Highlights

- Cannindah Resources has delivered ~192% returns to its shareholders in the past one year.

- CAE has made notable progress over the past year and recently the company reported drilling success at Mt Cannindah Project.

- CAE looks to continue expanding the potential of the project along with the review of opportunities for expansion.

ASX-listed explorer and resource developer Cannindah Resources Limited (ASX:CAE) has had an impressive year. The explorer has witnessed strong operational progress and the market has rewarded the Company with staggering share price appreciation.

Over the past year, the CAE stock has delivered ~192% returns to its shareholders, with share price zooming from AU$0.065 on 15 June 2021 to AU$0.19 on 14 June 2022. Let’s have a look at few important aspects of the Company.

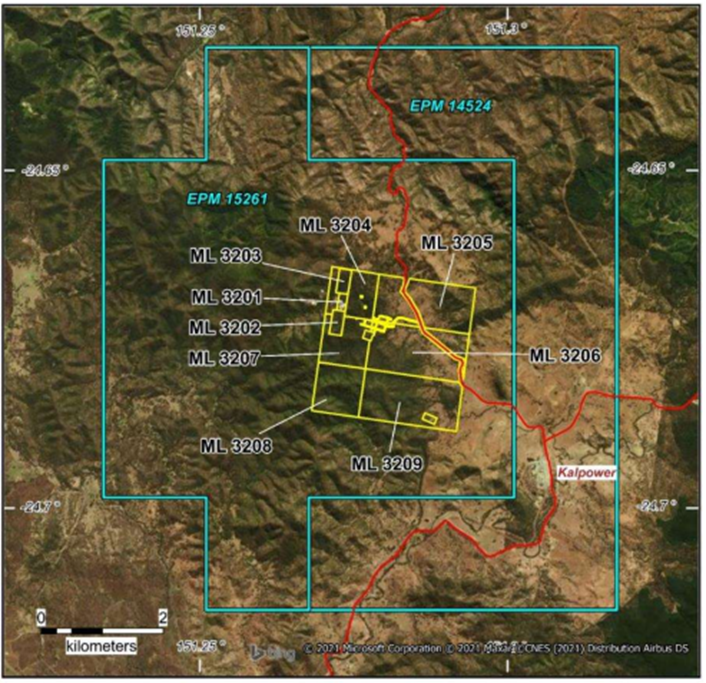

Mt Cannindah Project Tenure (Source: CAE Announcement 04/04/22)

Company strategy in alignment with shareholder interest

CAE’s strategy is to preserve shareholder wealth and enhance the value of its flagship assets through prudent exploration methods. Currently the Company continues to focus on the expansion of its flagship Mt Cannindah project.

Moreover, the Company has successfully identified additional exploration opportunities for copper and gold within the project area through drilling.

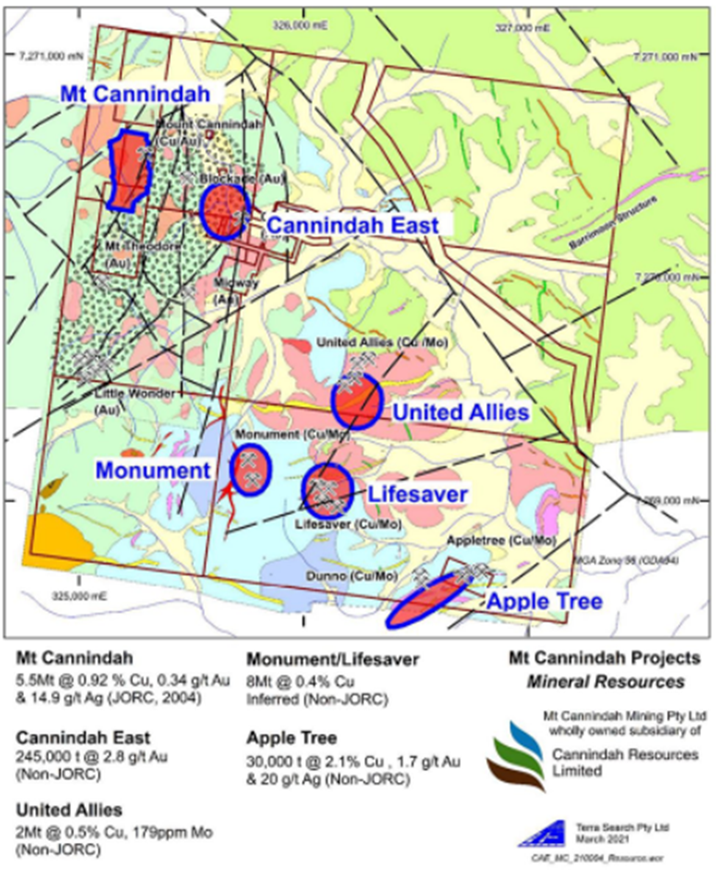

Source: CAE website

RELATED ARTICLE: Stellar assay results set Cannindah Resources (ASX:CAE) on success path at Mt Cannindah

