Iron Ore (62% Fe CFR Futures) prices have been on a rising trend from the start of the year 2019. On January 1, 2019, iron ore price was at US$71.06 per tonne and on July 16, 2019, it rose to US$121.14 per tonne, reflecting an increase of 70.5% on a year-to-date basis. The major reason can be attributed to the global supply shortage from top iron ore exports in the world, i.e. Australia and Brazil. Production in Brazil was hit, as one of its important Iron Ore company, Vale, was forced to shut operations following a tailings dam disaster in the month of January, wherein around 100 people lost their lives. Moreover, the companyâs inactive mine was also impacted due to dam failure. Australian exporters have also cut their export forecast, owing to bad weather conditions and after-effects of cyclone Veronica. Simultaneously, demand from China and other emerging markets continue to grow as the Government is providing the necessary impetus to boost the infrastructure spending.

The upward iron ore price rally is expected to continue for some more time, before a recovery in the global iron ore production. Till then, iron ore miners and producers are expected to benefit from the present iron prices. On the other side, high iron ore prices and declining steel prices are proving to be a nightmare for steel manufacturers, witnessing a huge toll on their margins. Steel Rebar Futures declined from US$540 per tonne on July 18, 2018, to US$466 per tonne on July 17, 2019, which was a decline of 13.7% in the span of one year.

Australiaâs top iron ore producing companies expected to benefit from the present iron ore prices are BHP Group, Rio Tinto, Fortescue Metals Group Ltd and Champion Iron Ltd.

BHP Group Limited (ASX:BHP)

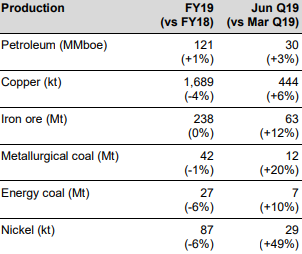

BHP Group Limited (ASX:BHP) in its June â19 quarter report highlighted that its petroleum production increased by 3% to 30 MMboe as compared to the previous quarter. This can be attributed to higher seasonal gas volumes and higher uptime due to planned shutdowns in the previous quarter at the Bass Strait. The Copper production increased by 6% to 444 kt as compared to the previous quarter. This was driven by strong performance at all three Chilean operations, partially offset by the impact of two minor production outages at Olympic Dam.

Iron Ore production increased by 12% to 63 Mt as compared to the previous quarter. This can be attributed to production increase at Western Australia Iron Ore (WAIO) after the impact of cyclone Veronica. The metallurgical coal production for the period increased by 20% to 12 Mt as compared to the previous quarter. This was on the back of improved mining performance across most operations and record production at BMC, following significantly wet weather impact in the previous quarter. Energy Coal production increased by 10% to 7 Mt as compared to the previous quarter. Despite the impact of adverse weather at Cerrejón, production at New South Wales Energy Coal (NSWEC) increased. The Nickel production increased by 49% to 29 kt as compared to the previous corresponding period. This can be attributed to the completion of final mending and increased production at the Kalgoorlie in the previous quarter.

June â19 Quarter Production Metrics (Source: Company Reports)

On the stock information front, at market close on July 19, 2019, the stock of BHP Group was trading at $41.060, down 0.146%, with a market capitalisation of ~$121.13 Bn. Its current PE multiple is at 28.140x, with EPS of $1.461 and an annual dividend yield of 4.05%. Today, it reached dayâs high at $41.190 and touched dayâs low at $40.800, with a daily volume of 3,169,387. Its 52 weeks high and low price stands at $42.330 and $29.062, with an average volume of 5,888,850 (yearly). Its absolute returns for the past one year, six months and three months are 27.75%, 24.19% and 7.56%, respectively.

Rio Tinto (ASX:RIO)

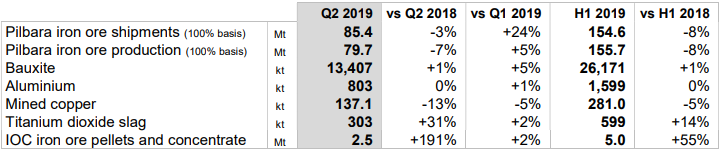

Rio Tinto (ASX:RIO) in its second quarter production results highlighted that its Pilbara iron ore shipments and production increased by 24% to 85.4 Mt and 5% to 79.7 Mt, respectively, in Q2 FY19 as compared to the previous quarter. However, Pilbara iron ore shipments were lower than the previous corresponding period, majorly due to recovery works following the Tropical Cyclone Veronica. The production of Bauxite, Aluminium, Titanium dioxide slag and IOC iron ore pellets and concentrate increased by 5% to 13,407 kt, 1% to 803 kt, 2% to 303 kt and 2% to 2.5 kt, respectively, in Q2 FY19 as compared to the previous corresponding period. The Mined Copper production decreased by 5% to 137.1 kt in Q2 FY19 as compared to the previous quarter.

Q2FY19 Production Metrics (Source: Company Reports)

On the stock information front, at market close on July 19, 2019, the stock of RIO was trading at $102.320, down 0.039%, with a market capitalisation of ~$38 Bn. Its current PE multiple is at 9.110x, with EPS of $11.238 and an annual dividend yield of 4.12%. Today, it reached dayâs high at $103.380 and touched dayâs low at $101.910, with a daily volume of 1,323,181. Its 52 weeks high and low price stands at $107.990 and $66.978, with an average volume of 1,712,422 (yearly). Its absolute returns for the past one year, six months and three months are 33.41%, 31.53%, and 4.73%, respectively.

