Prospa Group Limited (ASX: PGL) is a financial technology company headquartered in Sydney, Australia. PGL leverages seamless customer experiences for the small business economy in Australia and New Zealand through its cloud-based, data-rich and API-enabled technologies. The company was successfully admitted to the Australian Securities Exchange (ASX) under the ticker PGL and the stock of the company started trading on 11 June 2019. The initial public offer had been managed and underwritten by Macquarie Capital (Australia) Limited and UBS AG, Australia Branch.

The company was founded by Mr Greg Moshal and Mr Beau Bertoli in 2012. Initially, it started offering online business loan and now offers line of credit facilities & B2B payments. Since inception, the company has forwarded loans worth over $1 billion and served over 19,000 unique customers. As per the prospectus, PGL employs a staff of 230 and the net loan book of the company had grown over to $300 million as at 31 March 2019. In 2019, the company adopted the AFIA Code of Lending Practice, fully launched services in New Zealand for the small business economy and fully launched line of credit product.

Reportedly, the company offered approximately 29.0 million shares for the issue to raise approximately $109.6 million at the offer Price of $3.78 per share. The company further informed that 132.3 million more shares would be issued to existing shareholders on completion in connection with the restructuring.

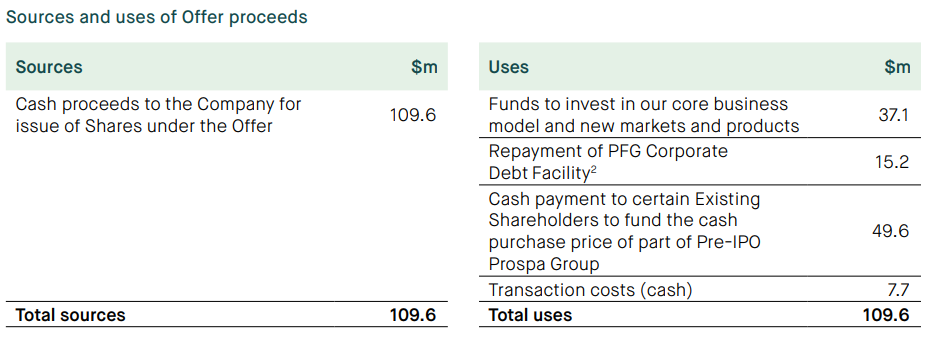

Also, PGL intends to use the fresh capital to support the growth initiatives and investments in continuously improving term loan product for small business & funding the investment in the equity portion of the loan book. Furthermore, it would utilise the fresh capital for meeting working capital requirements, repayment of PFG Corporate Debt Facility along with the cash payment to existing shareholders to fund the cash purchase price of Pre-IPO Prospa group and transaction costs.

Expected Utilisation of Fresh Capital (Source: Companyâs Prospectus)

As per the prospectus, the Board of the company hosts six directors that include Independent Non- Executive Chairman- Gail Pemberton, AO, Independent Non-Executive Director - Greg Ruddock, Independent Non-Executive Director - Fiona Trafford-Walker and Non-Executive Director - Avi Eyal along with co-founders, Greg Moshal & Beau Bertoli who are the Joint CEOs and Executive Director of Prospa Group Limited.

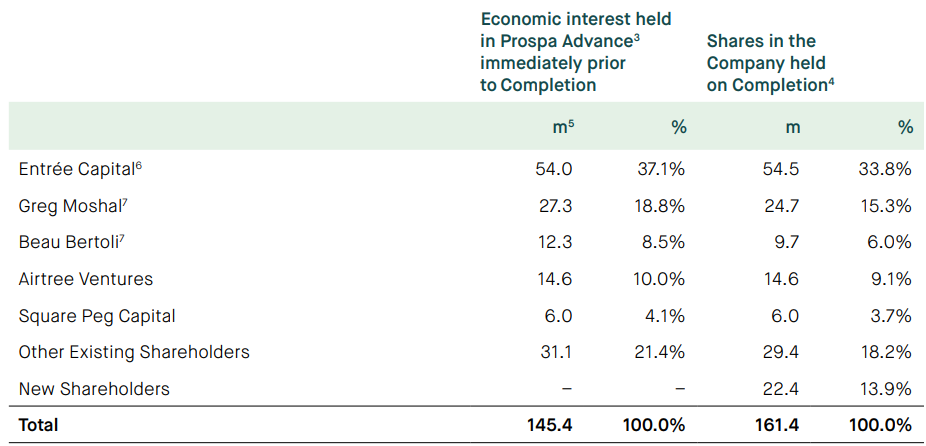

Pre & Post IPO Shareholding Structure (Source: Companyâs Prospectus)

Industry Overview:

Reportedly, PGL operates in the small business lending sector and provides financing solutions to small businesses for managing cash flows and growth initiatives. PGL also told that during CY18, it expanded small business lending to New Zealand.

