Highlights

The Australian share market opened higher on Thursday.

The ASX 200 gained 26.40 points, or 0.41%, to 6,488.40 at the open.

The All-Ordinaries index was trading 0.417% higher at 6,687.6 at the open.

The Australian share market opened higher on Thursday, gaining 26.40 points, or 0.41%, to 6,488.40, at the open. The domestic market was poised to open higher, tracking positive cues from Wall Street, which recorded a significant surge in overnight trade.

The ASX 200 benchmark index has shed 3.16% in the past five days. It has fallen 9.84% in the past 52 weeks, according to the ASX data.

While the All-Ordinaries index was trading 0.417% higher at 6,687.6, the volatility index rose 1.987% to 20.275. On Wednesday, the benchmark index closed 0.5% lower at 6,462 points.

In the first 10 minutes of trade, the ASX 200 was trading at 6,578.30, up 116.30 points, or 1.80%.

On Wall Street, the Dow Jones surged 1.9%, the S&P 500 gained 2%, and the NASDAQ ended 2.05% higher. In Europe, the Stoxx 50 rose 0.2%, the FTSE surged 0.3%, the CAC gained 0.2%, and the DAX ended 0.4% higher.

Market action

After the first half an hour, the benchmark index ASX 200 was trading up 1.88%, or 121.30 points, at 6,583.30, with the materials, utilities, real estate, and financials sectors recording strong gains in opening trade.

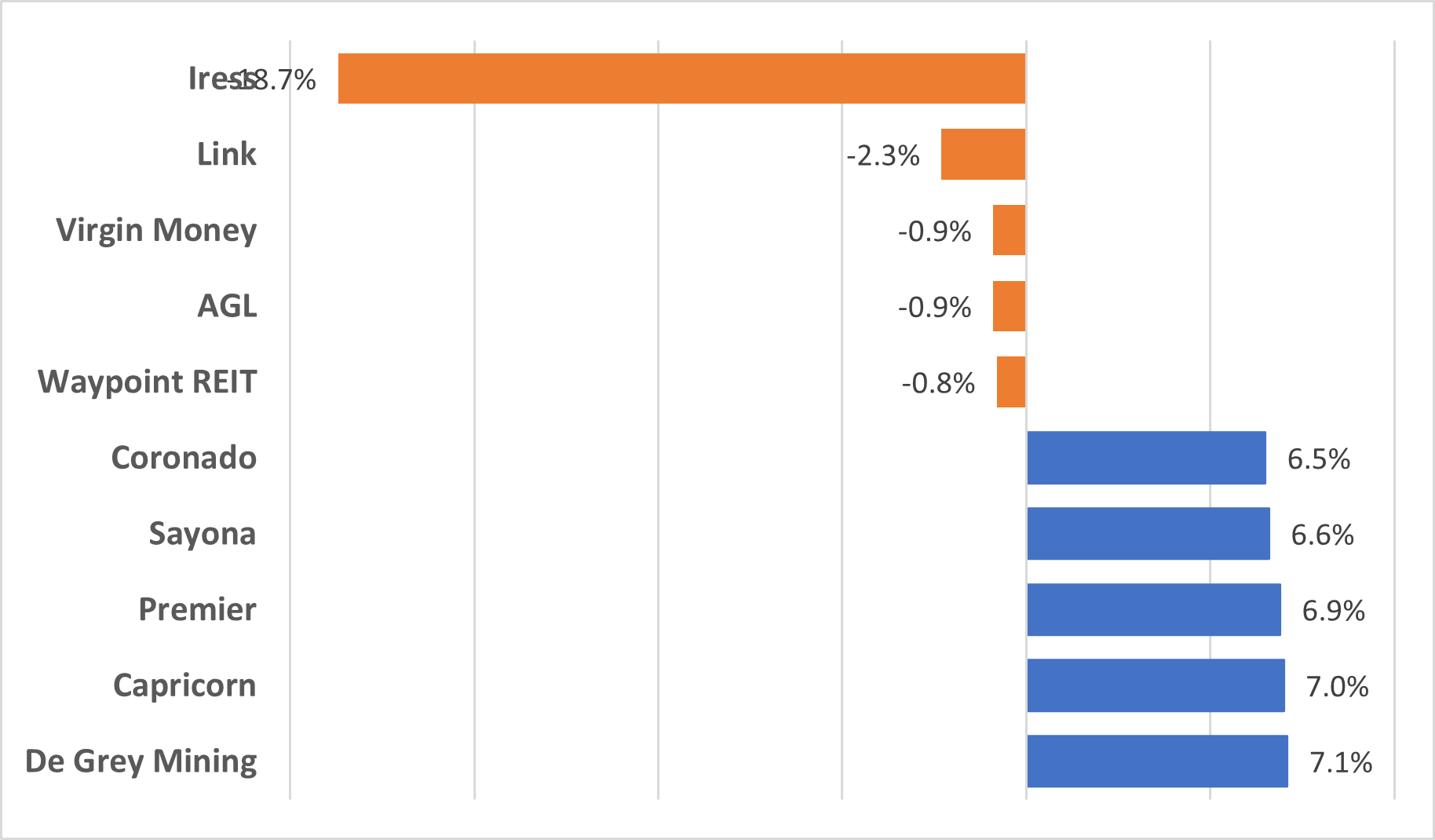

Iress shed the most, while De Grey Mining gained the most.

Data Source: ASX (as of 29 September 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

Newsmakers

- AGL said it would advance the closure of its Loy Yang A coal-fired power station in Victoria by a decade to 2035.

- The ASIC has filed a case against Nuix in the Federal Court alleging breaches of continuous disclosure and misleading conduct.

- Premier Investments reported a statutory net profit rise of 4.9% to AU$285.2 million in FY22.

- Iress downgraded its profit guidance, with a new net profit expected to be between AU$54 million and AU$58 million.