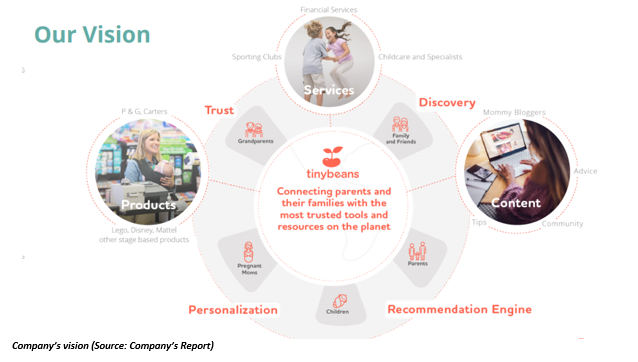

Tinybeans Group Ltd (ASX: TNY) is a company from the telecommunication sector and was founded in 2012. The company enables parents to safely record and share digital data privately and securely with family and friends, through its mobile and web-based technology platform.

On 13 May 2019, Tinybeans Group Ltd announced that it has launched a first-to-market offering that gives brands the ability to gain insights through millions of data points of Tinybeans with absolute individual privacy.

The solution offered to the brands uses Artificial Intelligence algorithms, and it allows the brands to get insights across a set of unique anonymous data points. Thus, the innovative offering made by the company will enable brands to enter into a partnership with Tinybeans not only as media and advertising but also as a true learning platform.

There are more than 200 million unique data points that have been added to the Tinybeans platform, which are private and will not be shared with any individual of any company. Through machine learning, these millions of data points are analyzed, and key areas of insights such as behavioural patterns, consumer choices and affinities are identified.

Further, the company announced its first commercial paid pilot and brand partnership to utilize and deploy this new offering. The company highlighted that one of the first brands with which it started working faced challenges, wherein several of their categories were losing market share in key periods of the calendar year. By using the machine learning platform of Tinybeans, the company was able to identify the insights surrounding this market challenge. Thus, the company was able to inform a strategy to fight this challenge and grow market share in future.

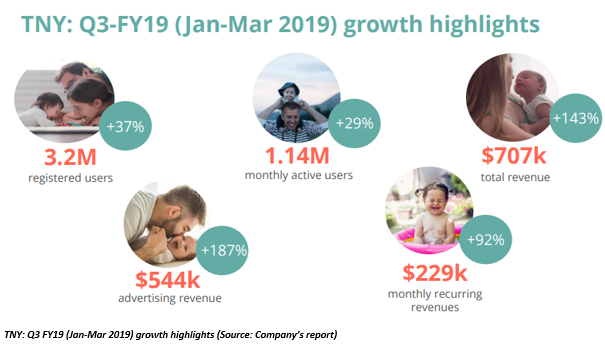

In the updated version of the US Investor briefing Presentation released on 1 May 2019 (previously released on ASX on 18 March 2019), the company provided its growth highlights for the third quarter of FY2019. The company reported an increase in the number of registered users by more than 37% to 3.2 million. The total numbers of monthly active users increased by more than 29% to 1.14 million. The total revenue generated by the company was up by more than 143% to $707,000. The company generated $544,000 worth revenue through advertising and $229,000 through the monthly recurring revenue.

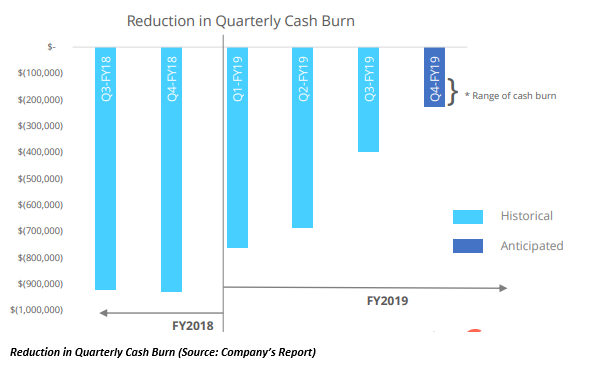

The company reported an improvement in the cash burn from Q1 FY2019-Q3 FY2019 and expects a cash burn in the range of $200,000 and $300,000

There was a growth in both direct partnerships of 253% to $241,000 as compared to its previous corresponding period. The baseline revenue increased by 15% to $229,000 per month as compared to the last quarter.

During April 2019, the company launched NPS tracking with a survey to all parents. There is an ongoing survey to new parents after their first month of membership. Tinybeans Group Ltd also launched a new content platform that is capable of delivering valuable content to its members everywhere.

TNY stock has generated an excellent YTD return of 222.22%. By the closure of the market on 13 May 2019, the price of the stock was A$1.00, down by 1.478% as compared to its previous closing price. TNY holds a market capitalization of A$33.44 million and approximately 32.95 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.