The markets have traded in red today as the benchmark index S&P/ASX 200 closed at 6553 points, down 0.3% or 20.4 points on 04 September 2019, with most of the industries moving in the downward trend. But beside this bearish trend the latest updates have taken some resource companies upside on the graph. Letâs have a lens over those companies!

Metals X Limited (ASX: MLX)

Metals X Limited provides an update on its key project Nifty Copper Operations, with new mining area development 10% ahead of schedule.

Nifty Copper Operations Update

On 1 May 2019, the Company announced the overview of the Nifty Reset Plan (Reset Plan) which provided a detailed roadmap to turn around the operational performance of Nifty. Since announcement of the Nifty Reset Plan, a significant focus has been placed on accelerating development outside of the Central Zone. This work has reportedly seen an immediate lift in development rates as operational focus moved away from the difficult conditions that were present within that historical area.

As per the update, development into new mining areas to the east and west is 10% ahead of schedule with 2,390m completed since May 2019, including a record of 720m during July 2019. The company told that the priority focus has been developing into the western and eastern ends of Region 4 to provide stoping access and within Region 5 to provide drilling access into the Northeast Limb.

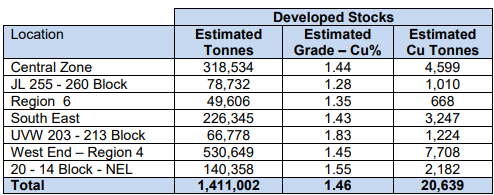

Nifty developed stope tonnes as at 31 August 2019 (Source: Company Announcement)

Outlook

The report read that the Nifty operation is in the process of transformation with the leading performance indicators such as culture, safety performance, development rates, grade control definition, operational efficiency and developed stocks all on a positive upward trend.

Metals X is confident that the work that has been completed to date over the last six months rebuilding Nifty is essential to the long-term success of the operation. The company is also confident that the momentum that is clearly building at Nifty in the various leading indicators will drive consistent and sustainable operational performance well into the future. On that basis, the company maintains the stated goal of building to 2Mtpa mining rates during the March 2020 quarter.

Mine output, which ultimately provides the financial rewards from this effort, is largely a lag indicator, as per the report, and is expected to remain flat for the September 2019 quarter and gradually start to increase in the December 2019 quarter, as the benefits of completing development activities into the new mining areas brings substantial additional reserves into the mining schedule.

MLX stock price surged up 3.33% to last trade at $0.155 on 4 September 2019. Over the past six months, the stock price declined 50.82% including a negative price change of 38.78% in the past three months.

Also Read: Metals X Proven Resources Inch up; Provides Annual Resources Update for Renison

Investigator Resources Ltd (ASX: IVR)

Investigator Resources Ltd completed a capital raising of $2.2 million via a placement of 91.67 million fully paid ordinary shares in the company at an issue price of $0.024 which represents a discount of 7.2% to the 30-day Volume Weighted Average Price (VWAP) and a 20% discount to the 15-day VWAP.

The placement includes a 1 for 3 attaching option. IVR stated that these options presents approximately 30.6 million options, which are consistent with the existing listed options series and are exercisable at $0.035 by 31 December 2020.

The company further informed that the fund would be utilised for:

- Geological review and assessment of future options for the Paris Silver Project in light of higher silver price outlook

- Ongoing assessment and securing of value creative base metals and gold opportunities currently under due diligence by the Company

- Working capital.

IVR last traded at $0.026 on 4 September 2019. Over the past 12 months, the stock surged up by 116.67% including the positive price change of 136.36% in the past six months.

Have an update on IVRâs Maslins IOCG Project

Aurelia Metals Limited (ASX: AMI)

On 4 September 2019, Aurelia Metals Limited unveiled a discovery of strong mineralisation in an update on its ongoing exploration activities in the Kairos area at the Peak Mine and at the Federation and Main Southeast areas near the Hera Mine.

