Summary

- Despite the COVID-19 challenges, some companies are unstoppable, and they are moving forward to achieve their goals.

- Value stocks belonging to majorly established players are those stocks that trade at a price below their actual worth, while growth stocks are stocks of those companies that have the potential to beat the market.

- Telstra has entered a deal for the sale of Clayton data centre; however, TLS will retain the ownership of all IT and telecommunication equipment.

- Transurban Group is set to pay a distribution totalling 16.0 cents per stapled security on 14 August for the six-month period ended 30 June.

- CSL is to acquire a late-stage gene therapy being designed to provide one-time treatment for haemophilia B, while RMD performed well in third quarter despite the challenges due to ongoing pandemic.

From the time COVID-19 gripped the world, stock markets have been on a roller coaster ride. There has been a lot of uncertainty in the markets, which are sensitive towards all kind of news coming their way. This pandemic has led to a turbulent time for the markets, on a global level. However, despite all the challenges, the world seems to be accepting this new normal and somehow managing the losses caused by this pandemic.

Do Read: Are We in a Messed-up state in the Fight Against COVID-19?

Yesterday on 5 August 2020, the Australian stock market ended the trading session in the red zone; however, on 6 August 2020 (AEST 01:06 PM), the benchmark index S&P/ASX 200 was moving forward by 0.23 per cent to trade at 6,015.0. Noteworthy, several businesses are not only functioning uninterruptedly during this challenging time but also moving forward to gain more success and achievements.

Let's discuss few of the famous names under the growth and value stocks from diverse sectors during these present times.

Telstra to Sell Clayton Data Centre for AUD 416.7Mn

Telstra Corporation Limited (ASX:TLS) has entered an agreement with Centuria Industrial REIT to sell its 3.2-hectare data centre complex in Clayton, Victoria, incorporating 10 buildings, for AUD 416.7 million.

The sale, which will not have an impact on Telstra's customers, includes a triple-net lease-back settlement. This means TLS will continue to have the ownership of all IT and telecommunications devices and ongoing operations, and will be the responsible party for repair work, upgrades, security, and future capex requirements.

The lease is for the next 30 years, and Telstra has the choice to extend the lease with two 10-year options. The transaction is anticipated to conclude towards the end of August.

Telstra CEO Andrew Penn stated that the sale is another marker on the progress of TLS' T22 strategy. As part of this strategy, TLS aims to build up to AUD 2 billion worth of assets to strengthen the balance sheet. By securing this deal, the company has now reached more than AUD 1.5 billion.

Data centres are one of the important parts of the digital ecosystem, and TLS continues to own and administrator the world's top facilities across its domestic and international market.

On 6 August 2020 (AEST 01:09 PM), TLS was trading at AUD 3.395, down by 0.147 per cent. The company has a market cap of AUD 40.44 billion and its stock has delivered a return of more than 10 per cent in the last three months.

Transurban’s Total FY20 Distribution at 47.0 cents per security

Transurban Group (ASX:TCL) released a trading update in June 2020, announcing a distribution totalling 16.0 cents per stapled security for the six-month period ended 30 June 2020, taking the total FY20 distribution to 47.0 cents per stapled security. The 2H20 distribution is due for payment on 14 August 2020. The company expects FY21 distribution to be in accordance with free cash, excluding capital releases.

TCL also highlighted progressive traffic recovery due to the easing of restrictions. The company is closely working with governments and contractors to deliver its portfolio of large-scale and complex projects. It will offer thousands of jobs to the local people.

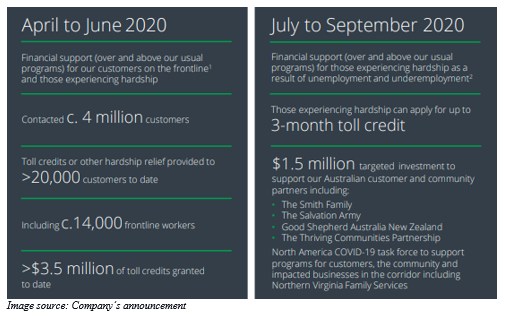

TCL is committed to maintaining jobs for the workforce during this tough time. Over AUD 3.5 million of toll credits have been given till date through the program centred around aiding frontline workers and other pandemic affected people.

TCL now intends to provide financial support to the customers adversely affected due to the pandemic. The company remains well-positioned and has a robust capital position. However, future performance will depend on overall economic conditions and government responses.

Must Read: Lockdown II: Sydney Airport, Transurban Shares Under Discussion

On 6 August 2020 (AEST 01:11 PM), TCL was trading at AUD 13.670, down by 1.014 per cent. The company has a market cap of AUD 37.77 billion.

CSL to Acquire Late-Stage Gene Therapy Candidate for Haemophilia B from uniQure

CSL Limited (ASX: CSL) has reached an agreement to gain access to uniQure's exclusive global license rights for the commercialisation of an adenoassociated virus (AAV) gene therapy program for the haemophilia B treatment. The transaction is subject to customary regulatory clearances before closing.

The AMT-061 (etranacogene dezaparvovec) program is right now undergoing Phase 3 clinical trials. Initial reports show that one dose of AMT-061 increases FIX plasma levels, the protein missing in such patients.

The program can be a breakthrough for treating haemophilia B if it becomes successful, with the patients receiving a one-time treatment instead of the current frequent and ongoing replacement therapies for restoring Factor IX (FIX) activity to functional levels. It can be one of the first gene therapies to offer long-term benefits for such patients.

CSL's CEO and MD Paul Perreault mentioned that the vision is to provide transformational treatment paradigms for haemophilia B patients that can free them from permanent suffering of the disease.

On 6 August 2020 (AEST 01:12 PM), CSL was trading at AUD 276.390, down by 0.633 per cent. The company has a market cap of AUD 126.29 billion.

Do Read: Healthcare Corner: Lens on CSL and Opthea

ResMed Q3 Revenue Up by 16 per cent

World-leading digital health company, ResMed Inc. (ASX:RMD) provides cloud-connected medical devices that transform care for people with sleep apnoea, chronic obstructive pulmonary disease (COPD), and other chronic diseases.

In its 3Q FY20 report for the quarter ended 31 March 2020, the company had highlighted:

- Revenue grew by 16 per cent to AUD 769.5 million

- GAAP gross margin stood at 58.4 per cent; non-GAAP gross margin increased by 60.0 per cent

- Net operating profit grew 39 per cent; non-GAAP operating earnings up 31 per cent

- GAAP diluted earnings per share of AUD 1.12; non-GAAP diluted earnings per share of AUD 1.29.

ResMed's CEO, Mick Farrell, had stated that amid these challenging times, the primary goal is the safety of employees and helping people. RMD ramped up the production of life support ventilators, ventilation mask systems, and non-invasive ventilators.

On 6 August 2020 (AEST 01:13 PM), RMD was trading at AUD 26.550, down by 5.009 per cent. The company has a market cap of AUD 40.5 billion.

Good Read: Can rising COVID-19 cases push these stocks further north? (RMD, FPH, ANN)