Source: Joyseulay, Shutterstock

Summary

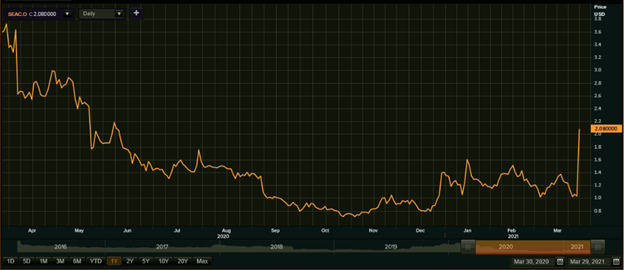

- Stocks of software company SeaChange International Inc (NASDAQ:SEAC, SEAC:US) shot up by nearly 102 per cent on Monday, March 29, bringing the price to US$ 2.08.

- Currently ranked high on the trending charts, SeaChange stock reflects a growth of nearly 49 per cent year-to-date (YTD) and that of over 76 per cent for the past one month.

- Its average movement volume for the last 10 days also shot up to over 37 million, while it stood at about 13 million for the past one month.

Stocks of software company SeaChange International Inc (NASDAQ:SEAC, SEAC:US) shot up by nearly 102 per cent on Monday, March 29, bringing the price to US$ 2.08.

Currently ranked high on the trending charts, SeaChange stock reflects a growth of nearly 49 per cent year-to-date (YTD) and that of over 76 per cent for the past one month.

1-year chart of SeaChange’s stock performance (Source: Refinitiv/Thomson Reuters)

So, what triggered this jump for this tech stock? Turns out, the video solutions provider recently shared a couple of corporate updates that are likely to have impacted its latest stock price spike. Let’s find out more about it.

SeaChange International Inc (NASDAQ:SEAC, SEAC:US)

SeaChange International announced on Monday morning that it has bagged a multi-year contract worth millions of dollars with a top broadband service providers in the US.

Without giving away too much details, SeaChange said that the new contract will see it help the unnamed client move its infrastructure to an online platform in order to enable “higher availability of service”. It will also be assisting the new client’s TV service business access “greater monetization” with the help of its technology.

©Kalkine Group 2021

The Massachusetts-based firm also informed its investors on Monday that it plans to launch an underwritten public offering of its shares to generate net proceeds for general corporate purposes.

While SeaChange stressed that the offering is “subject to market conditions” and does not come with a guarantee, it said that financial services provider Aegis Capital Corp is expected to be the sole book-running manager for it.

Amid these announcements, SeaChange recorded a share trading volume of over 386 million on Monday. Its average movement volume for the last 10 days also shot up to over 37 million, while it stood at about 13 million for the past one month.

SeaChange stocks currently record a price-to-book (P/B) ratio of 2.23, a price-to-cashflow ratio (P/CF) of 5.9 and a debt-to-equity (D/E) ratio of 0.23, as per the data on TMX.

The above constitutes a preliminary view and any interest in stocks should be evaluated further from investment point of view.