Summary

- Energy demand has suffered significantly during the pandemic as the social distancing focus is impacting people’s energy and fuel consumption while downstream industries such as automotive are also facing difficulties.

- The supply chain disruptions have affected business operations, although online channels continue to boost sales and consumer activity.

- Consumer sentiments concerning the travel stocks are substantially low with the ongoing border restrictions allowing the scope for only domestic travel, with necessary safety measures.

- The remote work trends have fostered robust potential for the tech-based companies providing cloud solutions.

Covid-19 induced disruptions seem to have radically transformed the operative landscape for the organisations as the world continues to witness revolutions in a matter of months. The closure of business operations, behavioural changes while adapting to the new norms and the economic crunch seems to impact the operative scenario for many industries broadly. Meanwhile, the unprecedented circumstances have skyrocketed volatility on the stock market front.

Amidst such scenario, while some investors with high-risk appetite tend to look for the growth stocks that have substantial growth prospects, others adopt a cautious attitude targeting the value stock of established companies that are significantly cushioned against market downturns.

ALSO READ: 5 ASX Growth Stocks Under $5

As the investor’s psychological struggle between the value and growth continues, let us look at a few stocks which remained in the spotlight.

BHP Group Limited (ASX:BHP)

The international resource-oriented company, BHP Group Limited saw its share price in the past one month mark an uptick of 11.7% with the gradual revival of economic activities after severe lockdown restrictions. However, the stock in the last year has given the price return of 7.33%.

BHP stock, with the market capitalisation of 117.3 billion and an annual dividend yield of 5.35% closed at 39.340 on 7 August 2020.

While the steel production in China has surged dramatically, the company in its June Quarterly Update anticipates the ‘steel production ex-China’ would contract by a double-digit percentage in 2020.

ALSO READ: China Poised to Grab the Global Steel Trade as Economies Open up for Trade

The demands in the downstream industries such as automotive have collapsed in conjugation with the difficulty of the logistics, altogether affecting the iron ore demand. Furthermore, BHP indicated that while the premium coking coals exhibited attractive medium-term fundamentals, lower quality products may confront headwinds for an extended period. The energy coal market is already under the radar for its environmental implications.

For the year ending June 2020, the company met its full-year guidance for iron ore, metallurgical coal and copper and energy assets, while petroleum production was marginally below guidance owing to lower than expected gas demand.

Corporate Travel Management Limited (ASX:CTD)

Business-related travel services provider, Corporate Travel Management Limited saw its share price dip by 11.25% in the past one month with its stock closing at $9.740 on 7 August 2020. CTD deferred the Interim dividend until October 2020 and has the dividend yield of 4.37%.

Corporate Travel Management shares with the market capitalisation of $997.36 million in the current traveller’s apprehensions appear to trade below its value, having the PE ratio of 12.380.

The travel restrictions imposed on a global level has not only brought the travel sector to a standstill but also has led to a significant plunge in the investor’s sentiments for the travel stocks.

Amidst the ongoing scenario, CTD has taken cost reduction initiatives, with the cost base from 1 April declining from $26-27 million to $10-$12 million per month. The company indicated that with the current reduced cost base, it has an ability to operate in a high performing domestic-only business until international recovers.

Metcash Limited (ASX:MTS)

Metcash Limited, operating as a distributor of grocery products to retail and independent stores witnessed an increase in the share price of around 7% in the past six months, the period primarily coinciding with the lockdown restrictions. The company having $2.88 billion capitalisation traded at $2.840 on 7 August 2020.

Metcash distributed total FY20 final fully franked dividend of 12.5% per share, with a dividend payout ratio of approximately 60% of underlying EPS and an annual dividend yield of 4.43%.

The change in consumer behaviour with COVID-19 safety measures has decreased the frequency of customer visits to stores but has increased the average basket size and new customer visits, while food sales were up ~18% in March and April. Furthermore, enhancement in the online shopping trends is on a growth trajectory leading Group revenue to increase by 2.9% to $13 billion for FY20.

