In this article, we would discuss two stocks from the Metals & Mining & Industrial sectors, respectively. On 23 July 2019, the two ASX listed stocks, under discussion had released significant updates pertaining to their respective business interest. The Australian benchmark S&P/ASX200 was trading at 6780.8, up by 56.2 points (as on 24 July 2019, at AEST 1:03 PM).

The latest updates on the 2 stocks are as follows:

Greenland Minerals Ltd (ASX: GGG)

An Australian entity, Greenland Minerals Ltd has been functioning from Greenland since 2007. It is engaged in the development of the Kvanefjeld Project in Greenland, for the exploration of the rare earth elements. It is said that it would be a low-cost project with a large-scale and long-term supplier of the rare earth metals.

On 23 July 2019, the company released an update related to the Kvanefjeld Project. Accordingly, Greenland Minerals had applied for an exploitation license (mining) with the Government of Greenland required for the project. Also, the company had submitted an Environmental Impact Assessment (EIA), Social Impact Assessment (SIA), and a navigational safety investigation study (MSS) for the Project in conjunction with the application.

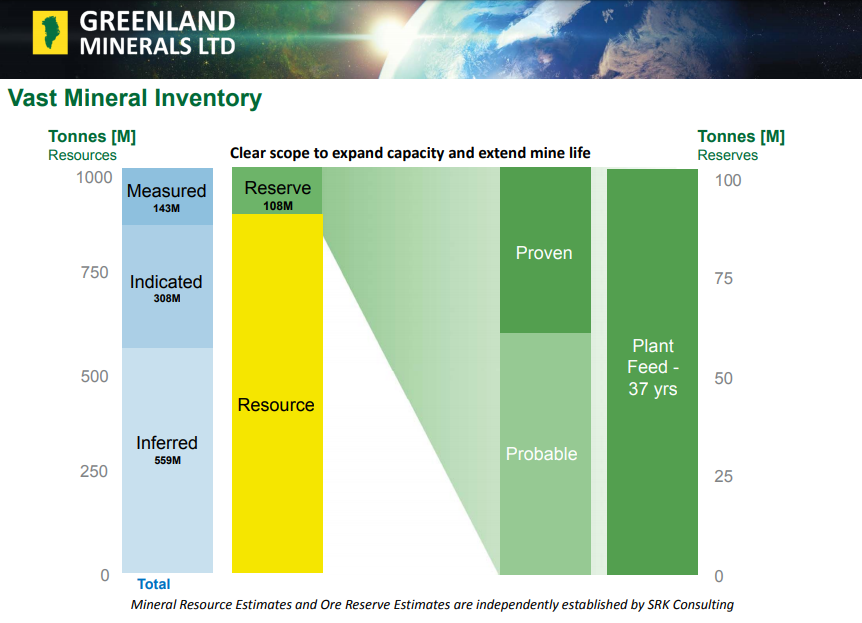

Mineral Inventory (Source: Annual General Meeting Presentation, May 2016)

Mineral Inventory (Source: Annual General Meeting Presentation, May 2016)

As per the release, the documents were submitted to Greenlandâs Mineral License and Safety Authority (MLSA) in English, Danish & Greenlandic. Also, these documents constitute the mining license application, and MLSA had confirmed the receipt of the application. Previously, the company had provided the feasibility study, financial mode and a JORC?code compliant ore reserve report.

Reportedly, the three documents MSS, EIA & SIA, were developed by the independent expert consultants. Also, EIA & SIA were prepared in line with terms of reference (ToR) approved by the Greenland Government in 2015 following an inclusive process of public consultation. Meanwhile, the assessments consisting of contributions from a range of internationally recognised experts were updated while the Greenland Government undertook an extensive period of review.

As per the release, following the submission of application, the companyâs representatives collectively with lead SIA consultant organised meetings in Kommune Kujalleq â the municipal authority for the region of southern Greenland which involves Nasraq and the Project. Subsequently, the Mayor of Greenland (South) region and associates of the Kommune Kujalleq were made aware of the key findings of the EIA and SIA. Also, a meeting was conducted with Kujalleq Business Council along with community meetings in the towns of Qaqortoq and Narsaq.

