Highlights

- As the Canadian economy is inching towards the normalcy, the sector, including movie and theatre, which suffered the pandemic heat may also see the crowd back, which is likely to boost their overall business performance.

- A theatre exhibition firm mentioned here partnered with a virtual reality company, Dreamscape, to launch a new immersive virtual reality (VR) venue in New Jersey on November 19.

- A Canadian movie company listed below posted a year-over-year (YoY) increase of 310.3 per cent in total revenues to C$ 250.4 million in the third quarter of fiscal 2021

When the COVID-19 outbreak hit the world, certain businesses, like movie theatres, retail stores, restaurants etc., were directly impacted due to the lockdown and social distancing norms.

But with the vaccination campaigns and easing pandemic rules, people are looking forward to exploring the outdoors again, and that is likely to boost the overall business performances of such enterprises.

Movie theatres, for one, are opening up again around the world. While certain COVID-related rules still exist, such as mandatory face masks and social distancing, cinema halls are witnessing a growth in their attendance, something that had dropped to dangerous levels amid the pandemic.

Also read: Top 5 Canadian industrial stocks to buy in Q4 2021

On that note, let us talk about two movie theatre stocks that seem to be on a recovery mode.

1. AMC Entertainment Holdings Inc (NYSE: AMC, AMC:US)

AMC Entertainment Holdings Inc is a theatre exhibition firm with operations in the United States and Europe.

Its stock closed at C$ 42.13 apiece on Wednesday, November 17, after hitting a day high of C$ 44.

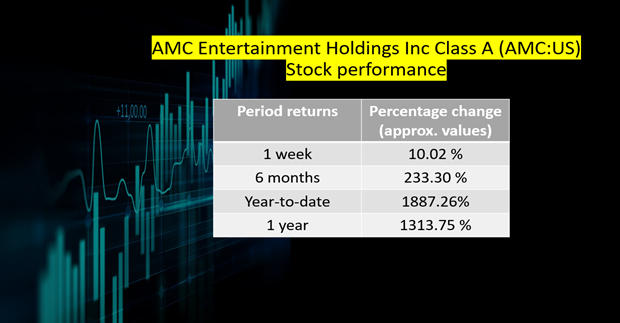

At this level, AMC scrip had spiked by about 10 per cent in the past week and grown by more than 233 per cent in the last six months. AMC stock also soared by about 1,887 per cent on a year-to-date (YTD) basis.

Image source: © 2021 Kalkine Media Inc

At the time of writing this, AMC held a market capitalization of C$ 21.6 billion and a return on equity (ROE) of 104.50 per cent.

Recently, AMC partnered with a virtual reality company, Dreamscape, to launch a new immersive virtual reality (VR) venue in New Jersey on Friday, November 19. This VR destination is set to serve the audience in greater New Jersey and New York metro area.

2. Cineplex Inc (TSX: CGX)

Movie theatre chain Cineplex Inc saw its stock close at C$ 13.84 apiece on November 17, having risen by more than five per cent in the past three months.

CGS stock also surged by nearly 60 per cent over the last year.

The Toronto-based enterprise posted a year-over-year (YoY) increase of 310.3 per cent in its total revenues of C$ 250.4 million in the third quarter of fiscal 2021.

Its theatre attendance also grew by 429.2 per cent YoY to 8.3 million in the latest quarter, while its box office revenues per patron increased by 22.4 per cent YoY to C$ 11.38 apiece in Q3 2021.

Also read: 2 real estate stocks to buy as Canada’s home sales surge

Bottom line

With people beginning to head back to cinema halls and entertainment venues, these companies are likely to see growth in their demand and sales. On the top of that, the holiday season is also expected to fuel peoples’ enthusiasm further.

However, the rising inflation could impact the consumer behavior to a certain extent, which investors should consider before diving into any investment decisions.