Summary

- Ora Banda has successfully concluded Retail Entitlement Offer to raise approximately A$3.3 million, as part of its capital raising.

- Eligible retail shareholders fully subscribed the offer, and Ora Banda shall issue approximately 14.5 million new shares at the offer price of A$0.23 per New Share.

- Ora Banda will raise A$55 million through Entitlement Offer raising A$15 million and A$40 million placement to institutional investors, subject to completion of the second tranche of the placement.

- New shares under the Retail Entitlement Offer shall rank equally with fully paid ordinary shares of Ora Banda as at the issue date and commence trading on 3 August 2020.

Uniquely placed gold exploration and development company, Ora Banda Mining Limited (ASX:OBM) had previously announced capital raising worth A$55 million through

- A two-tranche institutional placement to raise approximately A$40 million by the issue of about 174 million new shares.

- A one for nine Accelerated Non-Renounceable Entitlement Offer to raise approximately A$15 million by the issue of about 66 million new shares.

Off late, OBM has completed retail component of its one for nine accelerated non-renounceable pro-rata entitlement offer of new fully paid ordinary shares in Ora Banda as announced on 3 July 2020.

Detailed discussion at: Ora Banda Announces $55 Million Worth of Capital Raising to Accelerate Recommencement of Production at Davyhurst Project

OBM concluded the Retail Entitlement Offer on 24 July 2020 and now looks forward to raising nearly A$3.3 million by issuing around 14.5 million new shares at the offer price of A$0.23 per share.

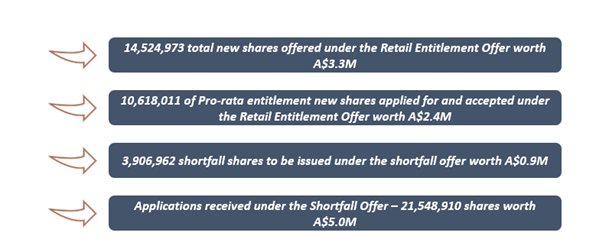

Applications for nearly 73% of the new shares available for issue under the Retail Entitlement Offer, that is 10,618,011 new shares, have been received by OBM from shareholders.

Valid shareholders oversubscribed shortfall of 3,906,962 shares with applications for 21,548,910 shares.

The below-given infographic outlines the results of the Retail Entitlement Offer:

Moreover, in accordance with eligible shareholders entitlements, OBM has resolved to equitably scale back applications for Shortfall Shares under the Shortfall Offer. Also, refunds related to scale back applications under the Shortfall Offer are planned to be despatched to shareholders in the near term.

Update on bookbuild: Ora Banda Completes Bookbuild for Capital Raising, Looks Forward to Collectively Raising $55 Million

With the A$40 million placement to institutional investors, along with Entitlement Offer raising A$15 million, Ora Banda looks forward to raising A$55 million (excluding costs). However, this is subject to completion of the second tranche of the placement, which comprises of 96.1 million new shares to be issued to Hawke’s Point and a Director, to raise approximately A$22.1 million.

OBM seeks the approval for the same from its shareholders at their general meeting, scheduled to take place in early September 2020.

Moving further with the share allotment, OBM plans to allot new shares under the retail entitlement offer on 31 July 2020. The same is then expected to commence trading on a normal settlement basis on 3 August 2020 and shall rank equally with fully paid ordinary Ora Banda shares as at their issue date.

On 30 July 2020, OBM stock was up by 7.042% at AEST 12:33 PM and was noted trading at $0.380.