Summary

- Average life expectancy in Australia ranges from 80-85 years with people mostly retiring by 55.4 years, as per ABS.

- While, retirement is inevitable, it is difficult to estimate exactly how much retirement corpus one needs.

- The current savings and expected retirement corpus are therefore important for retirement planning.

- If one can save AU$500 now (about 7% of average monthly earnings), would that be enough for a comfortable retirement?

Retirement is inevitable, and so is the question. ‘How much do I need to retire comfortably?’. In Australia, the average life expectancy ranges from 80-85 years. According to Australian Bureau of Statistics, with most people retiring by 55.4 years. This means one needs to plan for almost 30 years of funds for survival. Retirement is not just about survival it is rather about a comfortable life ahead. While, retirement planning is essential, no one can tell precisely how much they will spend in the future.

Do listen to our podcast on: Understanding the basics of Retirement Planning

What are the vitals for a comfortable retirement life?

Before retirement, one needs to ensure a comfortable life ahead. Few of the expenses for a comfy life post-retirement are-

Source: Copyright © 2021 Kalkine Media

The above are basic expenses that will continue for the remaining life. The allocated amount amongst categories may vary based on age and requirements. Other than this, one may plan additionally for leisure and unexpected, unavoidable expenditures.

What is the retirement corpus needed then?

According to ASFA’s budget estimates for retirees, based on March 2021 rates,

- A retired couple aged 65-85 may need around AU$62K yearly to live comfortably.

- While a single person can live in about AU$44K per annum.

- People aging 85 and above may only need, i.e. AU$42K-58K per year.

Every month, this turns out to be an average of AU$4,300. It means to retire with AU$4,300 monthly expenses & continue till 83; one would need a corpus of almost AU$1 million. To this estimate, inflation costs will also add up.

Suggested Reads: 3 Tips for a secure retirement

So, can you retire at a monthly saving of AU$500?

The average weekly earnings of an Australian, as per ABS Survey of Average Weekly Earnings, in November 2020, was AU$1,700.

This amounts to a monthly earning of approximately AU$6,800 (1,700 x4). If one were to save AU$500 per month, it would mean a 7.35% of salary.

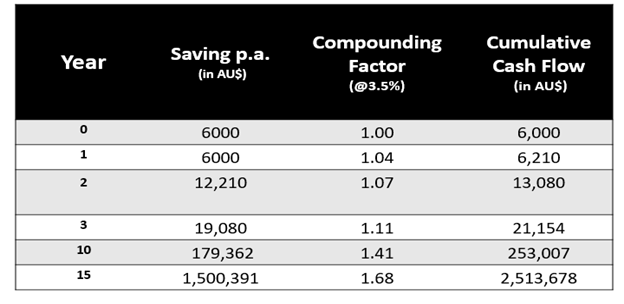

Now, Say you are 45 years old and earn a 3.5% (inflation-adjusted) annual return on your investments. Take that; you continue to save AU$500 per month (6K p.a); for 15 more years, you can build a corpus of AU$2.5 million by the age of 60.

Source: Copyright © 2021 Kalkine Media

It means annual earnings of AU$125K for 20 more years, AU$10K per month. Now, that is more than sufficient for a comfortable living! If you invest smartly now, it is possible to earn an even higher rate of return on your savings.

Suggested Reads: Planning for Retirement? These Tips Will Maximise Your Retirement Savings