Wall Street indices ended the last trading day of the month on a positive note on July 29, Friday, while S&P 500 index marked its best performing month in around two years.

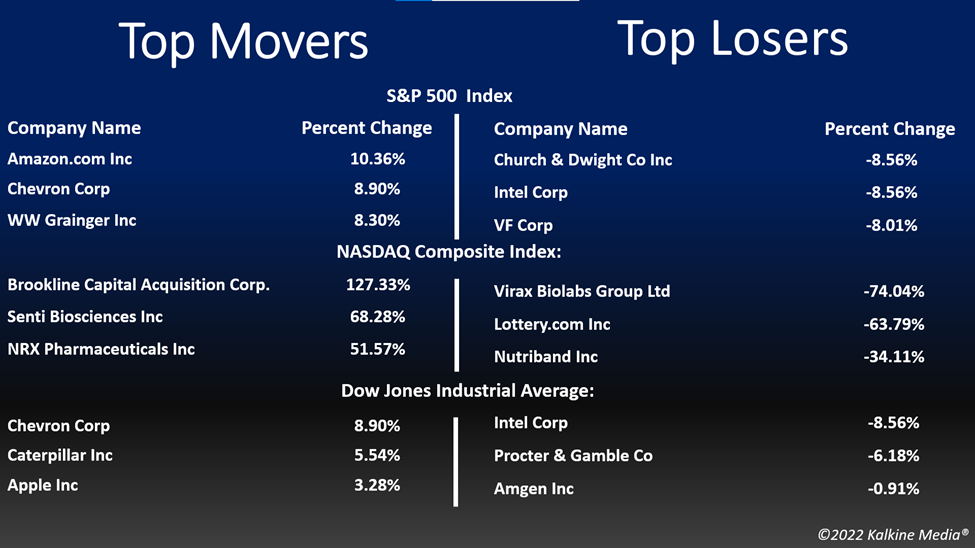

The S&P 500 rose 1.42% to 4,130.29. The Dow Jones was up 0.97% to 32,845.13. The NASDAQ Composite added 1.88% to 12,390.69, and the small-cap Russell 2000 rose 0.65% to 1,885.23.

The flurry of latest data suggesting that the economy is crippling has eased some concerns of the investors that the Fed may turn dovish with their monetary policy amid a cooling economy.

In addition, positive earnings from big companies like Apple Inc. (NASDAQ AAPL), and Amazon.com, Inc. (AMZN), among others lifted the market spirit suggesting that the big companies have avoided the market uncertainties in the latest quarter.

In economic data, consumer spending surged 1.1 per cent in the previous month, accelerating from May, the Commerce Department reported on Friday.

On the other hand, the PCE price index advanced one per cent in the prior month, the Commerce Department report showed Friday, noting its highest monthly gain since 2005. In May, the PCE price index rose 0.6 per cent.

Nine of the 11 segments of the S&P 500 index were in the green, with consumer staples and healthcare sectors declining. Consumer discretionary and information technology provided the highest boost.

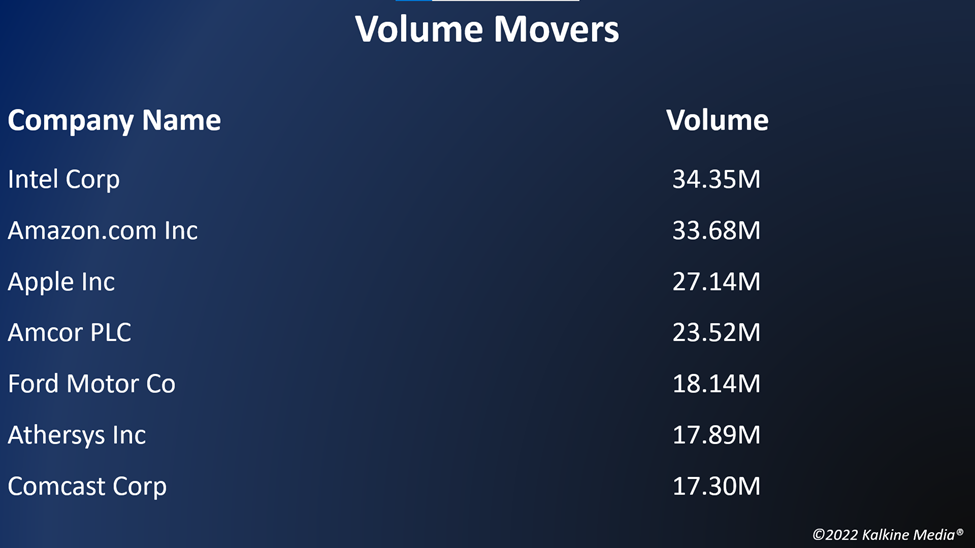

Shares of Apple Inc. (AAPL) gained 3.6% in intraday trading, a day after the technology company reported growth in its iPhone sales in the latest quarter.

Amazon.com, Inc. (AMZN) climbed 11.78%, a day after the e-commerce company reported strong quarterly revenue growth that topped the analysts' estimates.

The Procter & Gamble Company (PG) stock declined 5.76% after the consumer goods firm said that the consumers are trimming their spending after months of increasing inflation.

In the healthcare sector, AbbVie Inc. (ABBV) fell 4.17%, AstraZeneca PLC (AZN) declined 0.73%, and Abbott Laboratories (ABT) fell 1.38%. Novartis AG (NVS) and Bristol-Myers Squibb Company (BMY) plummeted by 1.64% and 1.23%, respectively.

In technology stocks, Microsoft Corporation (MSFT) gained 1.57%, NVIDIA Corporation (NVDA) soared 1.00%, and ASML Holding N.V. (ASML) jumped 2.45%. Oracle Corporation (ORCL) and Adobe Inc. (ADBE) advanced 1.04% and 1.64%, respectively.

In the energy sector, Exxon Mobil Corporation (XOM) rose 4.63%, Chevron Corporation (CVX) added 8.90%, and Shell plc (SHEL) grew 3.67%. TotalEnergies SE (TTE) and ConocoPhillips (COP) increased by 4.29% and 3.58%, respectively.

Futures & Commodities

Gold futures were up 0.78% to US$1,764.00 per ounce. Silver increased by 2.33% to US$20.330 per ounce, while copper rose 3.34% to US$3.5907.

Brent oil futures increased by 1.88% to US$103.74 per barrel and WTI crude was up 1.99% to US$98.34.

Bond Market

The 30-year Treasury bond yields were down 0.78% to 3.015, while the 10-year bond yields fell 0.94% to 2.656.

US Dollar Futures Index decreased by 0.51% to US$105.690.