Summary

- Ora Banda is a gold exploration and development company that has been keen to recommence operations at its 100% owned Davyhurst Gold Project.

- Recently concluded DFS has shown that significant existing infrastructure empowers OBM for a rapid and low-capex path to production at the project.

- OBM had announced a capital raising worth $55 million to meet the financing requirements for undertaking various activities at the project.

- Several high priority targets have been identified for planned regional exploration programs, including well-defined but inadequately tested prospect-scale gold occurrences.

Distinctively placed gold exploration and development company, Ora Banda Mining Limited (ASX:OBM) owns 100% of the Davyhurst Gold Project located in the exceedingly prolific Eastern Goldfields region of Western Australia.

OBM’s ownership of an existing centralised 1.2 Mtpa processing hub, as well as other established infrastructure at the Davyhurst, facilitates the rapid unlocking of the value contained within the known resource base held by the Company.

Ora Banda also focuses on the development of its other deposits like Riverina, Waihi, Siberia, Callion and Golden Eagle.

Ora Banda Concluded DFS at Davyhurst

The Company was careful about growing its reserves as well as delivering a Definitive Feasibility Study (DFS) on an initial five-year mine mining investment plan. Importantly, previous companies operating at Davyhurst were a clear failure due to the lack of reserves and capital to sustain healthy production levels over several years.

On 30 June 2020, the Company obtained the results of the Definitive Feasibility Study aimed at re-starting production at its Davyhurst Gold Project.

The finalisation of the DFS indicates the culmination of an extensive 12-month work program dedicated on a measured and value-driven production recommencement at the Davyhurst. Moreover, OBM is optimistic that the DFS validated significant current infrastructure shall empower Ora Banda to chase a fast and low-capex route to production.

OBM has scheduled mining to commence in Q4, CY2020 and aims the first gold pour during the first quarter of January 2021. However, this is subject to completion of suitable financing arrangements during Q3, CY2020.

Capital Raising to Finance Recommencement of Production at the Project

As a step towards arranging suitable financing, OBM has launched a capital raising worth A$55 million by way of:

- A two-tranche institutional placement to raise approximately A$40 million by the issue of about 174 million new shares.

- A 1 for 9 Accelerated Non-Renounceable Entitlement Offer to raise approximately A$15 million by the issue of about 66 million new shares.

OBM looks forward to employing proceeds from the capital raising towards the recommencement of production at Davyhurst. The Company is optimistic that these funds from equity raising, in conjunction with its existing cash balance shall help to meet the requirements of capital costs and working capital in order to begin the production at the project.

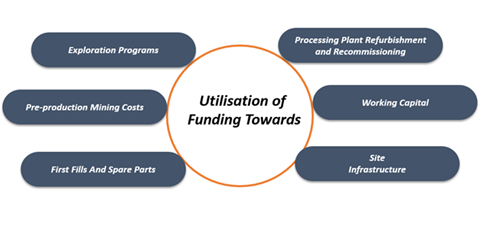

Detail description of use of proceeds:

Figure 1 Kalkine Image (Data Source: OBM's Announcement)

Moreover, this shall also strongly position Ora Banda to become a debt-free gold production company in Q1 CY2021.

Other Funding updates

The results of the Retail Entitlement Offer are expected to be announced on announce 29 July 2020 and the Retail Entitlement Offer is expected to be settled on 30 July 2020. Given the relatively low capital requirement and expected short time frame to the first production, OBM was confident that the Project would have been financed on attractive terms.

OBM approved urgent commencing of the first phase of development activities, and this was to be funded by its current cash reserves.

Moving Forward

Subsequent to obtaining results of the DFS, OBM had planned to continue optimising the DFS over the next several months with a view of refining its plans. In addition to this, provisions for a competitive tender process for contract mining is ongoing and is anticipated to be concluded by Q1 of FY 2021.

Moreover, OBM’s discussion with GR Engineering in relation to the plant refurbishment, optimasation, and recommissioning has been finalised holding a contract value of A$10.8 million. Work has already started and is expected to conclude during Q1 FY 2021.

The highly encouraging results from the DFS mark an important step for OBM’s evolution towards its ultimate objective of unlocking the significant value held in its strategic and prospective Davyhurst Project.

Also, OBM had identified several high priority targets for planned regional exploration programs. These targets are well-defined but poorly tested prospect-scale gold occurrences and include Flame, Young Australian/Peach Tree, Missouri, and Golden Eagle.

OBM closed at A$0.375, up by 19.048%, on 27 July 2020.