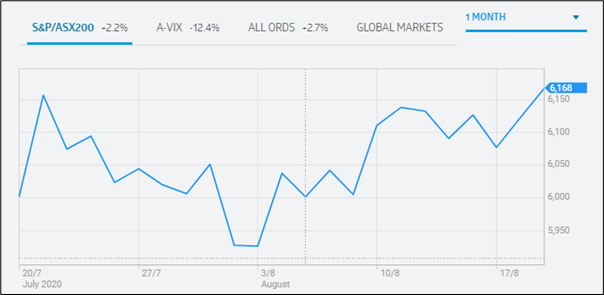

At the close of trading session on 19th August 2020, equity market of Australia ended in green. The benchmark index S&P/ASX200 rose by 44.2 points to 6167.6. In the last one month, the index has gained 2.2%. S&P/ASX 200 Information Technology (Sector) moved up by 44.6 points to 1,786.5. S&P/ASX 200 Energy (Sector) stood at 7,508.0 with a rise of 48.6 points.

S&P/ASX200 Performance (Source: ASX)

On ASX, the share price of WiseTech Global Limited (ASX: WTC) rose by 33.926% to $27.870 per share. The stock of Corporate Travel Management Limited (ASX: CTD) experienced an increase of 10.626% and settled at $13.430 per share.

S&P/NZX50 moved down by 0.83% to 11,751. The share price of Good Spirits Hospitality Limited (NZX: GSH) soared by 23.19% to NZ$0.085 per share. The stock of Hallenstein Glasson Holdings Limited (NZX: HLG) inched up by 20.99% to NZ$4.150 per share. However, the share price of Blackwell Global Holdings Limited (NZX: BGI) witnessed a sharp fall of 16.67% to NZ$0.020 per share.

Recently, we have written some important information on Musgrave Minerals Limited (ASX:MGV), and the readers can view the content by clicking here.

WiseTech Global Limited Recorded Growth in Topline.

WiseTech Global Limited (ASX:WTC) recently released its FY20 results, wherein, it reported a growth of 23% in revenue to $429.4 million. EBITDA for the period amounted to $126.7 million, reflecting a rise of 17%. Despite a rise of 66% in depreciation and amortisation, the company recorded an underlying NPAT of $52.6 million, which was in line with FY19 numbers. The company has decided to pay a fully franked final dividend of 1.60 cents per share on 2nd October 2020. WTC closed the year with a cash balance of $223.7 million. WTC is in a decent position to execute its strategic and operational initiatives.

Corporate Travel Management Limited Cancelled Dividend Payments for FY20

Corporate Travel Management Limited (ASX:CTD) recently notified the market with FY20 results, wherein, it recorded underlying EBITDA and underlying NPAT of $65.0 million and $32.0 million, respectively. During FY20, the company reported a strong operating cash flow of $79.2 million. The company managed to close the year with a healthy debt free balance sheet. The company stated that FY 2020 interim dividend, which was earlier deferred to October, has been cancelled. Also, there would be no final dividend.