Fortescue Metals Group Ltd (ASX:FMG)

Fortescue Metals Group Ltd (ASX:FMG) recently announced the official sod turning of the Eliwana Mine and Rail Project in the Pilbara, Western Australia. The project is worth US$1.275 Bn and includes the construction of a new 30mtpa dry ore processing facility (OPF) and 143 kilometres of rail and infrastructure. Eliwana Mine has the potential to deliver products at an iron grade of over 60%. The autonomous trucks, the latest technology along with the latest design has been deployed for the development, which is expected to bolster FMGâs reputation as the world leader in using innovative techniques across its mining operations. The project, once operational, is expected to provide employment to around 1,900 people during the construction and 500 full-time on-site positions.

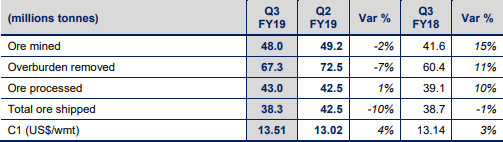

Q3 FY19 Key Highlights: The companyâs TRIFR declined from 4.0 in December 2018 to 3.6 on a rolling 12-month basis. Ore mined for the period decreased by 2% to 48 Mt in Q3 FY19 as compared to the previous quarter. The total ore shipped decreased by 10% to 38.3 Mt in Q3FY19 as compared to the previous quarter. The cash cost C1 increased by 4% to US$13.51 per wet metric tonne (WMT) in Q3 FY19 as compared to the previous quarter.

Production Summary (Source: Company Reports)

The dividend amount for December 2019 stands at $0.90 as compared to $0.23 in the previous corresponding period.

On the stock information front, at market close on July 19, 2019, the stock of Fortescue Metals was trading at $8.700, up 0.578%, with a market capitalisation of ~$26.63 Bn. Its current PE multiple is at 21.880x, with EPS of $0.395. Today, it reached dayâs high at $8.800 and touched dayâs low at $8.610, with a daily volume of 12,960,166. Its 52-week high and low price stands at $9.550 and $3.224, with an average volume of 15,391,748 (yearly). Its absolute returns for the past one year, six months and three months are 113.35%, 103.68%, and 23.90%, respectively.

Champion Iron Ltd (ASX:CIA)

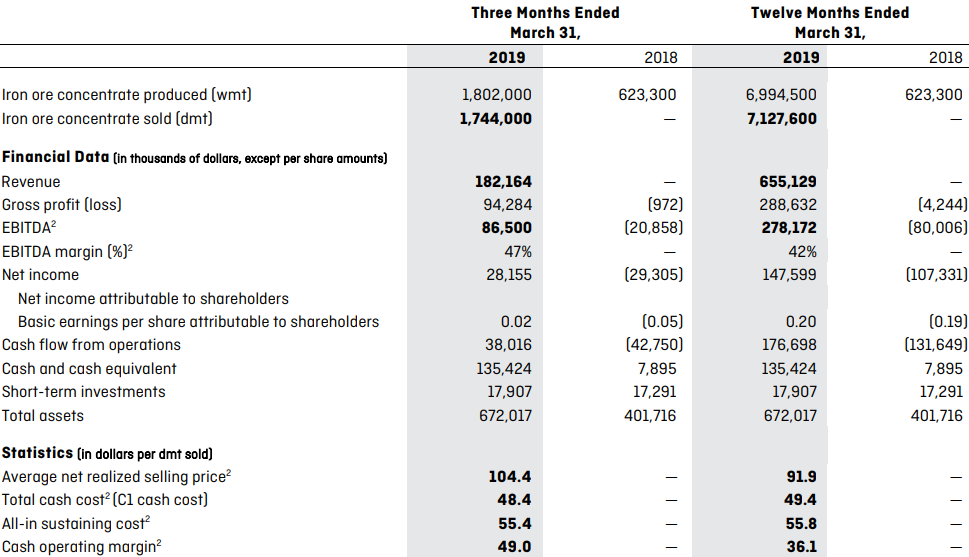

Champion Iron Ltd (ASX:CIA) in its Annual Report highlighted that its revenues for FY19 stood at $655.13 Mn. CIAâs gross profit for FY19 amounted to $288.63 Mn as compared to the loss of $4.24 Mn in FY18. The EBITDA for the period was reported at $278.17 Mn as compared to negative $80.01 Mn in the previous period. The net income for FY19 reported at $147.60 Mn as compared to a loss of $107.33 Mn in the previous period. The cash inflow from operations for FY19 was reported at $176.70 Mn as compared to the cash outflow of $131.65 Mn in the previous period. The cash and cash equivalents for the FY19 amounted to $135.42 Mn as compared to $7.90 Mn in the previous period. The company reported total assets for the period of $672.02 Mn as compared to $401.72 Mn in the previous period.

Key Financial Metrics (Source: Company Reports)

On the stock information front, at market close on July 19, 2019, the stock of Champion Iron was trading at $2.980, up 3.114%, with a market capitalisation of ~$1.25 Bn. Its current PE multiple is at 13.940x, with EPS of $0.207. Today, it reached dayâs high at $3.030 and touched dayâs low at $2.910, with a daily volume of 268,252. Its 52 weeks high price stands at $3.370 and 52 weeks low price at $1.000, with an average volume of 455,448 (yearly). Its absolute returns for the past one year, six months and three months are 118.94%, 158.04%, and 27.31%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.