Investors often explore potential businesses with low-priced priced stock, which can potential explosive growth prospects in the long run. However, a low share price does not certainly imply that a stock is inexpensive because it is a risky bet too.

Traders enter these stocks for short-term period, investing their extra money. With enough equity exposure, some of these firms excel in their businesses, and some flip from top to bottom.

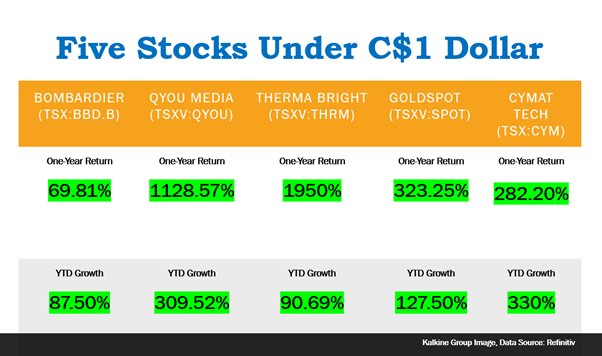

Here are five stock from the Toronto Stock Exchange (TSX) And TSX Venture Exchange under C$1:

- Stocks of Bombardier Inc. (TSX: BBD.B), an aircraft and train manufacturer, has gained almost 70 per cent in the last 12 months. At the last close of C$0.94 apiece, the stock is up 87.50 per cent year-to-date (YTD). It recorded an 18 per cent year-over-year (YoY) rise in revenue for the first quarter of 2021.

- The communication service provider QYOU Media (TSXV:QYOU) engages in short-form video content. The entertainment stock skyrocketed as much as 1128.57 per cent in the past one year. It has delivered a massive 309.52 per cent return this year. It operates across North America, India, and Ireland. Its current stock price is C$ 0.41 apiece.

- The medical equipment developer Therma Bright Inc. (TSXV:THRM) provides CoviSafe™ rapid saliva-based coronavirus test kit. It’s current share price is C$ 0.40, with a staggering one-year growth of 1950 per cent. The healthcare stock has added almost 91 per cent returns this year. The company claims that its AcuVid™ COVID-19 antibody test can provide results in just 15 minutes.

©2021 Kalkine Group

- GoldSpot Discoveries Corp. (TSXV:SPOT), a software-backed machine learning firm, which manages an artificial-intelligence (AI)-powered trading platform. Its stock price stands at C$ 0.90 apiece. The tech stock delivered more than 323 per cent return in the past one year. It is up 127.50 per cent YTD. The company’s consulting revenue boomed by 123 per cent in 2020 versus 2019.

- Cymat Technologies Ltd. (TSX:CYM) develops stabilized aluminum foam-base lightweight panels. The industrial stock price is C$ 0.80 apiece. It soared 282.2 per cent in the last one year. It has rallied 330 per cent this year. In its January 31 ended quarter, the company posted a 400 per cent surge in revenue YoY.

The above constitutes a preliminary view and any interest in stocks should be evaluated further from an investment point of view.