Financial investment is a critical decision for an individual and requires a range of value-laden information. By the time one realizes the importance of money and the need to secure the financial future, complicated jargons and stringent market rules can get jarring. Then there is something called ‘navigating current market dynamics’, which even seasoned pros are struggling to figure out. Naturally, investors seek out the best financial minds to manage their hard-earned looney.

A whopping 58 per cent Canadians are stressed out about money matters and financial situation due to the ongoing pandemic crisis, shows a recent poll by Canadian Payroll Association. Another pre-COVID survey by Financial Planning Standards Council shared that 42 per cent Canadians rank money as their biggest stress.

Money matters can lead to sleepless nights and this is where financial guidance from market experts come into the picture.

General Financial Guidance vs Personal Financial Advice

In the Canadian equity landscape, investors can seek two kinds of advice:

- General Financial Guidance

- Personal Financial Advice

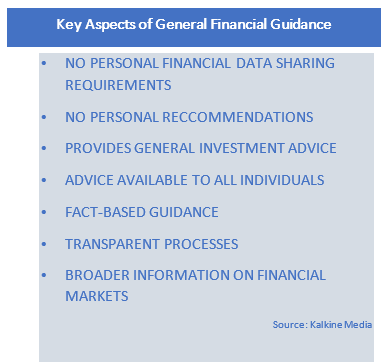

General financial guidance is provided by experts to navigate the financial markets. The advice is useful for individuals and larger groups, who can choose to follow or not to follow the guidance provided. Under these advisory services, only general financial advice is provided, without taking into account any individual’s investment objectives or financial situations or investment needs.

In short Investors are not required to share their personal or key financial data and neither receive any personalized investment advice.

The advisor presents a broader guidance, helping investors with information on ongoing market developments and general products available to make decisions. Therefore, one needs to assess whether the advice provided is appropriate to meet his financial objective after assessing his/her own financial situation.

General advice and guidance can be sought in all Canadian provinces and territories. Financial guidance is also suitable for the Do-It-Yourself (DIY) investors, many of whom choose to trade online.

In short, general guidance presents a holistic view of the market and do not take into account the personal circumstances of an investor. And therefore, it is advised to further seek help from financial adviser, stock broker or other professional before acting on any such advice.

Personal Advice, on the other hand, takes into account the investors’ personal financial goals, including taxation, estate and retirement planning. In Canadian markets, personal advice can only be offered by certified planners or advisors. These planners help create investment plans for long-term financial goals.

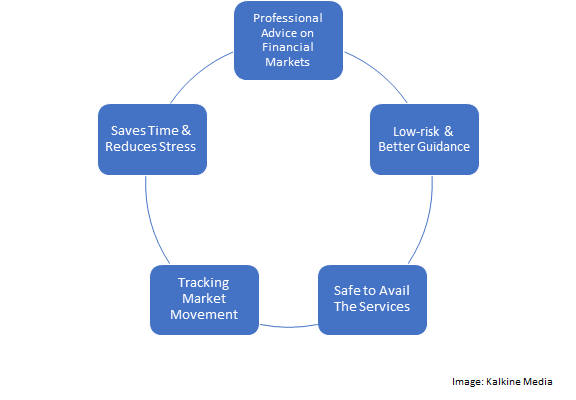

Any person or entity providing general guidance, on the other hand, provides advice about the market from a broader perspective, without keeping in mind the investors needs of financial management. Though, general guidance does not consider an individual’s need of financial planning, but it has some of its own benefits.

Benefits of General Guidance

Who Supervises Canada’s Financial Sector?

In case of a general advice, you can utilize the generic advice from the adviser to create your own opinion about whether a specific product is right for you personally or not.

Canada’s financial regulatory system is guided by the federal, provincial, and territorial governments. The government oversees regulation for banks, federal financial institutes, pension plans, etc. The Financial Institutions Supervisory Committee (FISC) supervises all financial institutions and sets up policies. The Office of the Superintendent of Financial Institutions (OSFI) also supervises the entire sector. The Bank of Canada sets the benchmark interest rates.

Financial advisors and planners are guided by regulatory authorities at provincial and territorial levels. Each Canadian province has separate legislative, regulatory, and administrative “rules” to govern the conduct of financial advisors (and firms) in each province. The rules are guided by an initial statutory framework arising from the “Securities Acts”.

However, agencies or individuals providing general guidance, including research reports, news and articles, are self-executing in nature and therefore exempted from filing or reporting to any Canadian securities regulator.