Summary

- The sustained increase in the silver and zinc prices has prompted Horizon Minerals to assess all options to create value at its Nimbus Silver-Zinc project.

- Extensive geological, metallurgical, and engineering feasibility work had been earlier completed on Nimbus Project.

- Many processing flowsheets have been evaluated for enabling concentrate and final product recovery from the complex mineralogy of the ore bodies.

- Horizon concerning the Nimbus Project has received several expressions of interest from third parties, with further updates and future project directions to be provided in the December Quarter 2020.

The zinc and silver prices steadily rising on the growth trajectory appears to gear up the exploration momentum of Horizon Minerals Limited (ASX:HRZ) at its 100% owned Nimbus Silver-Zinc project. The latest news on the ASX highlighted another round of development at the project.

The Company has kickstarted a Strategic Review of the project which would also include a detailed assessment of all previous Feasibility Study work completed to 2017. Significantly, the Company has received several expressions of interest to acquire or earn-in to the project. The Company intends to review the options in conjunction with an economic evaluation at current high silver and zinc prices.

Commenting on the recent undertakings at its Nimbus project, Horizon Managing Director Mr Jon Price stated that with sustained increase in the silver and zinc prices in recent times, the Company is currently assessing all options for creating value from the historically successful mining operation at Nimbus. He indicated that Horizon sees “substantial opportunity to develop the high grades lodes at Nimbus either on a stand-alone basis or in joint venture with an expert group.”

ALSO READ: Horizon Minerals Stirs up Exploration Momentum with the Successful $16.1 Million Capital Raising

Mr Price believes that there exists growth potential for the project in terms of scale and quality, with further exploration beyond the current mineralised envelopes. The growth and development potential will be considered by the company for pursuing any strategic option for Nimbus.

Casting an Eye over Recent Activities

Up until 2017, a substantial amount of engineering, geological and metallurgical work had been accomplished on the Nimbus project with the Feasibility Study put on hold owing to the depressed commodity prices. Significantly, the Company reviewed several ore processing options on extensive laboratory testwork with results signalling acceptable silver recoveries from conventional and proprietary processes.

The Company has evaluated many processing flowsheets for enabling concentrate and final product recovery from the complex mineralogy of the ore bodies

Horizon has now commenced a desktop study of all previous technical work undertaken for evaluating next steps options in advancing the project. As part of the study, the Company will evaluate the high-grade lodes for potential early stage development and concentrate generation.

ALSO READ: Horizon Minerals’ Dazzling June Quarter Report Card Zooming Strong Exploration Momentum

Third parties have shown considerable interest in the project with technical skillsets in the development of this style of mineralisation.

Nimbus silver-zinc project Overview

The Nimbus Silver-Zinc Project is situated 15 kilometres east of the City of Kalgoorlie-Boulder, near the Boorara gold mine in the Western Australian goldfields. It covers ~170km2 and is stationed on Exploration Licences, Mining Leases and Prospecting Licences and consist of the Boorara gold project area.

Source: HRZ ASX Update dated August 25, 2020

Project highlights include:

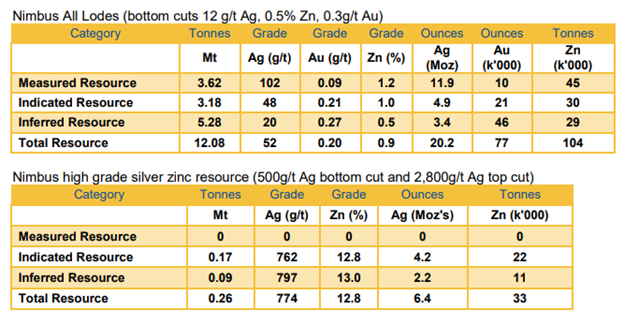

- High grade silver resource 260kt grading 774g/t Ag for 6.4Moz silver and 12.8% Zn for 33kt zinc contained in JORC 2012 Resources of 12.1Mt grading 52g/t Ag for 20.2Moz of Silver and 0.9% Zn for 104kt zinc

- Deposit remaining open at depth and along strike and have significant potential to enhance existing silver-zinc resources with further drilling.

- Significant regional exploration potential for finding additional silver and other base metal deposits.

- Close proximity to Kalgoorlie-Boulder and existing infrastructure

- Historical production of 3.6Moz of high-grade silver (352g/t)

A Glimpse at Nimbus Geology

The Nimbus project is situated within the major belt of greenstones, extending from Norseman to Wiluna in the Eastern Goldfields Province of the Archaean Yilgarn Craton.

Nimbus project is a shallow-water and low-temperature VHMS deposit, situated in the Kalgoorlie Terrane near the terrane boundary lying between the Kurnalpi Terranes and Kalgoorlie. The project is located within the Boorara Domain, which is one of the two structural-stratigraphic units division of the Kalgoorlie Terrane.

Nimbus primary sulfide resources exist as a series of stacked plunging lenses, overlying mined supergene and oxide mineralisation. The mineralogy of the project is complex and includes the mercury presence in the oxide and transition zones.

The Company indicated that it would provide a further update on Nimbus in the December Quarter 2020. The update may include a decision on the optimal pathway for creating value for shareholders in the existing high silver and zinc price environment.

Notably, HRZ stock traded at $0.132 on 27 August 2020 (at 1:44 PM). HRZ share price has increased by 36.84% in the past six-months.