Highlights:

- Perenti has upgraded its revenue guidance from AU$2.4-2.5 billion to AU$2.6-2.7 billion.

- The upgraded guidance is based on the factors that operating conditions and exchange rate remains unchanged.

Diversified global mining services company Perenti Limited (ASX:PRN) on Monday (14 November 2022) upgraded its guidance for the financial year 2023 (FY23). Perenti said that it had upgraded its FY23 guidance as it observed that the positive momentum of FY22 has continued into FY23. If the exchange rate and operating conditions remain unchanged, the company expects to achieve the upper end of EBIT(A) guidance.

Meanwhile, Perenti’s share price surged by 8.17% to AU$1.12 per share at 10:45 AM AEDT. The benchmark index, ASX 200 Materials (INDEXASX:XMJ) was up 3.95% to 17,633.70 points around the same time.

Upgraded FY23 guidance

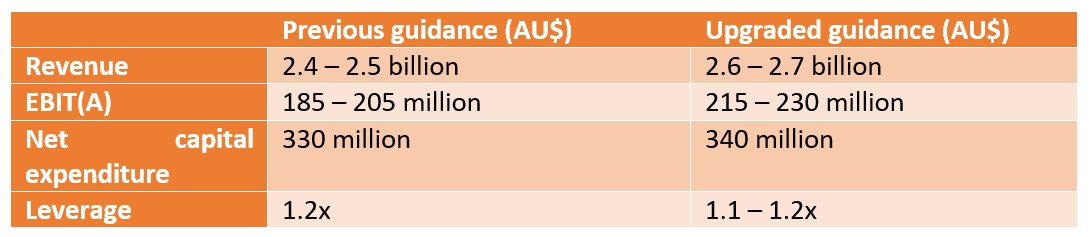

In August 2023, the company shared that it expects revenue in the range of AU$2.4 billion to AU$2.5 billion and EBIT(A) in the range of AU$185 million to AU$205 million. The anticipated net capital expenditure was around AU$330 million, and the expected leverage was circa 1.2x.

After undertaking quarterly forecasting activities, Perenti said that it expects revenue to be in the range of AU$2.6 billion to AU$2.7 billion. The expected range of EBIT(A) is AU$215 million to AU$230 million, and net capital expenditure of AU$340 million.

The company informed that the upgraded guidance is based on factors like favourable movements in the exchange rate of the US dollar to the Australian dollar and improved commercial and operational conditions.

Management Commentary

Mark Norwell, the CEO and managing director of Perenti, commented on the development,

.jpg)