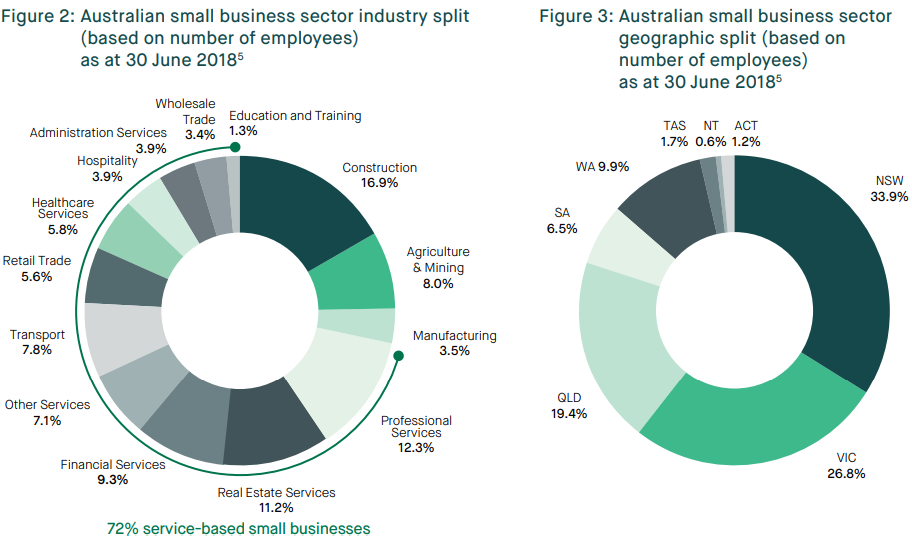

As per the Australian Bureau of Statistics (ABS), out of 2.31 million total businesses operating in Australia as at 30 June 2018, the small businesses account for 2.26 million of total businesses, which represents 98% of all businesses. Also, small businesses in Australia generated 35% of the GDP and employed 44% of Australian private sector workforce. As per the prospectus, over 70% of Australian small business are service-related businesses and the majority of these businesses are in Queensland, New South Wales and Victoria.

Small Business Composition in Australia (Source: Companyâs Prospectus)

Competitors:

Prospa Group Limited mentions that the competition includes banks, non- bank lender and online lenders or fintech. As per the prospectus, banks generally offer a range of business lending products including secured term loans, overdraft facilities, invoice financing and credit cards; this competition hosts major banks from the country. Also, non-bank lenders specialise in niche products, which are not provided by traditional banks.

Lastly, online lenders and fintech specifically address the needs of small businesses through technology-driven solutions; furthermore, this category extends to balance sheet lenders and marketplace lenders.

The company believes that the Australian small businesses are preferring online lenders due to the number of reasons that enhance the customer experience, including an easy online application process, unsecured finance, payment flexibility, timely credit decision & funding. As per the Australian SME Banking Council, a survey depicted that 11% of the small businesses considered the alternate source of financing, and PGL believes that the increase in awareness regarding the alternate source of finances would lead owners to explore more of such alternate source of financing.

PGL believes that small businesses are increasingly using the online service to manage their operations as the technology penetration increases in the sector. The company considers the small businesses are driven by the young, tech-enabled segment of small business owners. As per the prospectus, a survey from market expert depicted that in 2017, 89% of small to medium-sized businesses were intermediately or highly digitally engaged compared to 55% in 2013. Also, another survey from market expert found that 63% of small businesses run by millennials (aged between 18 and 35) would not exist without the internet.

Financials

Reportedly, the company generates revenue by charging the customers, which could be in the form of interest and other fees. The interest income represents the contractual interests due on loans to customers, and other income includes late fees on payments, fee received from syndicate partners and interest on cash deposits. Furthermore, some key costs associated with the business include transaction cost (commission paid to distribution partners), funding cost (interest expenses incurred during capital raising activities) and loan impairment which represents write off losses on loans and movement in the loan impairment provision. In addition to this other expense include general & administration, product development and sales & marketing.

The prospectus of the company entails the Pro Forma historical results of the business. As per the prospectus, the total revenue increased by 86.9% from A$55.8 million in FY17 to A$104.2 million in FY18, and after considering the transaction costs net revenues of the company rose up by 87.4% to A$99.3 million in FY18, compared to A$53 million in FY17. The total operating expenses increased by 70.9% to A$91.5 million in FY18 from A$53.5 million in FY17. The company posted an NPAT of A$1.3 million in FY18 against a loss of A$2.5 million in FY17.

PGL stock price declined by 5.789% to last trade at $3.580 on 14 June 2019. Since the day of listing on 11 June 2019, the stock has gone down by 14.80%. The market capitalisation of the stock is ~613.13 million, with 161.35 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.