The announcement notes that the next step in the process would be public consultation related to the application. As per the release, the interested stakeholders have the opportunity to convey feedback on the application to the Greenland Government or public forums over the period of next eight to twelve weeks. Besides, the company would provide necessary updates related to the licensing process.

Reportedly, in March, GGG had signed a Memorandum of Understanding (the MoU) the Kommune and the Kujalleq Business Council, which is directed to develop a participation agreement for community capacity development for Kommune workers and businesses. Also, the SIA enlists the development of the projectâs Impact Benefit Agreement (IBA). Besides, the IBA is intended to keep the interests of Greenland remains to protect during the span of the project, and the parties involved in IBA includes Greenland Minerals, the Kommune and the Government of Greenland.

On 24 July 2019, GGGâs stock was trading at A$0.155, up by 3.333% (at AEST 1:33 PM). The stock over the past one-year period has given a return of +82.93%. However, its year-to-date and the past three months return has generated a return of +120.59% and +111.27%, respectively. Besides, the market capitalisation of the stock is ~A$169.9 million, with around 1.13 billion shares outstanding.

Saunders International Ltd (ASX:SND)

Established in 1951, Saunders International Ltd (ASX: SND) has a history of consistent involvement in the progress of the Australian industries. It provides an array of dependable, innovative, profitable services, and hassle-free project delivery to its consumers. Some of the sectors it serves include- mining, mining process, defence, infrastructure and industrial.

On 23 July 2019, Saunders International reported the guidance for the FY19 full year financial result. Accordingly, subject to audit, it expects to report a loss in the range of $0.75 million and $1.25 million in EBITDA terms, and the revenue expectation is in the range of $50.0 million and $51.0 million. Nevertheless, the company asserted that the balance sheet would remain strong, coupled with a cash balance of $8 million at the end of June and no interest-bearing debt.

As per the release, the companyâs FY20 has started on a positive note propelled by the new projects worth $21 million in the pipeline over the past three months. Also, the new projects resulted in work in hand valued at $60.5 million. Besides, it includes contracts worth approximately $12 million in the Infrastructure Construction group, and three new contracts worth $9 million were secured in Asset Services.

Mark Benson, Chief Executive Officer, stated that the FY19 depicts as a stabilising year for the company after the disappointing FY18, and the company continued to witness a strong competition in the core tank construction sector. Subsequently, the escalated competition impacted the results through reduced revenue, margins. Meanwhile, the company did not achieve revenue and earnings expectations, but it undertook to restructure of the operations. Nevertheless, the company meet key objectives with the renewed operating model, and it expects to become profitable in FY20.

On 29 May 2019, it was reported that Malcolm McComas, one of the directors of the company, since September 2012, had resigned from the capacity effective immediately. Accordingly, Tim Burnett â Chairman of the company, stated that Malcolm provided considerable guidance to the company in his ~seven years tenure with the company. Also, he acknowledged that Malcolm had been a very valuable contributor in the transition for more diversified business. Further, he said that some of the significant aspects of transition involved the acquisition of the Civilbuild infrastructure business, capital raising, restructuring and more.

First-Half Results: On 27 February 2019, the company had released the Interim Financial Report for the half-year period to 31 December 2018. Accordingly, the net loss after tax stood at $0.14 million in H1 FY2019, which was 114.1% below the previous corresponding period at $1.02 million. Also, the earning per share for the period stood at 0 cent against 1.07 cents in H1 FY2018, and the EBITDA for the period was at $0.40 million.

H1 FY2019 Outlook (Source: FY19 H1 Investor Presentation)

H1 FY2019 Outlook (Source: FY19 H1 Investor Presentation)

Reportedly, the company reported a half-year revenue of $28.09 million in H1 FY2019, which was 34.2 lower from the $42.68 million in H1 FY2018. Also, it was asserted that the results were impacted by the delay from clients, and some developments lead to further costs on the loss-making project. Further, the site was demolished after the project work was completed, and the financial position was strong as at 31 December 2018, coupled with a cash balance of $12.67 million.

SNDâs stock last traded at A$0.33, on 23 July 2019. The performance of the stock over the past one year has generated a negative return of -27.47%. However, its last three months return has been of 3.13%. Besides, the market capitalisation of the stock is ~A$ 34.56 million, with around 104.73 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.