Harvey Norman Holdings Limited (ASX:HVN)

Australia-based retailer of consumer electrical goods along with furniture, bedding, and computers, Harvey Norman Holdings Limited, operates as a through franchisee model. HVN stock price has slumped by around 9% in the past six months. As of 7 August 2020, HVN stock with a market capitalisation of $5.02 billion ended the day’s trade at $3.970.

The company in June announced that it would pay a special dividend of 6 cents per share (fully franked) to shareholders. Notably, the group earlier in April 2020 cancelled FY20 interim dividend of 12 cents per share announced during pre-COVID disturbances and has the annual dividend yield of 8.19%.

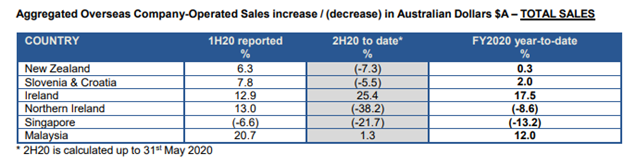

Overseas Harvey Norman® Company-Operated Stores witnessed temporary closures across different geographic markets, affecting the Sales Revenue for the financial period between 1 July 2019 to 31 May 2020. HVN stock has a PE ratio of 12.270.

Source: HVN ASX Update

Nick Scali Limited (ASX:NCK)

Australian furniture retailer, Nick Scali Limited reported an exceptional jump in its sales to post the recovery in consumer activities, with exceptional growth (over 70%) during May and June 2020 driving the written sales orders for FY20 up from $268.9 million to $293.2 million.

While poor trading and temporary store closures during March and April caused an estimated sales order loss of ~$9-11 million, H2 FY20 written sales were up by 18% on H2 FY19, with store traffic increasing by ~30% after store reopening.

On the stock market front, NCK stock with the market capitalisation of over $712.8 million, ended day’s trade at $8.710 on 7 August 2020. The company paid the final dividend of 22.5 cents per share in FY20 with the full year pay-out ratio of 90%. As on 7 August 2020, NCK stock has the dividend yield of 5.4% and a PE ratio of 16.960.

Infigen Energy (ASX:IFN)

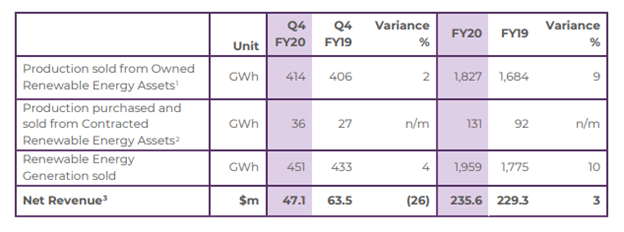

Infigen’s Net Revenue in Q4 FY20 decreased by 26% compared to FY19. The spot and forward prices of wholesale electricity have overall witnessed a substantial step-down owing to lower domestic economic activity and lower global energy prices.

Furthermore, the COVID-19 induced crisis is expected to result in continued low electricity prices. As a result of it, Infigen expects to record a non-cash loss in the order of $15-20m at its FY20 Full Year Results on the fair value of derivative financial instruments concerning its Contracted Assets.

Infigen on 3 August 2020 announced the indefinite suspension of distributions, with the subdued near-term earnings outlook and need for further capital investment for funding its long-term growth. Notably, the Boards has earlier determined not to pay a distribution concerning H2FY20.

Source: IFN ASX Update

IFN stock rose by over 32% in the past six months, closing at $0.925 on 7 August 2020. The company has the market capitalisation of 893.09 million and the PE ratio and an annual dividend yield of 19.170 and 2.17%, respectively.

ELMO Software Limited (ASX:ELO)

Software service provider, ELMO Software Limited reported strong growth in annualised recurring revenue by 19.7% to a record $55.1 million, propelled by organic growth from new and existing customers. Meanwhile, FY20 financial results also saw a significant increase in its statutory revenue, cash receipts and number of customers.

The incorporation of remote working trends amidst COVID-19 is fostering the robust opportunity to ELMO, which has integrated product suite providing solutions concerning cloud HR, payroll, and attendance solution.

ELO stock in the past six months slumped by 11% to $6.250 on 7 August 2020.

.jpg)