Annual General Meeting

Annual General Meeting or the annual shareholders meeting refers to the annual gathering of the shareholders and board of directors of the company. At the AGM, the directors of the company get a chance to disclose its annual report.

The company discusses itsâs performance, activities, any challenges faced by the company during the period, and how the company conquered the phase. The company also declares its annual results, any achievements during the period and their future prospects.

AGM also gives the shareholders an idea about the steps taken by the company during the period, to meet/miss its guidance.

On the other hand, shareholders also have an opportunity to ask questions to the board of directors related to the performance to obtain a satisfactory response.

Statutory Requirements for AGM

- A public company with more than one member must hold an AGM;

- AGM should happen once in every calendar year;

- AGM should happen within 5 months after the completion of the financial year;

- Failure to hold an AGM, results in the penalty is over $1000 or imprisonment of 3 months, or it could be both as well;

- In case the company wishes to extend its AGM, it may apply to ASIC to extend the date by which its AGM must be held.

In this article, we would try to understand the points covered in the recent AGM of Telstra.

Telstra Corporation Limited (ASX: TLS)

Telstra Corporation Limited (ASX:TLS), the provider of telecommunications and information services on 15 October 2019, released its Annual General Meeting (AGM) presentation.

In the AGM Telstraâs Chairman, John Mullen highlighted the FY2019 activities and performance of the company. He stated that FY2019 was an significant year in the companyâs history as the company started its T22 strategy to transform the company for the future.

The company during the period completed its $3 billion strategic investment program for the creation of the types of networks that would be required in the future to digitise the business.

- Within a year, the company made significant progress. Telstra has now become a very different, customer-centric and simpler company;

- During the period, the company reduced the Consumer, and Small Business plans from 1800 to 20 in market plans;

- The company also eliminated lock-in contracts that were related to all new Consumer and Small Business fixed and mobile plans;

- The company also removed extra data charges in Australia on their new mobile plans;

- The company noticed a fall in the number of calls coming to its contact centres by more than 15 million per year. The company aims to further lessen them by 16 million by 2022;

- Since the FY2016, the company was successful in reducing its cost by ~ $1.2 billion. The company targets to reduce another $630 million this year.

FY2019 Performance; NPAT of $2.1 billion

- The company reported a revenue of $27.8 billion, EBITDA of $8.0 billion, and Net Profit after tax of $2.1 billion. The results were affected because of the NBN impact;

- The interim dividend, along with the final dividend for FY2019, is equal to 16 cents per shares (fully franked). Thus, the total amount paid by the company to its shareholders for FY2019 was $1.9 billion.

World class networks

TLS is the first operator in Australia and midst the 1st in the world to launch 5G services. The launch of 5G would support new developments as well as opportunities in the area of Cloud Computing, Big Data, IoT, Machine Learning and Artificial Intelligence.

Telstra has ~ 350 5G enabled mobile base stations throughout the country in 10 cities nationwide. It is expected to increase to 800 by the end of CY2019. In the next 12 months, the 5G coverage is expected to grow almost 5 times. Further, 35 Australian cities and major towns are linked.

The companyâs mobile coverage presence has extended beyond 2.5 million square kilometres.

Telstra Reaching Aussies:

- Telstra provides more than 23 million customer services. It includes 18 million domestic mobile retail customer service, 1.4 million standalone voice services along with 3.7 million retail bundles and standalone fixed data services.

- As per the companyâs estimation, 95% of the Aussies use the services of TLS in some or the other form like EFTPOS, net banking, fixed and mobile network, online booking and many more.

NBN

In the AGM, Chairman John Mullen acknowledged that the creation of NBN a decade ago has had major effect on the industry and the country. Over this period, he believes that the private players have built high speed broadband access to the majority of the citizens, at no additional cost to the taxpayer. The chairman also believes that the governments could have used subsidy in areas which is unviable for private players that too at a fraction of the cost of the current NBN.

He stated that by setting up NBN the industry has created a state-owned monopoly which would cost the Australia over fifty billion dollars.

The chairman further stated that it is in every players best interest to make NBN successful. Most of the fixed broadband providers were impacted financially by NBN significantly. Telstra in the present scenario has absorbed ~ 50% of the economic headwind due to NBN. Telstra was also being compensated by the government for this, with the major portion being returned to the shareholders. However, post the end of the NBN rollout TLS would have to an impact on EBITDA of more than $3 billion into the future.

To overcome this loss, the company is working on its T22 strategy with an objective to fundamentally restructure TLS to respond to the changing environment as well as to lead the Australian Telecom market.

Board Renewal:

- Eelco Blok joined the company as the non-executive director to the board. He has more than 30 years of experience at KPN, which is the top landline and mobile telecommunications company in the Netherlands.

- Craig Dunn and Nora Scheinkestel, who are the current directors in the company, are eligible for re-election. These two directors have made a significant contribution to the company and he joined the board in 2016, and he is the current Chairman of the Audit & Risk Committee and also a member of the Nomination Committee. Nora Scheinkestel is also part of the Audit & Risk Committee, Nomination Committee and Remuneration Committee of the Board. Earlier she was the Chairman of the Audit & Risk Committee.

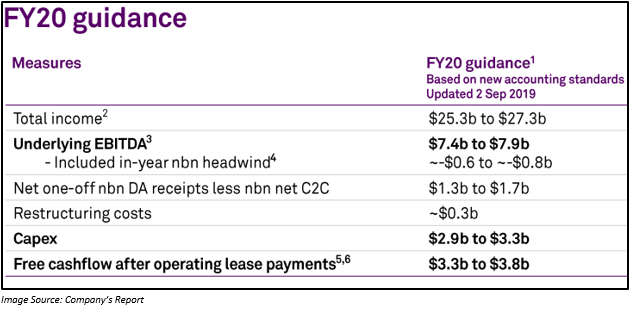

FY2020 Guidance:

Stock Performance.

The shares of TLS have generated a YTD return of 30.06%. The shares on 16 October 2019 opened at a price of $3.570. By the end of the dayâs trading, the closing price of TLS stood at $3.610, up 1.98% from its last close. TLS has a market cap of $42.1 billion with 11.89 billion outstanding shares, PE ratio of 19.56x and an annual dividend yield of 2.82%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.