Highlights

- Oil prices sank on Thursday, February 3, as investors processed the Organization of Petroleum Exporting Countries and its alliance’s (OPEC+) decision to further expand supply.

- The OPEC+, on Wednesday, February 2, agreed to return to an output of 400,000 barrels per day in March.

- Some market experts, however, expect oil prices to move toward US$ 100 per barrel, considering the current scenario of rising demand, slim stockpiles and continued supply crunch.

Oil prices sank on Thursday, February 3, as investors processed the Organization of Petroleum Exporting Countries and its alliance’s (OPEC+) decision to further expand supply.

The OPEC+, on Wednesday, February 2, agreed to return to an output of 400,000 barrels per day in March.

The move, while widely anticipated by some analysts, seems to have triggered doubts among investors over some OPEC members failing to meet their supply quotas.

Some market experts, however, expect oil prices to move toward US$ 100 per barrel, considering the current scenario of rising demand, slim stockpiles and continued supply crunch.

Amid all that’s going on, investors who are interested in TSX-listed oil stocks can explore the following options.

1. Imperial Oil Limited (TSX: IMO)

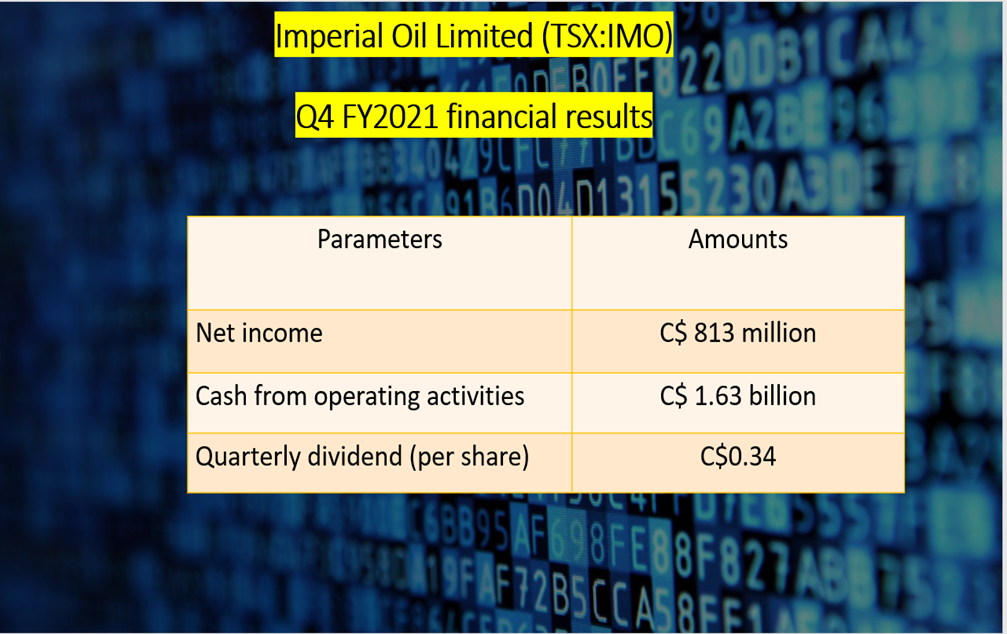

Imperial Oil generated a net income of C$ 813 million and a cash flow of C$ 1.63 billion in the fourth quarter of fiscal 2021. The integrated oil company’s free cash flow, on the other hand, stood at C$ 1.23 billion in the latest quarter.

The C$ 38-billion market cap oil producer is set to pay a quarterly dividend of C$ 0.34 apiece on April 1.

Also read: Imperial Oil (IMO) records profit of $813M in Q4. An oil stock to buy?

IMO stock closed at C$ 54.8 apiece on Tuesday, February 1, noting a daily trade volume of C$ 2.15 million.

The oil stock expanded by over 129 per cent in the past 12 months.

Image source: © 2022 Kalkine Media®

Data source: Imperial Oil Limited

2. Tourmaline Oil Corp (TSX:TOU)

Tourmaline Oil reported earnings of C$ 361.1 million in the third quarter of FY2021, while its cash flow amounted to C$ 761.3 million.

The Calgary-headquartered natural gas and crude oil firm, which has a return on equity (ROE) of 18.45 per cent, raised its quarterly dividend to C$ 0.20 apiece for the first quarter of fiscal 2022.

TOU stock rose by over three per cent to close at a value of C$ 48.85 apiece on Tuesday.

Tourmaline scrip swelled by about 159 per cent year-over-year (YoY).

Bottomline

If crude prices rise going forward, it can positively impact oil companies' earnings, which in turn, can push up their stock price. Similarly, unfavourable crude prices can adversely affect these stock prices.

Thus, investors should keep an eye on commodity prices to make the right investment decisions based on market dynamics.