Highlights

- New investors often consider high-yield dividend stocks to add an extra source of income stream.

- A mid-cap company listed below posted a net income of C$ 5.93 per share in Q4 FY2021, a year-over-year (YoY) increase of 67 per cent.

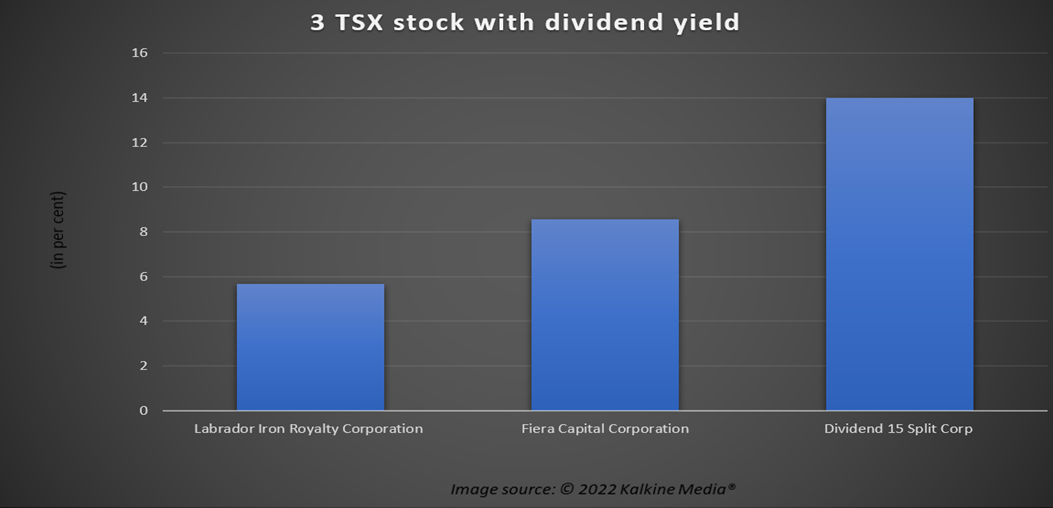

- A company mentioned here held a dividend yield of almost 14 per cent.

New investors often consider high-yield dividend stocks to add an extra source of income stream. Quality dividend stocks, which are steady in dividend payments and increase their payout from time to time, can help investors generate some wealth throughout the holding period and strengthen their portfolios.

Dividend stocks can also, in the right market environment, provide a little relief to investors in a challenging economic environment.

On that note, let us go through the following three TSX-listed stocks with high dividend yields.

1. Labrador Iron Royalty Corporation (TSX: LIF)

Labrador Iron Royalty is a Canada-based investment firm with a 15.10 per cent equity stake in a North American premium iron ore company, Iron Ore Company of Canada (IOC).

The firm is entitled to a Gross Overriding Royalty (GOR) of seven per cent and a commission of 10 per cent per tonne on all iron ore products that IOC manufactures, sells and exports.

The mid-cap company posted a net income of C$ 5.93 per share in Q4 FY2021, a year-over-year (YoY) increase of 67 per cent. Its adjusted cash flow grew by 94 per cent YoY to C$ 5.98 per share in the latest quarter.

Labrador Iron has a dividend yield of nearly six per cent at the time of writing this. The firm saw its stock slip by over 16 per cent in 12 months.

Also read: Teck (TSX: TECK.B) stock takes off after Q1 results. Buy call?

2. Fiera Capital Corporation (TSX: FSZ)

Fiera Capital Corp is a Montreal-based asset manager providing investment solutions to institutions and clients. The financial service company reported total revenues of C$ 241.92 in the fourth quarter of fiscal 2021 compared to C$ 174.92 in Q4 2020.

Its net profit amounted to C$ 0.03 million in the latest quarter, significantly up from C$ 0.003 million a year ago.

Fiera Capital recorded a dividend yield of roughly nine per cent. Stocks of Fiera Capital plummeted by over six per cent in a year.

3. Dividend 15 Split Corp (TSX: DFN)

Dividend 15 Split Corp is a Toronto-based mutual fund (MF) that invests in a portfolio of dividend-paying Canadian companies in order to provide cash dividends every month. The company held cash of C$ 150.58 million as of November 30, 2021, compared to C$ 105.17 million a year ago.

It realized a gain on the currency of C$ 247.27 million in 2021 compared to a loss of C$ 56.82 million in 2020.

Dividend 15 Split held a dividend yield of almost 14 per cent. As of its stock performance, DFN scrip spiked by over six per cent in a year.

Bottomline

Mounting inflation and borrowing rates have built pressure across industries. Dividend-yielding stocks, in such a state, can provide some financial flexibility by offering stable income to investors in the current market environment. However, it is vital to analyze and study a stock and related market factors.

Also read: Lion Electric (LEV) partners with US Energy Dept: An EV stock to buy?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.