Summary

- Canadian freight carrier Cargojet posted total revenues of C$ 162.3 million for the third quarter of 2020, increased from C$ 117.4 million in Q3 2019.

- Cargojet scrips have skyrocketed by 131.52 per cent this year.

- Stocks of Algoma Central Corp have increased by 10.22 per cent in the last six months.

Transportation is one of the hardest-hit sectors due to coronavirus pandemic. During the lockdown, handful essential transportation and supply chain companies were able to operate amid the federal-imposed restriction.

Despite the stringent measures, two transport stocks have managed to spin the tides against them and registered good stock performance, recovering financially. Let us have a look at two trending transport stocks: Cargojet Inc. (TSX:CJT), and Algoma Central Corporation (TSX:ALC).

Cargojet Inc. (TSX:CJT)

Current Stock Price: C$ 240.92

With a fleet of 27 carriers, Ontario-based Cargojet Inc offers time-sensitive overnight air cargo services. The company operates between fourteen Canadian cities and across select international air-routes between the USA and Bermuda. Cargojet also provides special overnight air cargo services and transfers over 8,000,000 pounds of freight weekly.

Cargojet Stock Performance

After the coronavirus pandemic-led stock crash, C$ 3.757-billion cargo carrier quickly rebounded and went on a growth rally. Its stock price started dropping in February, plunging more than 37 per cent within a month. March 19 onwards, shares of Cargojet have skyrocketed nearly 199.2 per cent.

The scrips are currently up by an impressive 131.52 per cent, from C$ 104.06 at the beginning of the year to C$ 240.92 at the time of filing this story.

In the last six months, Cargojet stock has soared by 77.42 per cent.

As per the TMX website, Cargojet’s price-to-book (P/B) ratio is 16.895, and its current price-to-cash flow (P/CF) ratio is 15.90. The company gives a negative return on equity (ROE) of 20.36 per cent, and a negative return on assets (ROA) of 3.79 per cent. The company’s total debt-to-earnings ratio is 2.66.

The air cargo company pays a dividend yield of 0.389 per cent. It offers a quarterly cash dividend of C$0.234 per share. The dividend growth for five-year is 10.20 per cent.

Cargojet is a part of TMX’s top industrial stocks across the TSX and TSXV with the largest price gains in the last 30 days. The air freight company has also been ranked on TMX’s top price performer stocks that have outperformed the markets (TSXV and TSX) in the last 30 days.

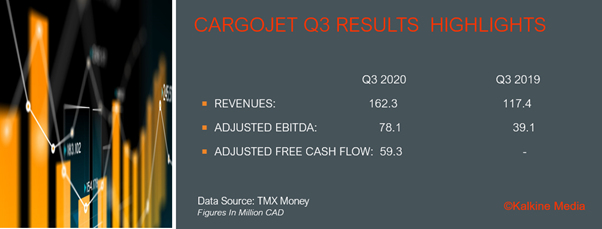

Canadian freight carrier Cargojet posted total revenues of C$ 162.3 million for the third quarter of 2020, increased from C$ 117.4 million in Q3 2019. The company reported an adjusted EBITDA of C$78.1 million for Q3 2020, as compared to C$39.1 million in Q3 2019. Cargojet computed an adjusted free cash flow of C$ 59.3 million in Q3 2020.

The company is continuing to invest in growth prospects while prudently bolstering its balance sheet with an overall reduction of $92 million in net-debt on a YTD basis, said Ajay Virmani, President & CEO, Cargojet.

Algoma Central Corporation (TSX:ALC)

Current Stock Price: C$ 10.515

Algoma Central Corp is an Ontario-based provider of marine transportation services. The company owns a Canadian flag fleet of dry and fluid bulk products such as coal, grain, ore, salt, and sand operating on the Great Lakes and the St. Lawrence Seaway. The company also owns vessels and tankers that transport petroleum products through Algoma Tankers Ltd.

Algoma Central Corp Stock Performance

The stock has recovered over 45 per cent, from a C$ 7.25 low due to the pandemic led market crash on March 24 to C$ 10.515 at the time of filing this story. In the last six months, the stock has increased by 10.22 per cent. Its current market capitalization stands at C$ 397.47 million.

As per TMX data, Algoma’s price-to-book (P/B) ratio is 0.627, and the price-to-cash flow (P/CF) ratio is 3.30. The company provides a positive return on equity (ROE) of 2.98 per cent, and positive return on assets (ROA) of 1.59 per cent. The company’s total debt-to-earnings ratio is 0.57. Algoma’s current price-to-earnings ratio is 21.20.

The shipping company holds a current dividend yield of 4.945 per cent. It pays a quarterly dividend of C$0.13 per share. The dividend growth for three-year is 12.14 per cent.

Algoma Central Corp has also been ranked on TMX’s top industrial stocks that have outperformed their peers and the markets (TSXV and TSX) in the last 30 days.

The marine transportation company’s revenue is C$ 0.15 million in the third quarter of 2020 (ending September 30), down from C$ 0.16 million a year ago. Net earnings stood at C$22,235, up from C$21,049 in Q3 2019 due to higher operating earnings.