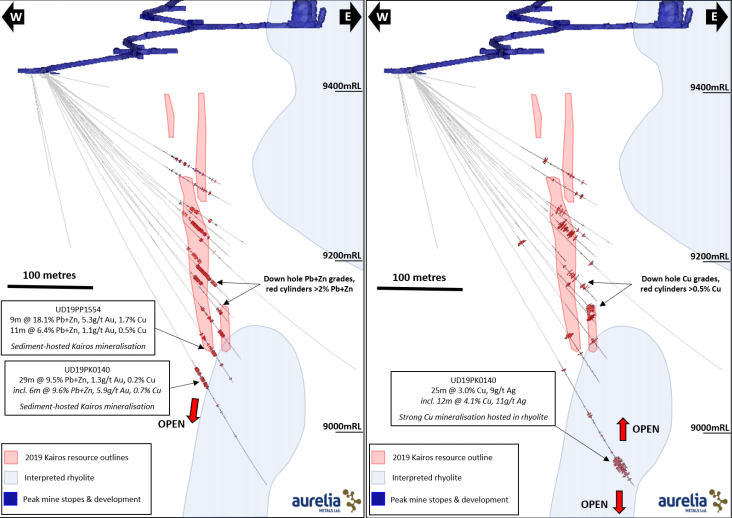

The company has identified new zone of strong copper mineralisation in drilling approximately 150 metres below the current Kairos resource, formerly known as Peak Deeps, 25 metres at 3.0% Cu & 9g/t Ag, including 12 metres at 4.1% Cu & 11g/t Ag. The report further read that the additional high-grade base metal and gold intercepts encountered in the lower Kairos area.

North-looking cross sections through the Kairos area showing recent AMI drilling with down hole Pb+Zn (left) and Cu (right) (Source: Company Announcement)

Aureliaâs Executive Chairman & Acting CEO, Cobb Johnstone, commented: âThe identification of strong mineralisation 150 metres below the known extent of Kairos is a standout result. Further encouraging intercepts at Federation also continue to support economic potential within this largescale mineralised system.â

Aurelia Metals stated that the Kairos zone remains highly prospective and is currently open in a number of directions, with exploration ongoing in the upper and lower parts of the system. As per the company, the steep holes required to test the area at depth have resulted in more challenging drilling conditions and the Company is reviewing the best options for follow-up in the area.

AMI last traded at $0.530, up 3.922%, on 4 September 2019. The stock has closed on 12.260 with the market capitalisation of $445.44 million.

Over the past 12 month, the stock has gone down by 15.70% including a negative price change of 12.82% in the past three months.

Also Read: How Aureliaâs Recent Drilling Marks A Transition Of The Chronos Gold Lode?

Pilbara Minerals Limited (ASX: PLS)

Pilbara Minerals completed a $91.5 million equity raising comprising of $55.0 million strategic placement to CATL and a $36.5 million underwritten institutional placement.

The company stated that it will undertake a placement by an issue of approximately 305.1 million new Pilbara Minerals shares at a price of A$0.30 per share. It will include the issue of A$36.5 million worth shares to institutional investors and remaining to CATL.

Contemporary Amperex Technology Limited (CATL), a company listed on Chinese stock exchange, is a world-leading developer, manufacturer and distributer of lithium-ion battery systems for hybrid and electric vehicles as well as energy storage systems. By investing A$55.0 million through placement, CATL has acquired a ~8.5% ownership interest in Pilbara Minerals, subject to placement conditions being satisfied.

Pilbara Mineralsâ Managing Director, Ken Brinsden, stated that the company is thrilled to welcome CATL as a new investor in Pilbara Minerals.

âThis relationship further enhances Pilbara Mineralsâ downstream integration strategy, which remains a key focus for it given the recently announced execution of binding terms for the downstream POSCO joint venture in South Korea.

âMoreover, CATL is supportive of the phased expansion strategy now contemplated for Pilgangoora. As a result of this landmark agreement, the company now has five world-class partners.â

Pilbara intends to utilise the capital raising towards the following purposes:

General working capital to strengthen balance sheet: enhanced financial flexibility to provide support for the companyâs Pilgangoora Project as it ramps-up to Stage 1 spodumene concentrate nameplate capacity.

POSCO JV: assist with funding Pilbara Mineralsâ initial 21% equity interest in the proposed POSCO Downstream JV, involving a primary lithium hydroxide downstream chemical processing facility in South Korea which will process spodumene concentrate from the Pilgangoora Project and integrate Pilbara Minerals further into the downstream value-add supply chain.

Pilgangoora Project Stage 1 Process Plant works: Stage 1 rectification and improvement projects. Rectification projects include the installation of additional low-intensity magnetic separation (LIMS) units that will assist in improved recovery.

Pilgangoora Project Revised Stage 2 Expansion studies: engineering studies required to complete the Revised Stage 2 Expansion Feasibility Study by December 2019 and the completion of long-lead orders, paving the way for a final investment decision in early 2020 for an incremental staged ramp-up of Stage 2 aligned with customer requirements.

PLS last traded at $0.350 on 28 August 2019. Over the past 12 months till that date, the stock has declined 59.30% including a negative price change of 51.39% in the past three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.