Highlights

The Australian share market opened flat on Wednesday.

The ASX 200 index fell 16.60 points, or 0.23% to 7.122 at the open.

The index has gained 1.85% in the past five days.

The Australian share market opened flat on Wednesday despite Wall Street closing on a positive note in overnight trade, supported by strong retailer earnings. However, the domestic market is expected to be weighed under recession concerns and weak crude oil prices.

The ASX 200 index fell 16.60 points, or 0.23% to 7.122 at the open. The index has gained 1.85% in the past five days but has declined 0.23% on a year-to-date (YTD) basis. The ASX All Ordinaries index was flat at 7,361.9, while the A-VIX fell 1.52% to 13.932 at the open. On Tuesday, the benchmark index closed 0.6% higher at 7,105.4 points.

How the ASX 200 soon rebounded. The benchmark index was trading at 7,113.30, down 7.90 points or 0.11% in the first 15 minutes of the trade.

In the US, the Dow Jones surged 0.7% and the S&P 500 rose 0.2%, but the NASDAQ fell 0.2%.

In Europe, the Stoxx 50 rose 0.4%, the FTSE also gained 0.4%, the CAC surged 0.3%, and the DAX ended 0.7% higher.

Market action

US Treasury yields surged on Tuesday on positive data from major US retailers. The benchmark 10-year Treasury yields soared to 2.81%. However, the US dollar index dipped 0.009%.

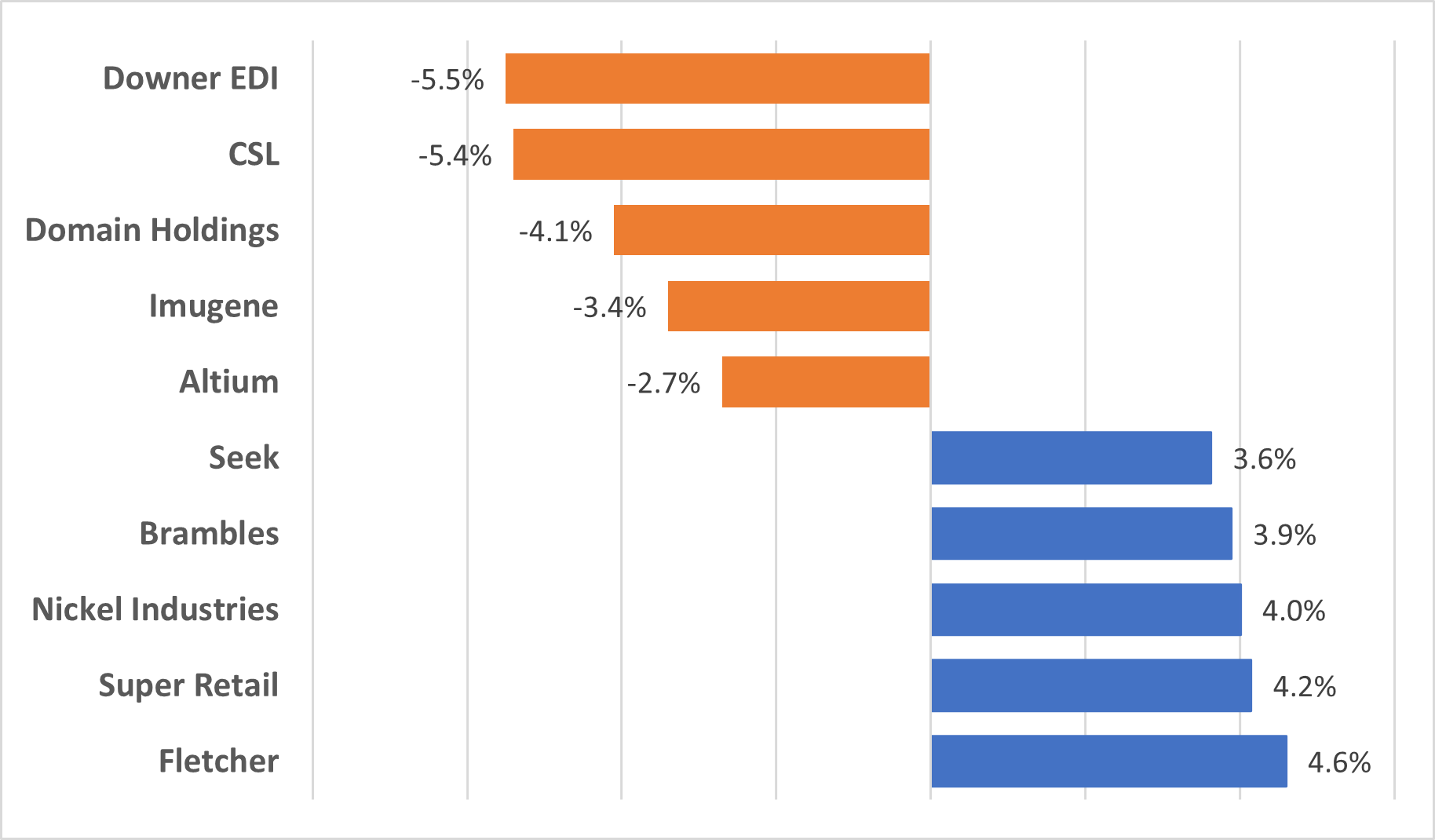

Data Source: ASX (as of 17 August 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

Fletcher was the top gainer, while Downer EDI was the top loser.

Meanwhile, on the ASX, consumer discretionary and industrials were the best performing sectors in early trade. Healthcare was the top laggard.

Newsmakers

- CSL reported a 6% fall in net profit after tax (NPAT) of US$2.255 billion (constant currency).

- Magellan reported a 23% decline in revenue to AU$553.53 million.

- Santos reported free cash flow of US$1.7 billion for 1HFY22 and an underlying profit of $US1.3 billion, up 300% on the prior corresponding period.

- Whispir has doubled its net loss to AU$19.4 million on sales up 48% to AU$70.6 million for FY22.

- Redbubble reported a net loss of AU$24.6 million in the year to 30 June.

- Domain reported a net profit after tax of (NPAT) AU$55.3 million for FY2022.