Highlights

- In Q2 2022, the net earnings for Fortis Inc. were C$ 284 million compared to C$ 253 million in Q2 2021.

- The total long-term debt of Hydro One Limited was decreased to C$ 13,018 million compared to C$ 13,620 million.

- On October 20, 2022, the stock price of Waste Connections Inc. was US$ 178.60 and increased by 10.64 per cent within a time of 12 months.

A recessionary environment brings down demand and consumption, lowers investment in the economy, increases unemployment, and eventually a market crash.

Instead of focusing on avoiding the damage, be prepared and safeguard yourself. Be ready for the tough times ahead and seek better and more profitable options. Looking at the stock market may put you in a fix. But try to understand the overall functioning of the market to beat the bear and breeze through the recessionary phase.

Your portfolio depicts your strategy as well as your future. Select the stocks that are recession-ready. They also add a safety net to your overall investment. Some of the stocks outperform and are consistent in generating returns.

Amid the fears of an impending recession, let’s explore five dividend stocks and their recent performances:

-

Fortis Inc. (TSX:FTS)

Fortis deals in distribution assets along with utility transmission. The company has 10 facilities that it operates in Canada and the US. Further, it serves more than 3.4 million electricity and gas customers. Also, Fortis Inc. is engaged in Caribbean utilities and electricity generation with smaller stakes.

In the second quarter of 2022, the net earnings for Fortis Inc. were C$ 284 million compared to C$ 253 million at the same time the previous year. For the same comparative period, the revenue grew to C$ 2,487 million from C$ 2,130 million. Contrary to this, the cash and cash equivalents decreased to C$ 338 million from C$ 599 million.

Fortis Inc pays a quarterly dividend of C$ 0.565 and has a dividend yield of 4.486 per cent. The three-year dividend growth is 5.13 per cent. Further, the earnings per share (EPS) of the company is C$ 2.65.

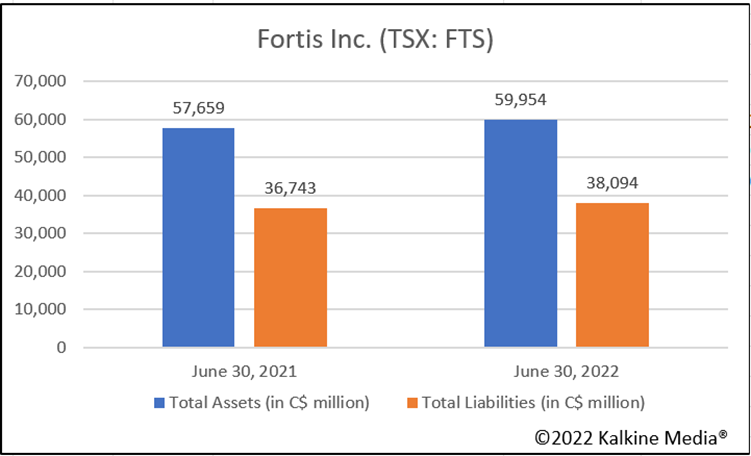

The below graph represents the increase in the total liabilities and assets of Fortis Inc in Q2 2022 compared to Q2 2021.

-

Hydro One Limited (TSX:H)

Hydro One Limited is engaged in distribution of assets in a regulated manner. Further, it is also engaged in transmission of assets. The company operates in Ontario. Further, the company serves approximately 1.5 million customers which accounts for nearly 60 per cent of the company's rate base.

For the quarter that ended June 30, 2022, Hydro One Limited’s revenue grew to C$ 1,840 million from C$ 1,722 million. For the same comparative period, the net income grew to C$ 255 million from C$ 238 million.

On October 20, 2022, the stock price of Hydro One Limited was C$ 31.09. Hydro One Limited pays a dividend of C$ 0.28 on a quarterly basis. It has a dividend yield of 3.597 per cent.

-

TELUS Corporation (TSX:T)

TELUS Corporation is a service provider in the wireless segment. It is counted among the biggest three providers in Canada. Further, it has nine million mobile phone subscribers nationwide that constitutes around 30 per cent of the total market.

On September 1, 2022, TELUS Corporation acquired LifeWorks Inc. and declared the completion of the process worth C$ 2.3 billion.

In Q2 2022, the consolidated revenue of the company grew by 7.1 per cent to C$ 4,401 million from the year-ago quarter. Further, the adjusted EBITDA grew by 8.9 per cent to C$ 1,622 million compared to C$ 1,490 million Q2 2021. Further, there was an increase in the EPS too by 36 per cent.

The quarterly dividend announced by the company is C$ 0.339 per share which was an increase by 7.1 per cent during the same comparative period.

-

Canadian Natural Resources Limited (TSX:CNQ)

Canadian Natural Resources Limited operates in Western Canada and is involved in the production natural gas and oil. Canadian Natural Resources Limited operates with an employee strength of 90,800.

For Q2 2022, the net earnings of Canadian Natural Resources were reported at C$ 3,502 million compared to C$ 1,551 million in the same quarter previous year. The cash flow from operating activities increased too to C$ 5,896 million from C$ 2,940 million.

In March 2022, Canadian Natural Resources Limited increased its quarterly dividend by 28 per cent to C$ 0.75 per share, up from $0.5875 per share. Further, the EPS announced by the company is C$ 9.73 with price to earnings (P/E) ratio of 7.8 per cent.

-

Waste Connections Inc. (TSX:WCN)

Waste Connections Inc. is engaged in providing recycling services for traditional solid waste. It operates in the North America and currently has 97 active landfills, 71 recycling operations, and142 transfer stations. The major sectors under the firm are industrial, commercial, residential and energy end markets.

In Q2 2022, the revenue increased by 18.4 per cent and to US$ 1.816 billion. As of June 30, 2022, the net income grew to US$ 224.1 million compared to US$ 177 million. Further, there was an increase in the total assets too which were posted at US$ 15,416,241 million from US$ 14,699,924 million. Furthermore, the liabilities increased too to US$ 8,546,579 million compared to US$ 7,706,379 million.

The quarterly dividend announced by Waste Connections Inc. is US$ 0.23. The dividend growth for the five-year period was reported at 13.81 per cent.

On October 20, 2022, the stock price of Waste Connections Inc. was US$ 178.60.

Bottom Line

Stocks markets are not meant to be stable at all times. They are consistently exposed to volatility, macroeconomic events and other factors. For instance, the pandemic hit the stock market and made it volatile. With any uncertainties approaching, investors should be in constant touch with the changing market trends. While selecting your stocks, ensure to analyze their past, present, and future prospects.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.