Highlights

Australian shares opened higher on Monday.

The ASX 200 index rose 6.10 points to 6,951.30 at the open.

The benchmark index ended 0.8% higher at 6,945.2 points last Friday.

The Australian share market opened higher on Monday, tracking strong cues from Wall Street. The domestic market was boosted by gains in the materials and technology sectors, countering banking shares’ losses.

The Reserve Bank of Australia (RBA) is widely tipped to hike its cash rate at its Tuesday’s policy meeting. The economists expect the Australian central bank to raise rate by 0.5% despite muted inflation data in the second quarter.

The ASX 200 index rose 6.10 points to 6,951.30 at the open. The ASX All Ordinaries index rose 0.074% to 7,179.1, while the A-VIX fell 0.354% to 15.3 at the open. The benchmark index was trading at 6,953, up 7.80 points or 0.11% in the first ten minutes of trade.

The benchmark index ended 0.8% higher at 6,945.2 points last Friday. The index has gained 2.38% in the past five days but has dropped 6.63% on a year-to-date (YTD) basis.

Global equity indices

July was a positive trading month for Wall Street. The tech-heavy NASDAQ delivered its strongest performance since April 2020.

Both consumer spending and labour costs rose sharply in the US in Q2. However, the US stock market indices rose due to strong earnings reported by big tech firms such as Apple and Amazon.

In the US, the Dow Jones rose 1%, the S&P 500 surged 1.4%, and the NASDAQ ended 1.9% higher.

In Europe, the Stoxx 50 rose 1.5%, the FTSE surged 1.1%, the DAX gained 1.5%, and the CAC ended 1.7% higher.

Market action

The benchmark 10-year Treasury bond yields declined 0.94% to 2.656. Similarly, the US Dollar Futures Index fell 0.51% to US$105.690.

Data Source: ASX (as of 1 August 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

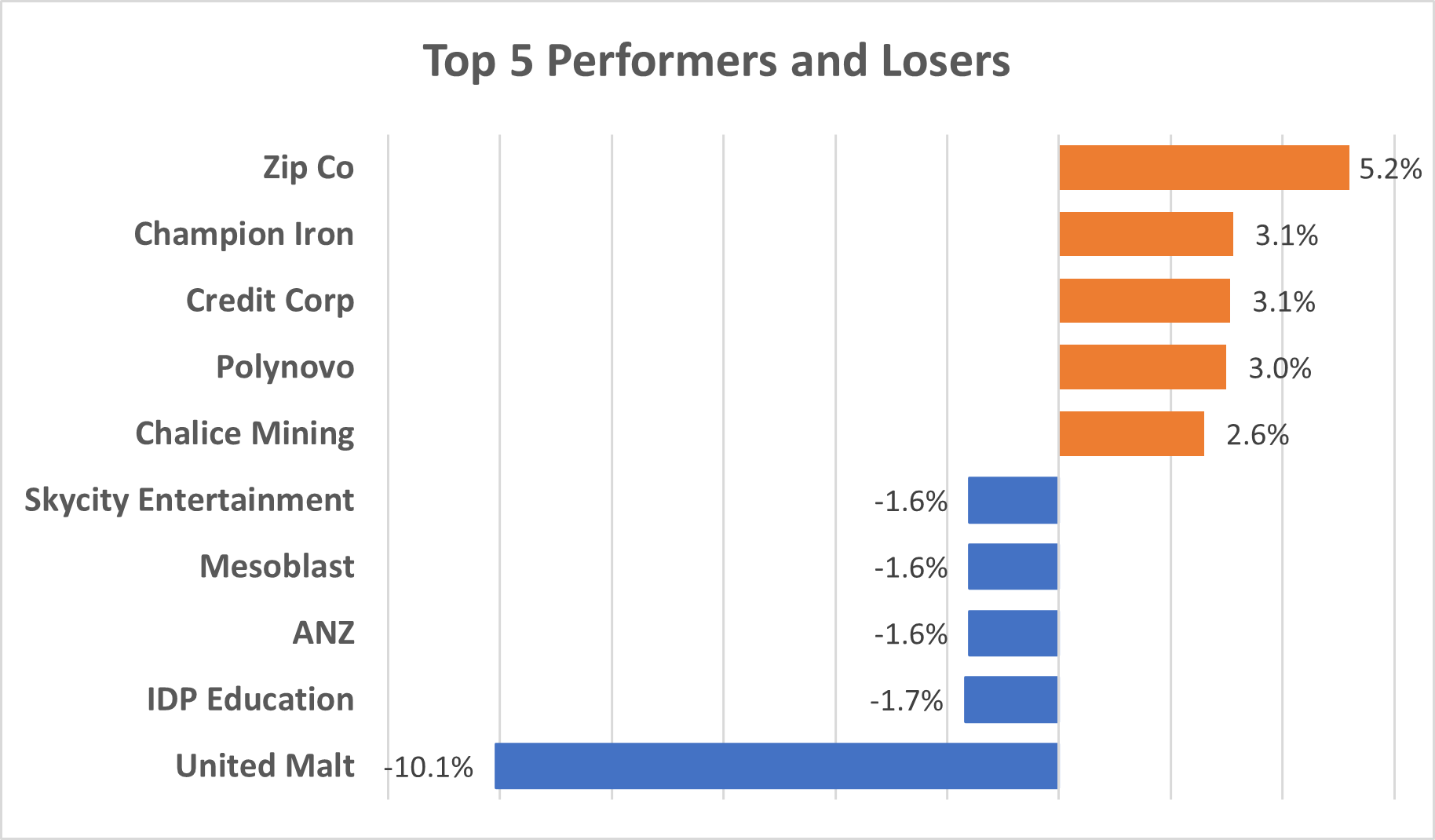

While Zip (ASX:ZIP) and Champion Iron (ASX:CIA) were the top gainers, United Malt (ASX:UMG) and IDP Education (ASX:IDP) were the top laggards.

Barring financials and energy, all sectors were trading in the green.

Newsmakers

- Deterra Royalties reported total royalty receipts of AU$113.1 million for the June quarter.

- Westpac said that it has completed the sale of Westpac Life Insurance Services to TAL Dai-ichi Life Australia.

- United Malt Group expects FY22’s underlying EBITDA between AU$100 million and AU$108 million.

- Emerging lithium and boron supplier Ioneer has inked an agreement with Prime Planet Energy & Solutions (PPES), which is a joint venture between Toyota and Panasonic.