Highlights:

- Strong ROE Performance: Reef Casino Trust (ASX:RCT) boasts a robust Return on Equity (ROE) of 47%, significantly higher than the industry average of 10%. This impressive ROE underpins the company's 24% net income growth over the past five years, surpassing the industry's 7.4% growth rate.

- Effective Use of Earnings: Despite a 100% payout ratio, where the company returns most of its income to shareholders, Reef Casino Trust has achieved substantial earnings growth. This high payout ratio, coupled with a long history of dividend payments, reflects the company's strong commitment to shareholder returns.

- Evaluating Future Prospects: The company's strong ROE and earnings growth suggest a positive outlook. Investors should assess whether this growth is already reflected in the stock price to determine if Reef Casino Trust represents a fair investment compared to its peers.

It’s challenging to feel optimistic about Reef Casino Trust's (ASX) recent performance, given the 4.1% decline in its stock over the past three months. However, long-term stock prices are typically influenced by a company’s financial health, which appears to be solid for Reef Casino Trust. In this article, we will delve into Reef Casino Trust's Return on Equity (ROE).

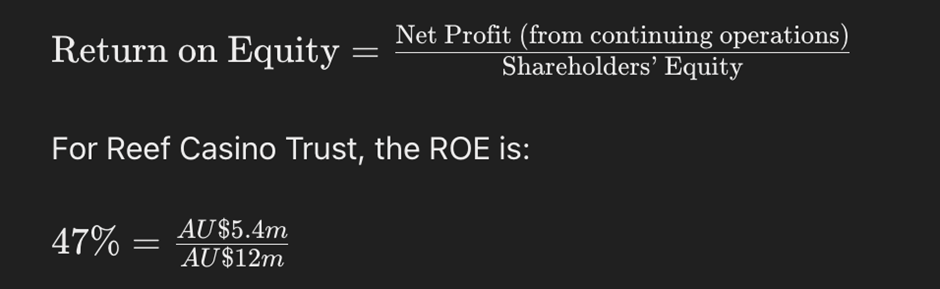

Return on Equity (ROE) measures how effectively a company is increasing its value and managing shareholders' investments. Essentially, it indicates the company's ability to convert shareholder funds into profits.

Calculating Return On Equity

This calculation is based on the trailing twelve months to December 2023, meaning that for every A$1 of shareholders' equity, the company generated A$0.47 in profit.

The Significance of ROE for Earnings Growth

ROE is a crucial metric for assessing a company's potential to generate profits and grow its earnings. The proportion of profit a company reinvests for future growth is an indicator of its growth potential. All else being equal, companies with higher ROE and profit retention rates are likely to grow faster than those without these attributes.

Reef Casino Trust's Earnings Growth and 47% ROE

Reef Casino Trust's impressive ROE stands out, especially when compared to the industry average of 10%. This strong ROE is reflected in the company’s notable 24% net income growth over the past five years, which surpasses the industry average growth rate of 7.4% for the same period.

Earnings growth significantly impacts stock valuation. Investors should determine if the anticipated growth or decline in earnings is already factored into the stock price. This assessment will help them gauge the stock's future prospects. To see if Reef Casino Trust is fairly valued compared to other companies, consider these three valuation measures.

Effective Use of Retained Earnings by Reef Casino Trust

Reef Casino Trust’s high three-year median payout ratio of 100%, which means it retains only -0.06% of its income, indicates the company has achieved substantial earnings growth while returning most of its income to shareholders. Additionally, the company’s long history of dividend payments—over ten years or more—demonstrates its commitment to sharing profits with its shareholders.