Highlights

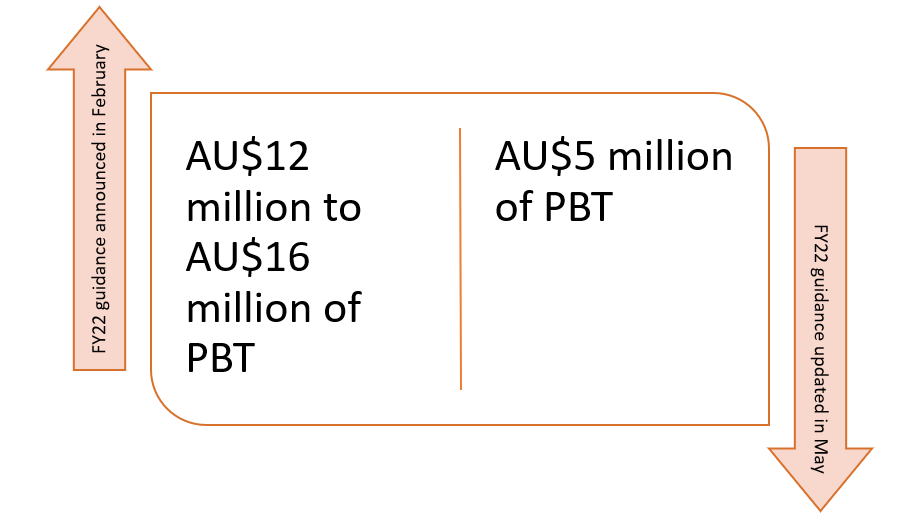

- Pro-Pac has cut FY22 profit before tax (PBT) guidance from AU$12M – AU$16M to AU$5M

- At the beginning of April, Pro-Pac had reiterated its FY22 guidance, which was shared in February

- Pro-Pac shares are down over 14% today.

Shares of the small-cap company, Pro-Pac Packaging Limited (ASX:PPG) fell on the ASX after the company downgraded its guidance for full-year 2022 (FY22). At 10:34 AM AEST, the shares were spotted trading 14% lower at AU$1.15 per share. With today’s fall, the stock has corrected over 21% year-to-date (YTD) and 94% in the last one year.

Today (13 May 2022), Pro-Pack shares are underperforming its benchmark index, ASX 200 Materials (XMJ) which is trading in green, up 0.69% at the time of drafting this article.

Change in FY22 guidance

On Friday, Pro-Pac said that it wouldn’t be able to meet the FY22 guidance shared by it in February and reiterated in April. Reportedly, since April, the results are not aligned with the company’s expectations. Pro-Pac expects that performance momentum will continue in the coming two months. On this assumption, the full-year guidance has been cut to around AU$5 million of profit before tax (PBT).

Image source: © 2022 Kalkine Media®

On 25 February 2022, the diversified distribution and manufacturing company shared the half-yearly results for the period ending 31 December 2021. In the first-half results, the company said that it expected underlying PBT of AU$7.8 million to AU$11.8 million in the second half of 2022. For FY22, the company expected PBT in the range of AU$12 million to AU$16 million.

At the beginning of April, Pro-Pac further reiterated its FY22 guidance through ASX-announcement. The packaging company said that strong demand, alleviation of bottleneck issues and continuous development of labour supply strategies would drive its earnings in the second half and FY22.

The new guidance has been provided with the assumption that the company will complete Rigid’s disinvestment for AU$56 million on 30 June 2022.

Suggested reading: WHC, VEA: Why these ASX energy shares hit multi-year highs yesterday

Why did Pro-Pac cut its FY22 guidance?

Image source: © Piscine26 | Megapixl.com

Pro-Pac informed its shareholders that raw material supply is constrained because of the sea freight restrictions globally, while problems in Europe and Asia are stoking uncertainties further. Cost is another factor that pushed the ASX-listed packaging company to cut its guidance. Pro-Pac said costs have been rising due to sea freight, foreign exchange, and inflation rates.

In addition to this, the production capacity is affected due to Covid-19 related impacts and shortage of labour. In February, the company mentioned that operating would remain challenging, mainly because of the supply chain crunch and labour shortage.

Does Pro-Pac pay dividends?

Pro-Pac distributes dividends after considering the business performance. In 1HFY22, the company did not announce an interim dividend as the performance was severely impacted by the Covid-19, labour shortage and supply chain disruptions.

Must read: ASX 200 opens positive, Link Administration, Blackmores lead gains