Highlights

- Lion Electric is set to collaborate with the US Department of Energy, the company said on Wednesday, April 27.

- According to the agreement, Lion Electric will collaborate with the US and industry leaders to develop and integrate bidirectional EV charging infrastructure.

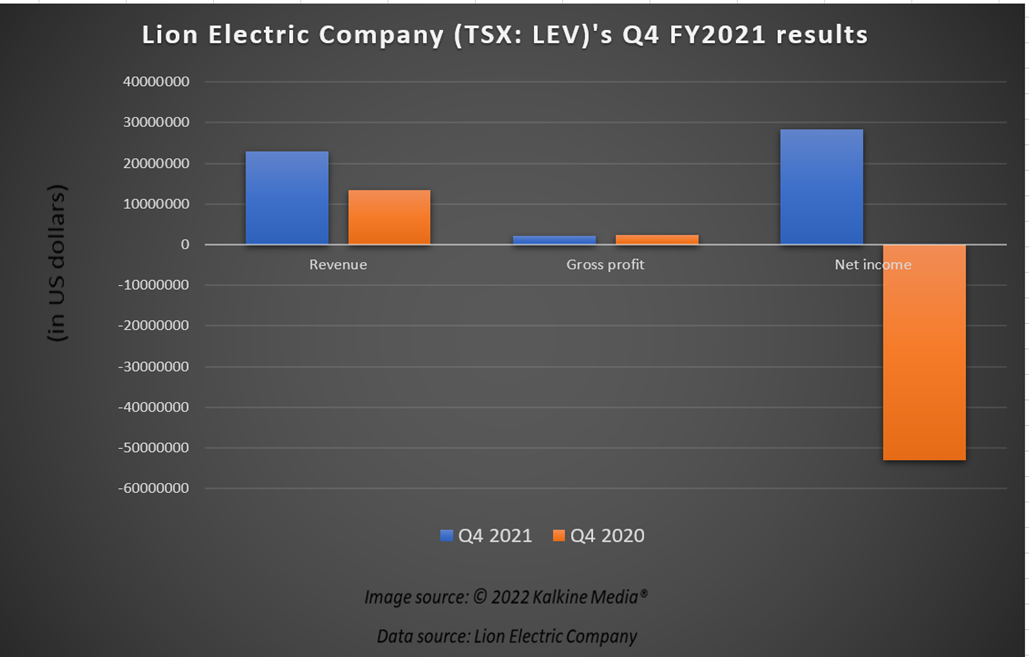

- The Canadian EV company reported a net income of US$ 28.26 million in the latest quarter against a loss of US$ 52.98 million in the same quarter of 2020.

Lion Electric Company (TSX:LEV) has been trending on the stock markets after the company mentioned signing a Memorandum of Understanding (MoU) with the United States Department of Energy on Wednesday, April 27.

The Canadian electric vehicle (EV) company said that it was the only bus maker chosen by the US to speed up the development and deployment of vehicle-to-everything (V2X) techs.

According to the agreement, the company will collaborate with the US, government agencies and industry leaders to develop and integrate bidirectional EV charging infrastructure into the country’s energy grid.

Lion added that it will also focus on developing cybersecurity for the deployment of V2X techs.

With this agreement in line, the EV maker is actively participating in exploring V2G programs in North America. That said, let us have a quick look at its financial performance.

Lion Electric Company (TSX:LEV)’s financial performance in Q4 FY2021

Lion Electric delivered 71 EVs in the fourth quarter of fiscal 2021 compared to 46 vehicles in Q4 2020.

Its revenue grew by US$ 9.4 million year-over-year (YoY) to US$ 22.87 million in the latest quarter.

The EV manufacturer posted a gross profit of US$ 2.17 million in Q4 FY2021 against US$ 2.47 million a year ago. However, it reported a net income of US$ 28.26 million in the latest quarter against a loss of US$ 52.98 million in the same quarter of 2020.

On a full-year basis, Lion Electric’s revenue was US$ 57.71 million in 2021 compared to US$ 23.42 million in 2020. Its net loss for 2021 amounted to US$ 43.32 million compared to US$ 97.35 million in 2020.

Also read: Cenovus (TSX:CVE) triples dividend after $1.6B profit. Buy call?

Lion Electric’s stock performance

Having closed at C$ 8 on Tuesday, stocks of Lion Electric were trading at C$ 8.31 per share at 9:59 EST on Wednesday, April 27. The EV scrip slipped by nearly 36 per cent year-to-date (YTD).

Bottomline

Lion Electric Company said that V2G and V2X technologies reduce the strain on the renewable power grid during peak energy production and export this energy back when energy production is low, thereby minimizing dependence on fossil fuels with reliance on domestic energy.

Also read: Air Canada (TSX:AC) posts operating revenue of $2.5B in Q1. A buy?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.