Summary

- Entertainment stocks Cineplex Inc (TSX:CGX) and Walt Disney (NYSE: DIS or DIS: US) registered a spike in the wake of the news of Pfizer’s successful COVID-19 vaccine trials on November 9.

- Cineplex scrips climbed almost 30 per cent in November.

- The company’s total revenue in Q3 2020 was down a whopping 85.4 per cent year-over-year. However, it was significantly up from its revenue in Q2 2020.

- Walt Disney stocks are trading flat this year. The Pfizer news, however, saw its shares jump over 19 per cent in November so far.

Entertainment stocks Cineplex Inc (TSX:CGX) and Walt Disney (NYSE: DIS or DIS: US) spiked this month after pharmaceutical companies Moderna and Pfizer along with BioNTech announced that their COVID-19 vaccine candidates have over 90 per cent efficacy in latest trials.

The entertainment industry and movie theatre chains suffered acutely amid the pandemic this year, with the lockdown restriction disrupting usual production and operations. The hope of a COVID-19 vaccines in November has been able to brighten things up a bit for the industries.

In the light of the spike in their stock prices recently, let’s take a closer look at the profiles of Walt Disney and Cineplex Inc.

Cineplex Inc (TSX:CGX)

Current Stock Price: C$ 7.26

Stocks of cinema theatre chain Cineplex Inc are currently trending among top communications stocks with the largest 30-day price gains on the TSX and the TSXV. It gathered an average share movement volume of 1.13 million in the last 10 days and of 1.2 million in the past month. It has a 53-week high of 34.39.

The impact of the coronavirus pandemic saw Cineplex’s business take a tumble around March as movie theatres were forced to temporarily shut down amid the lockdown. Its shares, too, plunged sharply during this time.

Cineplex stocks are currently down about 80 per cent year-to-date (YTD). The stock price slid by nearly 53 per cent in the last six months and by about 19 per cent in three months.

In November, however, its scrips climbed almost 30 per cent following the news of Pfizer and BioNTech’s successful COVID-19 vaccine trials.

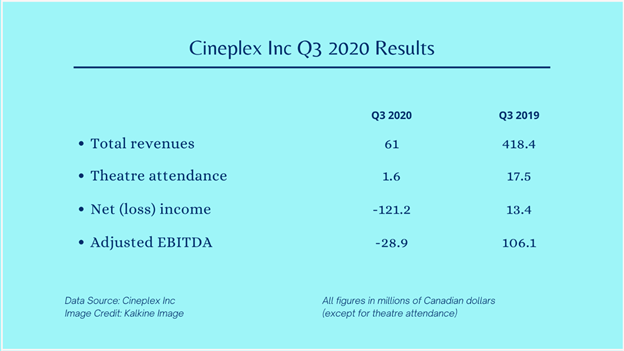

CINEPLEX INC Q3 2020 RESULTS

The impact of the COVID-19 pandemic on Cineplex’s business was substantial, which reflected on its second quarter of 2020. Its third quarter, ending 30 September 2020, showed comparatively better results.

The company’s total revenue of C$ 61 million in Q3 2020 was down a whopping 85.4 per cent year-over-year. However, it was significantly up from that of C$ 22 million in Q2 2020.

Cineplex became one of the first cinema theatre chains across the world to reopen post coronavirus lockdown after all its 164 theatres and 1,687 screens across Canada reopened on 21 August 2020. Its first major film in five months, Tenet, saw over 1.6 million people come into the theatres.

Cineplex experienced a net cash burn of C$ 49.7 million in Q3 2020, and of approximately C$ 16.6 million on a monthly basis.

As of the end of September 2020, the top Canadian movie theatre chain has about C$ 460 million in its credit facilities.

The Walt Disney Company (NYSE: DIS or DIS: US)

Current Stock Price: US$ 144.67

Shares of The Walt Disney Company boomed on November 9 after the news of Pfizer’s successful vaccine trials broke. The scrips gathered an average share movement volume of 14.3 million in the last 10 days and that of 9.9 million in the last 50 days.

Walt Disney stocks are trading flat this year. Since tumbling sharply during the March lows, its stock price rebounded almost 33 per cent in the last six months and nearly 11 per cent in the last three months.

The Pfizer news, however, saw Disney shares jump over 19 per cent in November so far.

THE WALT DISNEY COMPANY Q3 2020 FINANCIAL RESULTS

The coronavirus pandemic saw Walt Disney’s much-beloved outdoor experiences of theme parks, cruises and resorts shut down temporarily – a move that had quite an impact on its third fiscal quarter report.

In its fourth fiscal quarter ending 3 October 2020, Walt Disney reported a 23 per cent YoY decline in its revenue of US$ 14.7 billion. The number, however, was an improvement from the revenue of US$ 11.7 billion in Q3 FY20.

Walt Disney’s income from continuing operations stood at a loss of US$ 580 million in its Q4 FY20, down from US$ 1.24 billion in Q4 FY19. Its total segment operating income in the fourth fiscal quarter registered a drop of 82 per cent YoY, amounting to US$ 606 million.

The company recorded a free cash flow of US$ 934 million in Q4 FY20, up from US$ 409 million in Q4 FY19.

The Walt Disney Company pays a semi-annual dividend of US$ 0.88. It currently yields 1.217 per cent, as per the data available on the TMX.