Highlights

- Vanadium Resources, through its South African subsidiary, is purchasing land for its proposed SRL (Salt Roast Leaching) Plant.

- The 135-hectare industrial site sits within a 15km radius of the Steelpoortdrift mine.

- A water treatment facility and a solar PV plant are planned to be constructed near the proposed SRL site.

- VR8 expects to finalise the Steelpoortdrift DFS in September 2022.

Vanadium Resources Limited (ASX:VR8) is making some serious strides at its flagship Steelpoortdrift Project, one of the world’s largest and highest-grade vanadium deposits.

In a major development, the company’s subsidiary Vanadium Resources (Pty) (VanRes) has entered into an option agreement to acquire a 135-hectare industrial land for the proposed Salt Roast Plant (SRL Plant).

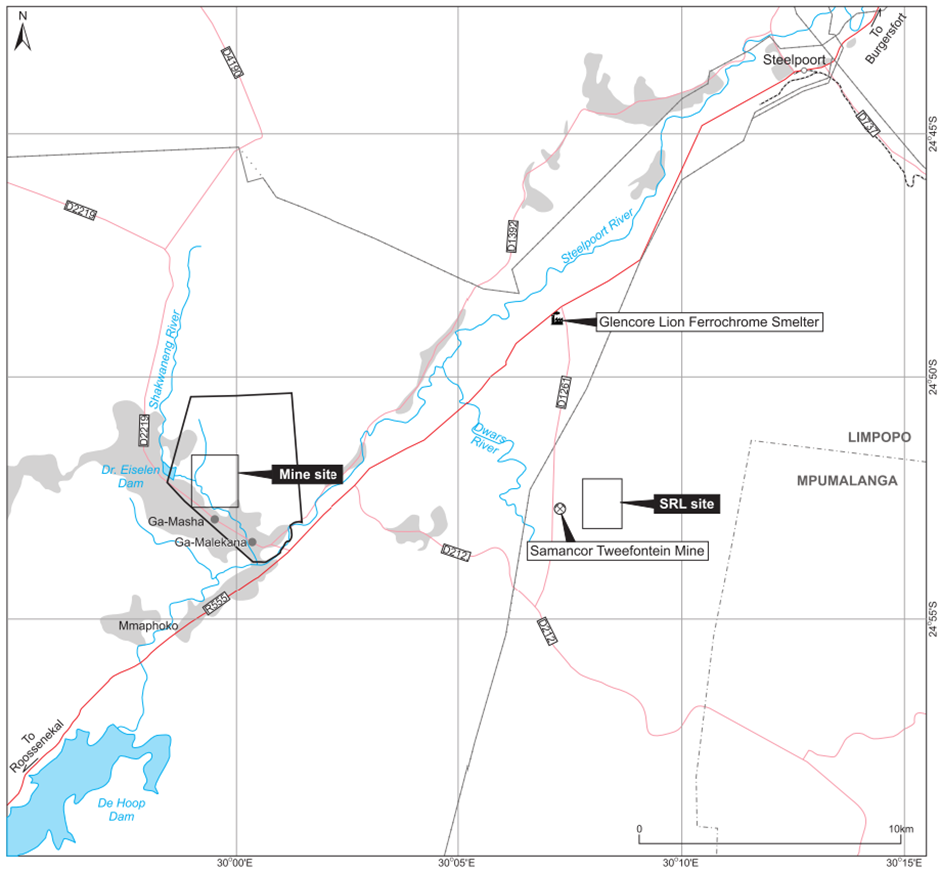

The proposed SRL site will be in close proximity of nearly 15km from the Steelpoortdrift Mine site, thereby reducing trucking distance by half, saving costs and resulting in significant ESG efficiencies.

VR8 is currently advancing the Definitive Feasibility Study (DFS) on the project, which is expected to be finalised in September 2022. The DFS is focused on mining operations and the construction of a concentrator and salt roast plant.

The concentrator and SRL plant are expected to have an initial capacity of 12,500tpa of V2O5 flake at an estimated CAPEX of US$200 million.

To know more about VR8, click here.

Details of the Option Agreement

VanRes has executed an agreement with Kadoma Investments Proprietary Limited, under which the former holds an option to purchase a portion 15 of the Farm Tweefontein in Limpopo, South Africa, for a total consideration of AU$2.9 million.

The option agreement is conditional, including:

- VanRes needs to raise sufficient funding for the construction of the Steelpoortdrift Mine, concentrator and the SRL Plant.

- VanRes secures all regulatory permits, including environmental and heritage approvals required for the purpose of processing and refining vanadium, titanium and iron as applicable by the law.

- Kadoma procures the rezoning in accordance with the by-laws to rezone the SRL site for the processing and refining of vanadium, titanium and iron bearing minerals to produce high-purity metals.

For VR8’s latest update, click here.

Under the terms of the agreement, VanRes will be entitled to waive compliance of any one or more of them at any time before or on 31 August 2023. The option provided in the agreement will commence on the fulfilment of the conditions or waiver of the suspensive conditions and will endure for a period of 30 days up to 30 September 2023.

SRL Plant sits within a world-renowned mining hub

The proposed SRL Plant site is located within a 15km radius of the mine site in the world-renowned Bushveld Complex. Chrome and platinum mining operations are located near the proposed site, which is nearly 22km by road from the Steelpoortdrift Mine.

Location of SRL site with respect to Steelpoortdrift Mine and existing infrastructure (Image source: VR8 update, 19 August 2022)

SRL Plant site to have significant ESG credentials

Kadoma plans to have a water treatment facility and a solar plant adjacent to the SRL site. The facilities are expected to serve the proposed SRL Plant and existing mining operations in the area.

The water treatment facility is expected to provide water to the SRL Plant at a beneficial cost. Also, the facility will process and treat the grey and stormwater from the SRL Site and other mines in the vicinity.

To supply green energy to the SRL Plant and other existing mining operations, Kadoma and its holding company Freedom Property Fund will develop a utility-scale PV Solar Plant. The plant will be commissioned in modules, each with a 2MW peak capacity.

Share price movement: Shares of VR8 traded at AU$0.073 apiece on the ASX on 19 August 2022, up over 4% from the last close. The company has a market cap of AU$33.14 million as of 19 August 2022.