Summary

- The Australian government’s stimuli package and RBA’s move of a low cash rate and three-year yield target empowered household and businesses to boost the economy by maintaining essential consumption and avail credit at lower interest rates.

- Support for Australian companies and ramp-up in infrastructure spending increased employment and ASX construction and infrastructure shares significantly.

- The government has also allotted funds to conduct R&D activities concerning a potential vaccine and treatment for COVID-19.

- The stimulus programs and infrastructure spending has led the Australian economy and the share market to an upward trajectory with the S&P/ASX 200, the representative index of ASX share market, recording a 32.96% increase since its March low.

Australia has been hit hard, just like any other nation, by the COVID-19 pandemic. To safeguard its people and save the country from witnessing a significant economic downfall, the government of Australia has implemented various relief measures to ensure adequate physical and mental health of the people, and financial health of the businesses. From providing survival money through JobKeeper and JobSeeker stimulus program to providing Business aid to infrastructure spending, the Australian government has left no stone unturned to make the economy rebound from the bearish market since the coronavirus pandemic struck the world.

The island nation put in place strong social-distancing measures to contain the spread of the virus and prompted the Australian businesses and consumers to stay put. Despite the recent rise in Victoria cases, the government initiatives have helped the country manage the pandemic in a way much better than some of the other significant geographies.

On that backdrop, let us discuss a few reforms and how they have stimulated the share market.

Government’s JobKeeper and JobSeeker program have supported in keeping purchasing power of people intact, thus augmenting consumption in the economy

The Federal government has extended JobKeeper wage subsidy and Seeker unemployment benefit to save the economy from severe liquidity crunch as business activities come stalling with the second wave of coronavirus intensifies. However, the A0 billion-program has given a substantial boost to the purchasing power of the common man.

GOOD READ: JobKeeper 2.0: 5 Things to watch while Card Spending reflect different trends

- JobKeeper wage subsidy: The government currently provides A$1,500 a fortnight which is going to become A$1,200 a fortnight from October. For people who will be working less than 20 hrs a week, JobKeeper payment will be A$750 a fortnight from October. The rates will further reduce from 2021 with A$1,100 a fortnight allotted for full-time workers and A$650 a fortnight for people working less than 20hrs a week.

- JobSeeker unemployment benefit: From October 2020, JobSeekers will get a payment of A$815 a fortnight on JobSeeker coronavirus supplement program.

DO READ: Transiting from JobKeeper to JobSeeker: Morrison’s Government plan to boost employment

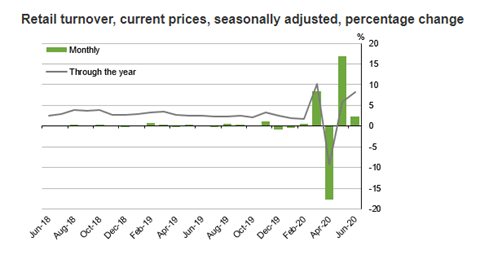

The Australian economy saw a boost with the Australian Bureau of Statistics (ABS) revealing that the retail turnover rose by 2.4% in June 2020 month-over-month and by 8.2% when compared to June 2019. The rise in retail turnover was backed by the limited reopening of cafes, restaurants and takeaway food services, and clothing, footwear, and personal accessory retailing. Food companies such as The a2 Milk Company Limited (ASX:A2M), provider of milk and other dairy-related products, had recorded double-digit growth since the March bear market.

Source: ABS

INTERESTING READ: Will Australia experience a surge in Voluntary Administration once financial stimuli lapses?

Monitory measures from the Central Bank have helped businesses and household to avail credit easily and at lower interest rates

To keep the Australian economy healthy, Reserve Bank of Australia (RBA) did not change the cash rate and three-year yield target and kept borrowing costs low for households and businesses to avail credit readily. The monetary policies will act as a complement to fiscal policies such as economic reforms and infrastructure spending. The Australian economy and share market have rebounded ever since the lockdown measures have been relaxed and RBA had incorporated emergency measures in March.

In the last three months, all major banks including Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corporation (ASX:WBC), National Australia Bank Limited (ASX:NAB), and Australia and New Zealand Banking Group Ltd (ASX:ANZ) recorded positive price growth on ASX.

Source: ASX

Support for Australian businesses

The COVID-19 has crippled several industries with SME sector impacted significantly. According to ABS, the SME sector was worst hit as 73% of the companies started working under modified conditions. To support the business, the Australian government injected A$320 billion into the economy and ensured that economic activities recommence rapidly as pandemic subsides.

For example, the federal government announced a A$688 million HomeBuilder stimulus package for six months to support jobs and activity in the construction sector. The announcement got reflected in the share market price rally of many companies such as Brickworks Limited (ASX: BKW) and CSR Limited (ASX:CSR) which experienced a growth of 33.52% and 10.13% respectively in the last three months.

The ramp-up in infrastructure spending

PM Scott Morrison has announced infrastructure spending as part of its five-year jobmaker plan and has committed A$1.5 billion for immediate infrastructure ramp up, as identified by states. While A$1 billion has been assigned to priority projects, A$500 million reserved for road safety works targeting areas across the country, not only in rural and regional areas.

Critical infrastructure projects such as Inland Rail, transport infrastructure, water projects, agricultural expansion, telecommunications services, electrical infrastructure, and projects related to mineral and resources such as iron ore, had been fast-tracked in Western Australia to create more jobs. The projects are worth more than A$72 billion, comprising public and private investment and are expected to provide over 66,000 direct and indirect jobs.

The investments in major infrastructure projects reflect the share market price rally in many companies such as Boral Limited (ASX:BLD), and NRW Holdings Limited (ASX:NWH) by 53.06% and 12.19% in last three months respectively.

Investment in vaccine raising hopes of a better economic future

The government is investing A$66 million into identifying vaccine and treatments for COVID-19 from the Medical Research Future Fund. The key research areas include investing in a COVID-19 vaccine and antiviral therapies for COVID-19, running clinical trials of possible COVID-19 treatments and improvising the health system for managing COVID-19 and future pandemics

The University of Queensland has also teamed up with CSL Limited (ASX:CSL) and Seqirus, and they are developing Protein Subunit ANZCTR targeted against the SARS-CoV-2. The Protein Subunit is currently in a phase 1 trial.

A look at the Stock Market

The stimulus programs drove the Australian economy and the share market to an upward trajectory. The S&P/ASX 200, the representative index of the ASX, recorded an upward journey since the March bear market. The S&P/ASX 200 index closed its trading session at 6,044.2 on 27 July 2020. The figure reflects a change of 32.96% since the March low of 4,546.035 recorded on 23 March 2020.