Summary

- King River Resources’ gold-centric exploration plans at Mt Remarkable Project and Tennant Creek Project appear to be bolstered by the recent successfully closed Security Purchase Plan (SPP).

- KRR completed the SPP offer and received applications totalling $7,861,240; the funds are planned to be utilised towards advancing gold exploration programmes.

- A 2,000m RC drill programme, which would test for high-grade gold mineralisation at Tennant Creek Project, has been commenced.

Recent gold exploration plans of King River Resources Limited (ASX:KRR) have been toast of the town, with latest news on ASX indicating full-fledged strategy of the Company to make a dominant move in the gold exploration space. Significantly, the gold buzz generated during COVID-19 pandemic does not appear to be simmering down, as the world yet continues to look forward to a treatment or vaccine for coronavirus.

ALSO READ: King River Resources Impressively Gliding through High Tide of Gold Prospects

Looking at the sunny side, improving scenario in Australia as a whole seems to buoy up hopes for the explorer further to advance its gold exploration journey.

The gold-centric focus of KRR was seemingly championed by investors, portrayed through the successful completion of Security Purchase Plan (SPP). Taking initiatives in calculated directions, the Company has already commenced its exploration journey on Tennant Creek Project, piggybacking the robust leadership and strategic orientation.

With this backdrop, let us unveil the recent Security Purchase Plan along with ongoing and proposed gold exploration developments, that together seems to catalyse King River Resources’ growth journey.

Successful Completion of Security Purchase Plan

King River Resources recently announced the successful completion of Security Purchase Plan (SPP) and receipt of applications totalling $7.86 million.

The SPP has allowed subscription of new shares at $0.033 by eligible shareholders, with one new free attaching option to every two shares issued. Significantly, the new options have an exercise price of $0.06 and expiry date of 31 July 2022.

ALSO READ: King River Resources’ Security Purchase Plan Centred on Advancing Projects’ Exploration Ventures

The Company indicated that the securities would rank equally in all respects with the existing issued securities in the class from their issue date.

King River Resources will be using the funds raised for bringing forward gold exploration programmes at the Tennant Creek and Mt Remarkable projects.

2020 Gold Exploration Focus

Exploration Programme at Tennant Creek Project

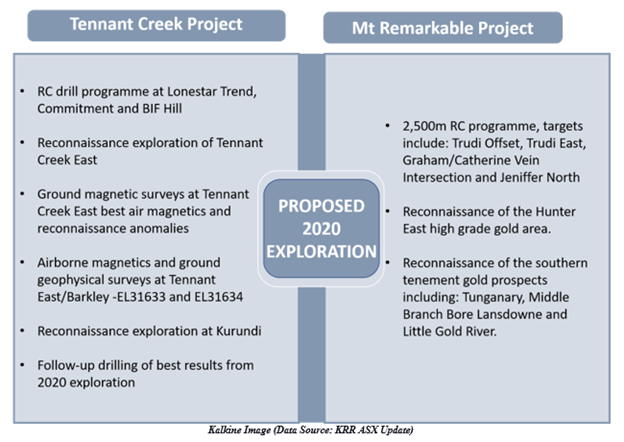

King River Resources has commenced its 2,000m RC drill programme, testing for high-grade gold mineralisation at the Tennant Creek project in the Northern Territory. At the Lone Star area, drilling will target three main coincident gravity and magnetic trends, which have their magnetic and gravity anomalism strength comparable to other known Iron Oxide Copper Gold (IOCG) deposits in the area.

ALSO READ: Supercharged King River Resources to Beef Up Gold Exploration at Tennant Creek, Stock Zooms ~18%

Drilling will then make a beeline to the Commitment Prospect, where a large coincident magnetic and gravity anomaly follows a NW/SE trend. The Company would target the primary magnetic body and a strong gravity anomaly, somewhat offset from the main magnetic body probably embodying a hematite rich zone.

In addition to the current drilling programme, exploration planned for 2020 will include reconnaissance of the Tennant Creek East area. With ground magnetics/gravity surveys, the Company plans to test the best of the known magnetic anomalies and reconnaissance discoveries in this area.

In the Tennant East/Barkley area, its co-funded programme with the Northern Territory Geological Survey (NTGS)-granted 50% of the survey cost, includes a ground geophysical and a detailed airborne magnetics survey over EL31633. It also incorporates a ground geophysical survey over EL31634 for testing and defining significant magnetic anomalies and depth of cover in a previously unexplored area.

The Company has also planned initial reconnaissance exploration for Kurundi Project where it has four exploration licences (2 granted) over the Kurundi Anticline’s part and covers the Kurundi historic gold mine as well as the Whistle Duck prospect.

Mt Remarkable Project Exploration Plans

KRR has strategically laid exploration plans for its high-grade Mt Remarkable project in Western Australia, which would include a 2,500m RC drill programme at the main Mount Remarkable project, where the Company witnessed several high-grade gold results.

ALSO READ: King River Resources’ Quarterly Report Card Shining with Imprints of Strategic Accomplishments

Trudi offset target would be included in targets, where the Company has discovered a new mineralised zone 150m east of the main Trudi deposit. Furthermore, KRR has designed plans for reconnaissance exploration concerning its extensive regional Mt Remarkable tenement holding.

Other drill targets include the Jeniffer North prospect, easternmost extents of the Trudi vein and a new target where the Catherine Vein and the Grahame Vein intersects under interpreted cover units 400m north of Trud.

Stock Performance

Notably, KRR stock marked an uptick of over 6% on 21 August 2020, closing the day’s trade at $0.035. The share price of KRR has given a return of over 57% on a year-to-date basis.