Highlights:

- South32's fair value projected at AU$6.68.

- Stock appears discounted by 50% compared to intrinsic estimates.

- Estimated equity value of AU$19 billion

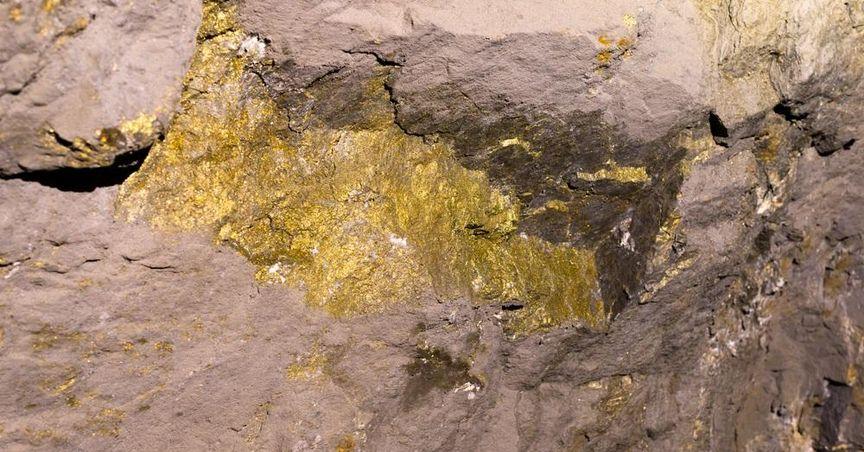

South32 Limited, a prominent company in the mining and metals sector, has a substantial presence globally. Specializing in producing base metals, energy coal, and other critical materials, South32 plays a significant role in various supply chains. The company's stock (ASX:S32) is actively evaluated by market participants using different models to assess its true worth. This article explores the intrinsic value of South32 through the Discounted Cash Flow (DCF) model.

DCF Model: A Look at South32's Intrinsic Value

The DCF model provides a mathematical framework for determining the intrinsic value of a company by estimating future cash flows and discounting them to their present value. This technique, while technical, offers an approachable understanding of how to assess a company’s true worth. For South32, the forecasted cash flows are derived from both publicly available analyst projections and historical data where necessary. The model splits growth into two phases: one with higher growth and another with more stable, long-term growth rates.

Projected Cash Flows and Present Value

The projected future free cash flows (in millions of USD) for South32 over the next decade demonstrate significant fluctuations as the company adapts to global market conditions and mining cycles. These figures help assess the company’s financial viability and growth trajectory. Discounting these cash flows at a rate of 7.3% results in a present value that totals roughly AU$5.6 billion. Furthermore, the estimated Terminal Value (TV), which reflects the company’s ongoing growth beyond the forecasted period, stands at AU$13 billion.

Equity Value Calculation and Current Valuation

By adding the present value of projected cash flows and the discounted terminal value, the total equity value of South32 reaches approximately AU$19 billion. With the stock trading at AU$3.36, it is suggested that the current market value is about 50% below its intrinsic value. This discrepancy implies that the stock is trading at a significant discount relative to its fundamental worth.

Financial Health and Industry Considerations

The DCF model, while a useful tool, is heavily dependent on certain assumptions, such as the discount rate and cash flow projections. In South32’s case, the discount rate is set at 7.3%, with the cost of equity factoring in a beta of 1.150. It's important to acknowledge that this model is only one piece of the puzzle. A deeper look at the company's financial health, debt levels, and competitive positioning within the industry is essential for a complete understanding of its market standing.

SWOT Review of South32

The financial structure of South32 reflects a strong balance sheet, but there are areas for improvement. Despite its strengths, the company faces challenges such as a relatively low dividend yield compared to industry peers. Opportunities are emerging, especially as the company approaches a break-even point and boasts a solid cash runway. However, South32 must address threats, including concerns about dividend sustainability given cash flow limitations.