Summary

- ASX 200 listed company, WiseTech share price zoomed up by 33.926 per cent on 19 August 2020. The soared share price was buoyed by the unveiling of its robust FY20 results ended 30 June 2020 on the same day.

- The Company garnered attention for recording AU$4 million of total revenue, AU$160.8 million noted as statutory NPAT and AU$126.7 million as EBITDA.

- WiseTech’s bolstered balance sheet, with a cash balance of AU$223.7 million and solid operating cash flow of AU$146.3 million at the end of 30 June 2020, would further facilitate WTC in administering both strategic and operational initiatives, with swelled global demand among large logistics service providers for WiseTech’s digital solutions.

- WiseTech witnessed marginal impact of COVID-19 headwinds on its business performance in FY20 results and further expects FY21 EBITDA in the range AU$155 - AU$180 million, and revenue in the range AU$470 - AU$510 million.

The coronavirus crisis has led to a difficult period for people across the globe, with the virus severely affecting human health and the economy. Owing to pandemic induced turbulent time for the markets, numerous market participants strive to remain positive.

Do read; ASX 200 Stocks with Cracking Equity Raising deals: A look at Lynas and IAG Share Price

Notably, On 21 August 2020, the S&P/ASX 200 Information Technology Index was trading at 1811.6, indicating a marginal increase of 0.52 per cent (at AEST 1:12 PM).

However, the benchmark S&P/ASX200 index was trading at 6113.5, decreasing by 0.11 per cent (at AEST 1:11 PM), on 21 August 2020.

Did you read; ASX indices Showing Interesting Developments- Benchmark ASX200, IT, and Financial Index

On that note, let us cast an eye over ASX 200 listed company, WiseTech Global Limited (ASX:WTC), a leading developer and provider of software solutions to the logistics industry across the globe.

Source: ASX, dated 21 August 2020

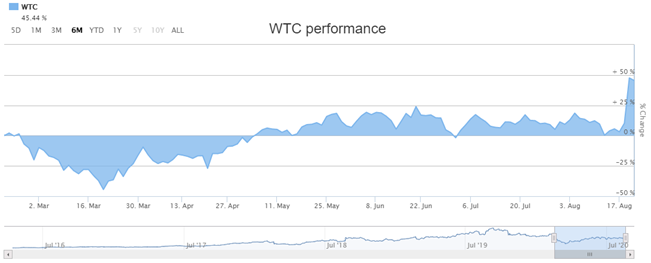

WiseTech share price has been rising on ASX and has generated a return of 32.98 per cent, and 45.44 per cent in past three months and six months, respectively.

On 19 August 2020, WiseTech share price witnessed an uptick of 33.926 per cent and settled the day’s trade at AU$27.87. However, on 20 August 2020, WiseTech share price closed the day’s trade at AU$27.460, down by 1.471 per cent.

On 21 August, 2020, WiseTech was trading at AU$27.66, marginally up by 0.728% (at AEST 1:10 PM).

Noteworthy, the increase in the share price on 19 August was followed by the released results for the full year ended 30 June 2020, as discussed in the article.

Did you read; Resilient ASX 200 Technology Stocks: EML Payments and WiseTech share prices

Let us quickly acquaint ourselves with the latest news of the Company.

Impressive business performance during FY20

WiseTech unveiled its FY20 performance report and highlighted the total revenue of AU$429.4 million for the period versus AU$348.3 noted in y-o-y.

This upsurge of 23 per cent on last year was driven by considerable organic revenue growth of 20 per cent (y-o-y) from its CargoWise platform and increase of 29 per cent (y-o-y) from strategic acquisitions and integration procedure.

Additionally, the organic revenue growth from CargoWise platform stood at AU$263.0 million, indicating a y-o-y increase of 20 per cent. This surge is ascribed to boosted gains in new customer base by winning contracts from numerous new clients (comprising of Hellmann Worldwide Logistics, Aramex and Seafrigo Group) and enlarged usage by existing customer base, slightly counterpoised by lower transaction volume owing to the impact of the COVID-19 pandemic on the logistics vertical across the globe.

Did you read; WiseTech founder dumps $45.8m of shares, Is the charm around WiseTech Share Price fading away?

It is worth noting that CargoWise experienced an upbeat momentum and by July end, its user base stood near pre-COVID-19 levels.

Although WiseTech’s underlying NPAT was noted to be flat at AU$52.6 million, its statutory net profit after tax (NPAT) witnessed a robust y-o-y growth of 197 per cent and reached AU$160.8 million.

Did you read; Flick through 3 Large Cap ASX Tech stocks – WTC, CPU, XRO

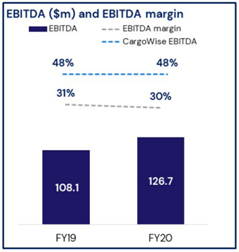

Additionally, WTC’s EBITDA experienced an incremental y-o-y growth of 17 per cent and was recorded at AU$126.7 million.

Source: ASX announcement, dated 19 August 2020

Did you read; WiseTech Global Renegotiates Earnout Arrangements for Acquisitions

Furthermore, WiseTech also divulged its bolstered financial position with cash of AU$223.7 million and operating cash flow of AU$146.3 million, as on 30 June 2020.

Notably, the boosted balance sheet echoed that WiseTech is well-positioned to enforce strategic and operational initiatives, with considerable financial flexibility and headroom.

Innovation and Product development

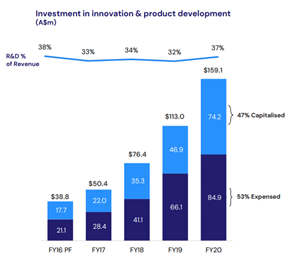

Innovation and product development continued to be a priority for WiseTech. The investment in the product noted an upsurge of 41 per cent (y-o-y), demonstrating enlarged innovation pipeline with focus primarily on the enrichment of existing product, assimilating acquired products and building new platforms.

Source: Company’s Presentation, dated 19 August 2020

Dividend

WiseTech also updated that its shareholders would be receiving a fully franked final dividend of 1.60 cents per share (cps) on 2 October 2020. The dividend declared would go ex on 4 September 2020, and has a record date of 7 September 2020.

Notably, the total dividend comes to 3.30 cps, inclusive of 1H20 interim dividend of 1.70 cps and 1.60 cps of 2H20.

Source: Company’s Presentation, dated 19 August 2020

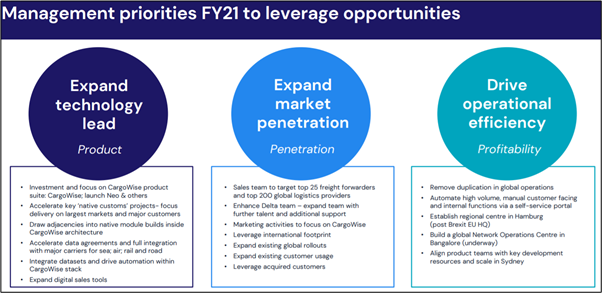

Outlook for FY21

The Company provided the earnings guidance for FY21 and anticipated the following-

- Revenue growth between 9 per cent - 19 per cent (AU$470 - AU$510 million); and

- EBITDA to surge amid 22 per cent to 42 per cent (AU$155 - AU$180 million).