doors opening in 1999. It is regularly rated among the best and fastest growing online brokerage firms of the country. It primarily operates online but also has a physical store. It allows investors to trade on both the Canadian and the US stock markets.

Questrade offers two ways of investing – Self-Directed Investing (DIY model) and Questwealth Portfolios (pre-built portfolio model). The ETFs are free to buy on Questrade. The platform focuses on user experience and provides well-researched market analysis for investors.

Questrade is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF), which means funds are protected against insolvency of up to C$ 1,000,000.

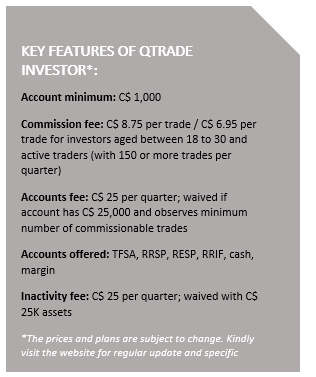

- Qtrade Investor

Qtrade has a good stock research platform and portfolio-level insight tools.

It offers 100 free ETFs and free mutual funds trade as well. Previously known as Credential Direct, Qtrade Investor has earned a reputation of being a cost-effective platform for frequent traders and young investors. Its customer service responsiveness has good reviews. It is also a member of the investor protection association, CIPF.

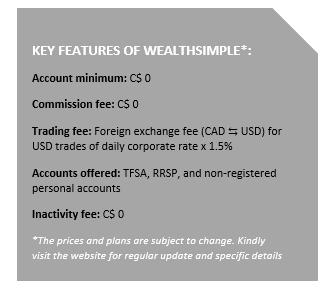

- Wealthsimple Trade

Wealthsimple, Canada’s answer to the US’ Robinhood app, is a mobile-only platform and offers commission-free stock trading. Its platform lets traders buy and sell thousands of stocks and ETFs on major Canadian and US exchanges. Traders can choose from Canadian or US-listed stocks available on the platform. The brokerage is protected by the CIPF and IIROC.

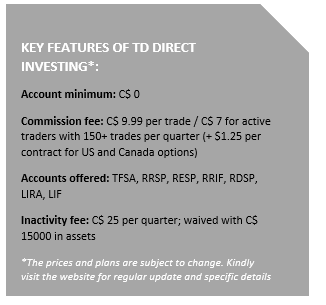

- TD Direct Investing

TD Direct Investing is the online brokerage service wing of Toronto Dominion Bank. The platform is deemed worthwhile for experienced traders seeking special or deep-insight tools and high trade volumes. The company boasts 30+ years of experience and operates as TD Ameritrade in the US. Its brick-and-mortar store was launched in 1984.

TD Direct Investing offers real-time market data, commission-free mutual fund trades and exclusive research reports through its Analyst Centre. It has four investing boards: WebBroker, TD app, Advanced Dashboard and thinkorswim® (for US options only).

- Interactive Brokers

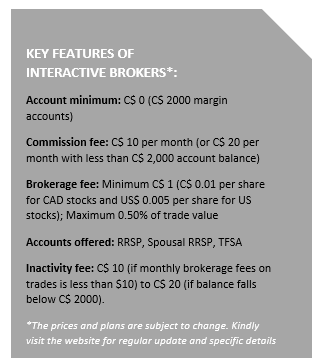

Interactive Brokers (IBKR) is rated among the best online brokerage platforms in Canada, not just for its low commissions but also for its versatile trading tools. It offers access to over 135 stock markets across 33 countries and presents 65 different order types.

In 2019, the company launched IBKR Lite that allows commission-free trades of stocks and ETFs. It has the IBKR Pro platform for professional traders. Interactive Brokers has a Trader Workstation (TWS) platform, primarily built for professional and institutional traders. It is a member of IIROC and CIPF.

The above-mentioned list provides a general overview of the key players in the Canadian market. Some of the other Canadian online stock brokerage firms are National Bank Direct Brokerage, Scotia iTRADE, BMO InvestorLine Self-Directed, CIBC Investor's Edge, HSBC InvestDirect, RBC Direct Investing and Virtual Brokers.

Pros & Cons of Online Trading

Some of the advantages and disadvantages of using online brokerage firms in Canada for early-stage equity investors include:

Online brokers are mostly appropriate for traders interested in the DIY (Do It Yourself) model or seasoned traders. Emerging online platforms may simplify the entire process for new traders, but it is still not as easy as using a robo-advisor or approaching a brick-and-mortar store. In both cases, an external agency does all research work for us. However, the digital brokerage system cuts through paperwork and brokerage-bias and helps the traders gain a rich understanding of investment.

One should also talk to the broker after shortlisting a few or more, and know about the procedure, formalities, integrated account services, charges, fees, settlement charges, custody fees, privacy assessment and additional service on demand etc.