Business lending

Business lending refers to loan agreements that are signed between business owners and banks or private lenders. Businesses may require capital for various purposes such as funding current operations or for simply to start themselves up and plan for turning a profit. The banks and lenders in the market play a crucial role here and extend financial assistance in advance, in lieu of assurance that the money would be paid back on an agreed-upon schedule, with interest.

Now, depending upon the amount of time a borrowing business has been around, its credit quality, presence of a collateral and current financial health, the loan may or may not be utilised as debt capital. There are plenty of lending options for all kinds of businesses such as Small Business Administration (SBA) loans, Fixed-asset loans, Bank line of credit, Personal (unsecured) loans and others.

The most common form of lenders are banks, credit unions, and other financial institutions.

It cannot be denied that lending to businesses, especially start-ups can be risky, which is why lenders charge high interest rates and are mostly reluctant to offer loans to small businesses. Besides, Lenders are not the same as shareholders participating in a company. In fact, lenders come before the owners of the company, meaning that if a business goes bankrupt, lenders, before all other stakeholders, must be paid what they were offered.

In a world where global corporations are flourishing with profits, small businesses have it rough and it can be hard to get a new business off the ground, even if itâs a small one.

A new small business is created in Australia every 100 seconds and according to Prospa Group Limited, over 60% of these businesses shut down before reaching the year three. Some common causes of business failure may vary from inadequate cash flow, lack of business acumen to trading losses. But itâs not all doom and gloom, in 2017-2018, there were ~ 2.3 million actively trading in Australia and around 66% of the millennial business owners are striving for growth and expansion of their businesses in the next three years and 1 in 5 are also planning investments in new technology.

Those are some encouraging figures to note.

Also, a recent study by Prospa Group Limited demonstrated that owners of small businesses, around 75% in Australia, struggle to manage various areas of the business. Of all the challenges that the owners of small businesses face, management of finances and digital marketing tops the list.

Prospa Group Limited

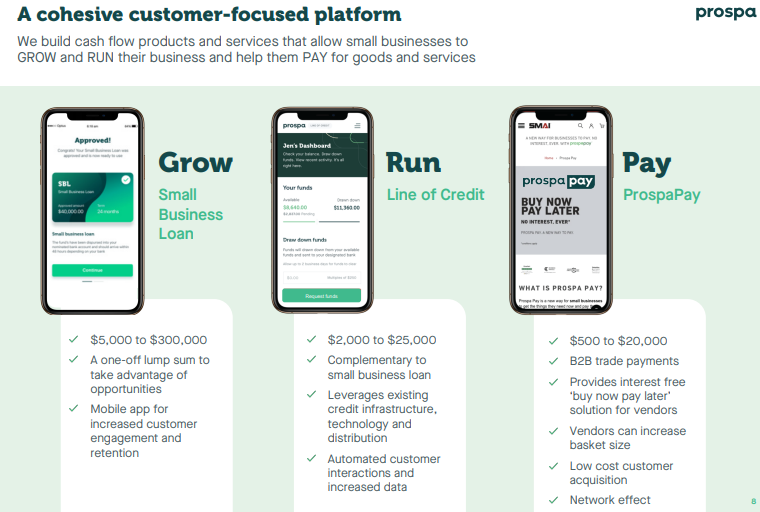

Australia-based Prospa Group Limited (ASX: PGL) acts as a saviour to these small businesses from distinct sectors by offering cash flow products and services that help them to prosper. Prospa understands that small business owners require faster finance solutions so that they may grab the opportunities as they arise and make quick decisions.

Business Overview- The company provides loans between $ 5,000 and $ 300,000 with no security required to access up to $ 100,000. The application takes ten minutes of time and the approval may be granted on the same day making it possible to receive the funding in 24 hours. The creditworthiness of the loan is determined by evaluation of the health of a business through Prospa Groupâs proprietary technology platform.