Recent drilling results and lease renewal

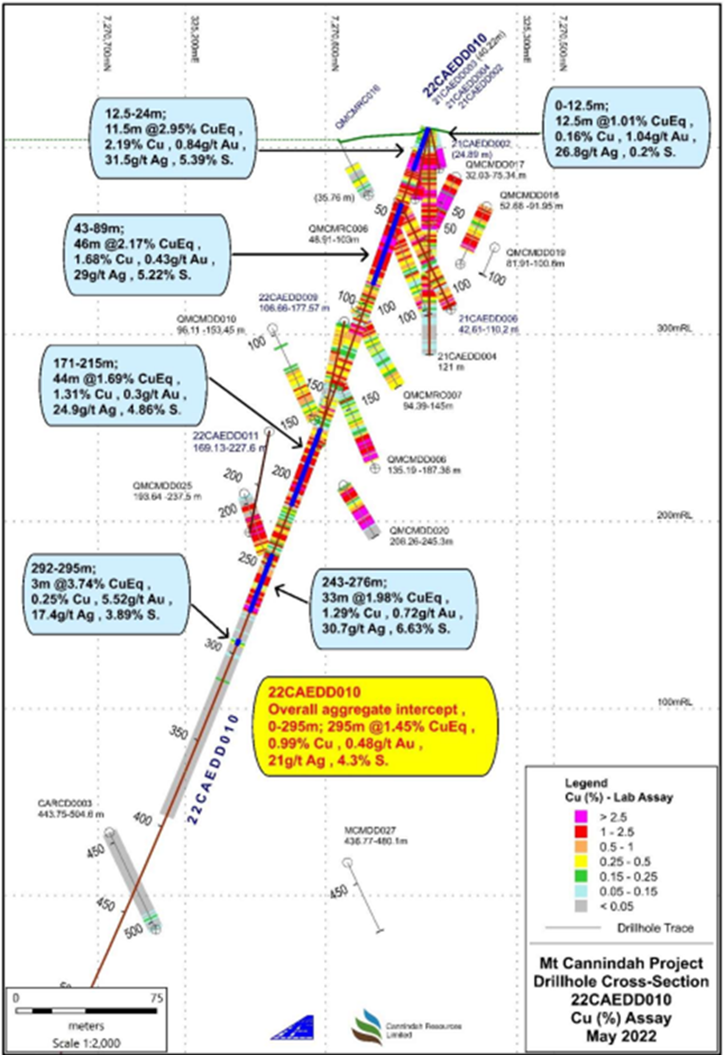

Recently, CAE has reported back-to-back exploration success with another massive copper hit from the surface with hole 9 and exceptional width and grade received in Hole 10 at the Mt Cannindah Project.

The Company also renewed nine mining leases at the Mt Cannindah project until 31 March 2034.

The hole 9 delivered 400m @ 0.91% CuEq along with a significant gold zone of 14m @ 1.65g/tAu from 287m. CAE believes that the hole extended mineralisation to the north and indicated that there is far more copper than earlier recognised in the system.

Subsequent drilling at Hole 10 delivered 295m @ 1.45%CuEq from the surface, indicating excellent outcomes for the Company to continue striving for further outstanding results and expand the project size.

CAE hole 10 looking north-east (Source: CAE Announcement 12/05/22)

DETAILED DISCUSSION AT: Excellent drilling results from hole 10 boost Cannindah Resources’ (ASX:CAE) shares up

The recent drilling has delivered exceptional results further cementing the confidence on the flagship Mt Cannindah project.

The Company is focused on expanding the potential of the project along with upgrading the present JORC resource.

Expansion opportunities

CAE looks to expand the gold target areas across the Piccadilly Gold project area. CAE continues to review opportunities for expansion via mergers and acquisitions. The expansion is also possible through potential diversification opportunities to take advantage of positive market sentiments.

The current JORC resource for the main Mt Cannindah mine part of the project stands at 5.5Mt @ 0.93% Cu, as determined in 2011. Furthermore, recently the Company has also reported stellar exploration success at the Mt Cannindah project.

All eyes now remain on what the updated JORC resource could look like, which will include new holes.

RELATED ARTICLE: Cannindah Resources (ASX:CAE) renews nine mining leases till 2034