Highlights

- The benchmark ASX 200 index shot up 0.8% to 6,996.7 in the first 15 minutes of trade.

- US stocks ended on a mixed note on Thursday.

- The ASX healthcare sector is the leader so far, surging 0.9% in early trade.

The Australian share market opened on a positive note on Friday as Aussie investors shrugged off concerns over interest rate hikes, energy supply, China’s COVID-19 situation and prospects of global recession and splurged cash on beaten-down stocks. The benchmark ASX 200 index shot up 0.8% or 55.7 points to 6,996.7 in the first 15 minutes of trade, while the ASX All Ordinaries index was up 0.84% to 7,226.5. The A-VIX fell 2.19% to 18.85.

Global equity markets fell to their lowest point in over 18 months on Thursday as investors were fretting over high inflation leading to a potential of aggressive rate hike, which could slow down the economies.

US stocks ended a volatile session on a mixed note on Thursday, with the Dow Jones Industrial Average falling 0.33% to 31,730.31, while the S&P 500 took a hit of 0.13% to end at 3,930.09 points. The NASDAQ Composite ended the session with a gain of 0.06% to 11,370.96.

Market action

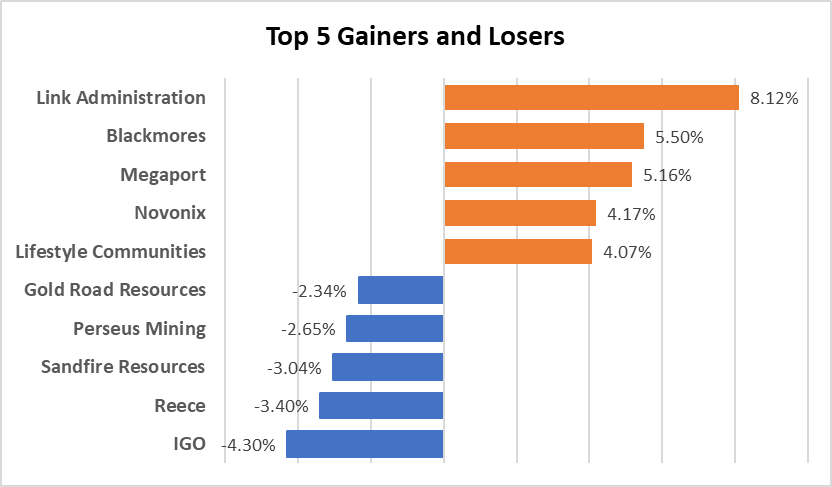

Data Source: ASX (as of 13 May 2022, 10:30 AM AEST)

Image Description: Top 5 ASX gainers and losers

Image Source: © 2022 Kalkine Media®

Coming to the top ASX 200 gainers, Link Administration Limited (ASX:LNK) and Blackmores Limited (ASX:BKL) were leading the pack, gaining 8.12% and 5.5%, respectively. On the flip side, IGO Limited (ASX:IGO) and Reece Limited (ASX:REH) were the top losers, falling 4.3% and 3.4%, respectively.

On the sectoral front, eight out of the 11 sectors were trading positive in early trade. The healthcare sector was the leader, surging 0.9%, followed by a 0.5% uptick in the IT sector. The consumer staples sector is trading with a cut of 0.17%.

Read More: Cheers or fears? Crypto ETFs debut in Australia amid crypto mayhem

Newsmakers

- Australian Strategic Materials (ASX:ASM)

- Shares of ASM have been placed under a trading halt by the ASX.

- Shares will remain in a halt till 17 May 2022 or when the company releases a pending announcement, whichever comes earlier.

- The company is to make an announcement regarding equity funding agreement and revisions to a framework agreement.

- Pro-Pac Packaging Limited (ASX:PPG)

- In a trading update, the company said its raw material supply has continued to be constrained as a result of global sea freight restrictions and unreliability arising from bottlenecks in Asia and Europe.

- Production capacity continues to be restricted by the shortage of labour and the ongoing impacts of COVID-19.

- It expects FY22 underlying PBT result to be circa AU$5 million.

- Crater Gold Mining Limited (ASX:CGN)

- The company has signed an agreement to undertake a helicopter-borne Electro-Magnetic Survey, combined with aeromagnetic surveying, over all five of its Queensland-based tenements at Croydon.

- The survey will target graphite mineralisation, gold-bearing quartz reef mineralisation and polymetallic mineralisation, and is capable of penetrating up to several hundred metres below ground surface.

- Resolution Minerals Limited (ASX:RML)

- Resolution Minerals and OZ Minerals have entered into a Farm-in and JV agreement on the Benmara Project in the Northern Territory, Australia.

- OZ Minerals can earn a 51% interest by spending AU$4 million over five years.

- Resolution would remain the operator during the Earn-in period with technical input from OZ Minerals.

- Neometals Limited (ASX:NMT)

- Neometals’ battery recycling JV, Primobius, has executed a cooperation agreement with LICULAR GmbH, a subsidiary of Mercedes-Benz.

- The Cooperation is conditional upon LICULAR GmbH issuing a purchase order for the engineering, supply and installation of the necessary equipment for the Recycling Plant.

Read More: Why Australian bond yields are scaling new heights