Source: FY2019 Results Presentation

Source: FY2019 Results Presentation

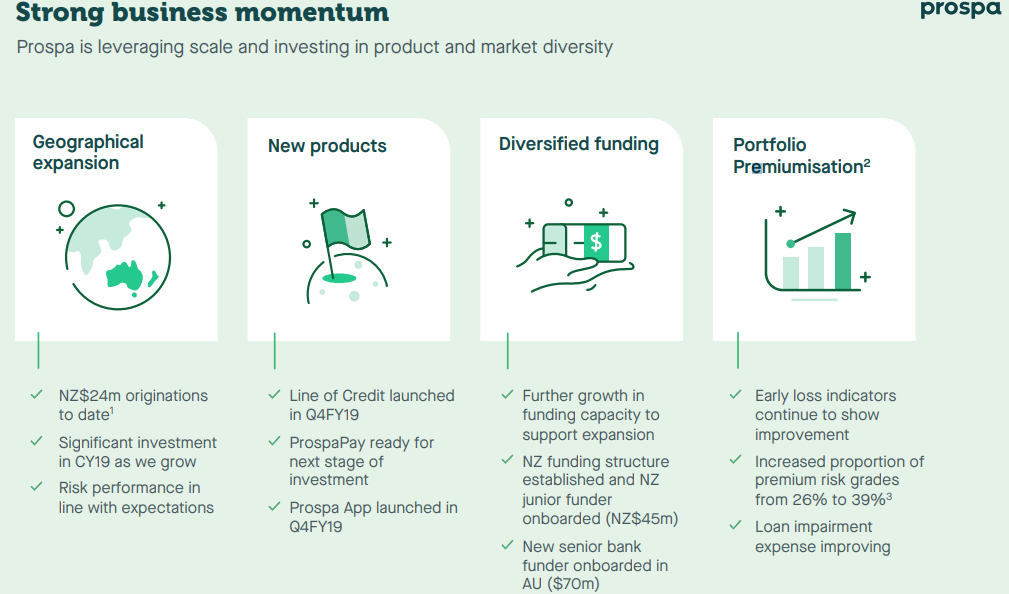

Over the years, Prospa Group has originated more than $ 1.2 billion in loans to customers across New Zealand and Australia. The Groupâs small business customer-base stands at 20,000. During 2018 -2019, Prospa was honoured with the Australian Fintech Lender of the Year award and also achieved a straight victory in the MFAA Excellence awards across five States.

FY19 Results Update â The Group disclosed its financial results for the full year to 30 June 2019 (FY19), reporting 9 loan originations of $ 501.7 million, up 36.6% on$ 367.3 million in the prior year FY18, 3.1% ahead of prospectus forecast.

The Groupâs revenue for FY19 stands at $ 136.4 million up 31.2% on $ 104.0 million recorded in the prior year and in line with prospectus forecast. In addition, the Groupâs pro forma EBITDA for FY19 was around $ 6.8 million, up 11.5% on the prescribed forecast in the prospectus.

Prospaâs total customers have consistently grown in Australia and New Zealand since inception reaching 20,000 in FY19, up 58% on the prior year while the Group has delivered ~$1.2 billion in loans to date. The Group also pleasingly reported that the customer satisfaction continues to be consistently high.

The loan impairment expense for FY19 was ~$1.7 million (5.3%) below prospectus forecast, demonstrating upgrade in credit quality and the impact of portfolio premiumisation currently underway.

Source: FY2019 Results Presentation

Source: FY2019 Results Presentation

New Zealand Funding Facility- Recently on 8 August 2019, Prospa Group informed the stakeholders to have opened a new three-year warehouse facility with an initial capacity of NZD 45 million. It is designed to be seamlessly scalable, quite similar to Prospaâs Australian funding platform and would particularly cater to the small business loan needs, increasing access to finance in New Zealand.

According to CFO, Ed Bigazzi, the new facility is anticipated to support the companyâs further growth while Prospa continues to pioneer in the online small business lending space.

The customers in New Zealand belong to a range of different industry sectors such as retail, professional services, hospitality, construction and trade. Prospa Group currently boasts of a TrustPilot rating of 9.8/10 (as at 31 July 2019) while it stands first in the non-bank finance category in New Zealand.

Besides Prospa has developed good tie ups including partnership with a locally based Tier 1 funding company that has an existing understanding of the small business lending space and a long-term interest in the same. The funding partner has also subscribed to Class B Notes in the New Zealand facility.

Given the positive business momentum and Prospaâs market leading position, the Group remains well positioned to achieve its prospectus guidance for CY19.

Stock Performance - Prospa Group Limited debuted on the ASX in June 2019 and currently has a market capitalisation of ~ $ 726.08 million with ~ 161.35 million shares outstanding. On 30 August 2019, the PGLâs stock was trading higher at A$4.570, edging up 1.556% by $ 0.070 (at AEST 3:47 PM) with ~ 125,764 shares traded.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.