Highlights

- Stocks of Hut 8 Mining climbed over nine per cent on Tuesday, February 1, with 3.85 million shares exchanging hands.

- The crypto stock was among the top gainers on the S&P/TSX Composite Index this day.

- On Monday, January 31, the North American crypto miner said that it has closed its definitive agreement with TereGo Inc to acquire its cloud and colocation data center

Stocks of Hut 8 Mining climbed over nine per cent on Tuesday, February 1, with 3.85 million shares exchanging hands. The crypto stock was among the top gainers on the S&P/TSX Composite Index this day, right after Spin Master Corp (TSX:TOY).

Hut 8 Mining is a Toronto-headquartered company that mines digital assets, including Bitcoin (BTC), with data centres across the country. The digital asset miner has been in the crypto world since 2018.

On Monday, January 31, the North American crypto miner said that it has closed its definitive agreement with TereGo Inc to acquire its cloud and colocation data center business.

With this acquisition deal, the company added five data centres throughout Canada and expanded its technological footprint by including “scalable” cloud services.

Also read: Imperial Oil (IMO) records profit of $813M in Q4. An oil stock to buy?

Hut 8 (TSX: HUT)’s mining production update for December 2021

In December, the company mined and deposited 276 BTC into custody following its HODL strategy.

As of December 31, 2021, the digital asset miner had 5,518 bitcoin in its reserves, up by 97 per cent year-over-year (YoY).

The crypto company noted a YoY growth of 125 per cent in its installed operating capacity, which was at 2.0 hashrate.

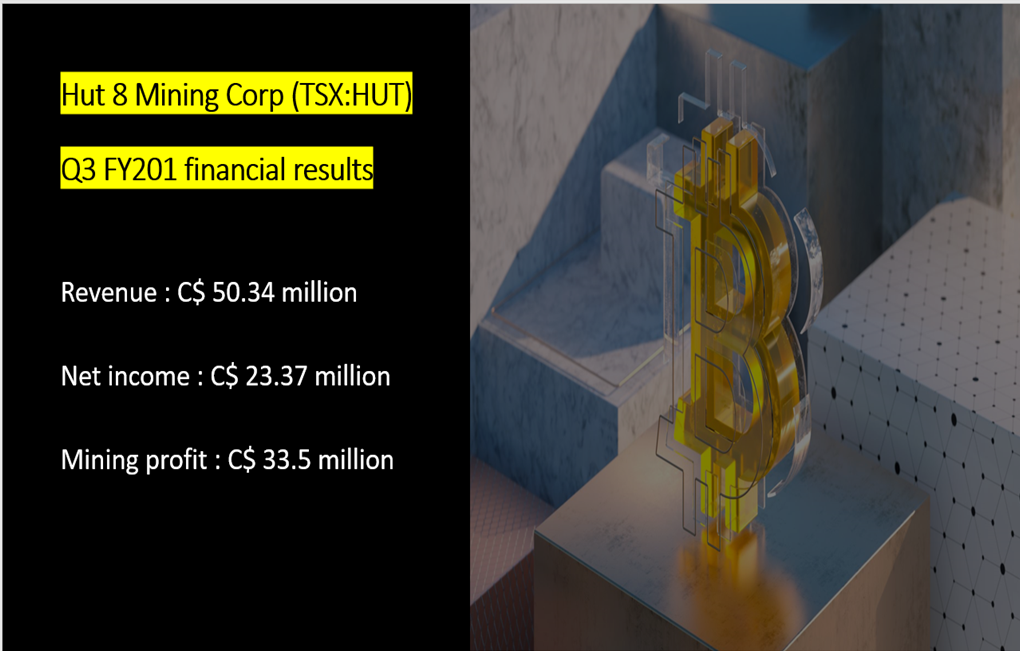

Hut 8’s financial performance in Q3 FY2021

The innovation-focused digital asset company generated third-quarter revenue of C$ 50.34 million in fiscal 2021, considerably up from C$ 5.75 million in Q3 2020.

Hut 8 saw its net income reach C$ 23.37 million in the latest quarter, up from a net loss of C$ 0.9 million a year ago.

Image source: ©2022 Kalkine Media®

Data source: Hut 8 Mining Corp

Hut 8 stock performance

Stocks of Hut 8 Mining soared by roughly 67 per cent YoY.

The crypto stock closed at C$ 8.23 apiece on Tuesday and returned almost 19 per cent in the last one week.

Bottomline

In January this year, the crypto space was hit hard as almost all digital currencies, including BTC, saw a substantial decrease in their value. However, the industry now seems to be recovering.

Investors should, however, keep in mind that crypto stocks are, to some degree, exposed to the volatility risk that is associated with cryptocurrencies.

Also read: Top 5 TSX growth stocks to watch in February