Highlights

- Unfavourable weather conditions, including floods in British Columbia last year and the omicron wave, continues to hamper economic recovery in 2022.

- The retail sector, which was majorly affected by the coronavirus in 2020 and 2021, is again facing challenges as omicron cases continue to rise in North America.

- Consumers appear to be facing inflationary pressure as inflation in December 2021 mounted by 4.8 per cent year-over-year (YoY), while grocery prices jumped 5.7 per cent YoY, according to Statistics Canada.

- Despite these obstacles, a Canadian retail company managed to increase its profit by 8.6 per cent YoY in the first quarter of FY 2022. In addition, the retail company also hiked its quarterly dividend by 10 per cent for the latest quarter.

The Canadian economy appears to have recovered a little from the supply chain constraints led by the COVID-19 variants in 2021. However, unfavourable weather conditions, including floods in British Columbia last year and the omicron wave, continues to hamper economic recovery in 2022.

The retail sector, which was majorly affected by the coronavirus in 2020 and 2021, is again facing challenges as omicron cases continue to rise in North America. On top of that, consumers appear to be facing inflationary pressure as inflation in December 2021 mounted by 4.8 per cent year-over-year (YoY), while grocery prices jumped 5.7 per cent YoY, according to Statistics Canada.

Despite these obstacles, a Canadian retail company managed to increase its profit by 8.6 per cent YoY in the first quarter of FY 2022. In addition, the retail company also hiked its quarterly dividend by 10 per cent for the latest quarter.

This Montreal-based company, with a market capitalization of over C$ 16 billion, is one of the largest grocery retail companies in the country. It also operates pharmacies under different trademarks like Jean Coutu and Brunet.

We are talking about Metro Inc (TSX:MRU), which currently has a return on equity (ROE) of 13.51 per cent.

Metro (TSX:MRU) saw profit gallop by 8.6% YoY in Q1 FY2022

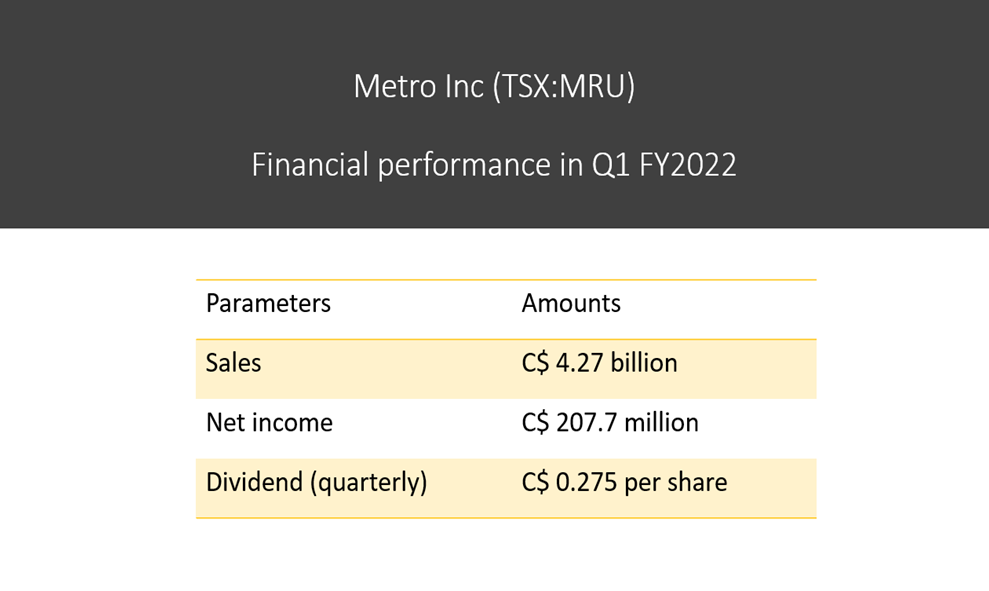

The grocery and pharmacy store owner generated net sales of C$ 4.31 billion in the latest quarter, up from C$ 4.27 billion in Q1 FY2021.

Metro noted a food basket inflation of 3.5 per cent in the first quarter of fiscal 2022. Its same-store sales decreased by 1.4 per cent YoY, but its online food sales remained consistent in Q1 FY2022.

On the other hand, its pharmacy same-store sales jumped 7.7 per cent YoY in this quarter. An uptick in physician visits pushed up prescription drugs by 7.1 per cent YoY, while its over-the-counter growth also helped its front-store sales grow by 8.9 per cent YoY in Q1 FY2022.

The retailer, in Q1 FY2022, generated net earnings of C$ 207.7 million in the latest quarter, as compared to C$ 191.2 million in the same period in FY2021.

Image source: © 2022 Kalkine Media®

Data source: Metro Inc

Metro is also scheduled for a quarterly dividend of C$ 0.275 apiece on March 7 (ex-dividend date: February 9), which is up from the previous payment of C$ 0.25.

The retail giant has said that it expects its pharmacy sales to increase in the wake of the launch of the COVID-19 rapid test through its distribution network, with fewer restrictions from the government as compared to the previous year.

How did Metro (TSX:MRU) perform in the stock market?

Stocks of Metro Inc catapulted by over 20 per cent in the last nine months.

The grocery scrip closed at a value of C$ 67.09 apiece on Thursday, January 27, noting an increase of roughly four per cent from the previous close.

It was only about two per cent below its 52-weel high of C$ 68.34 clocked on December 17, 2021.

Bottomline

Metro Inc appears to have tackled the challenges posed by COVID-19, labour conflict and supply chain problems well in the past year, and started 2022 on a positive note.

The company, on January 25, disclosed its corporate responsibility plan for 2022 to 2026, according to which it is committed to “eliminate single-use plastic shopping bags by the end of 2022”, minimize greenhouse gas emissions and food waste, etc.