Highlights

- IOUpay is initiating the rollout of myIOU KA$Hplus Visa Prepaid Card in collaboration with Virtualflex.

- The initial two years will see the issue of a minimum of 10,000 cards.

- The two-stage product launch will involve card issue to selected myIOU BNPL customers and card integration with myIOU BNPL Service.

- IOU is developing myIOU Islamic, a Shariah-compliant BNPL offering.

- The company is working to gain a Shariah Compliance certification for the new product under development.

Set for an exciting period ahead, IOUpay Limited (ASX:IOU) has unveiled its first product development update for the next financial year.

The fintech company has launched a strategic collaboration for a co-branded prepaid card and initiated a new Islamic BNPL offering, as part of the efforts to boost its foothold in the South-East Asia (SEA) region.

Triggered by the update, IOU shares jumped over 13% to trade at AU$0.051 midday on 24 June 2022.

RELATED READ: Fintech player IOUpay (ASX:IOU) issues update on IDSB transaction

Agreement with Virtualflex for myIOU KA$Hplus Visa Prepaid Card

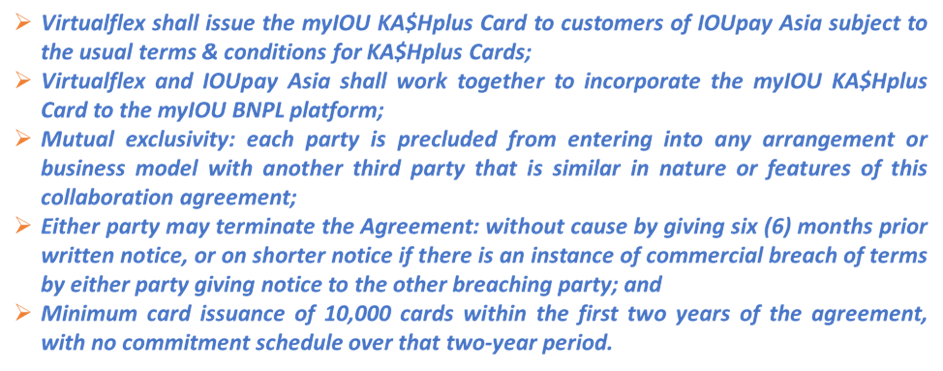

IOU’s wholly owned subsidiary, IOU Pay (Asia) Sdn Bhd, has entered a collaboration agreement with Virtualflex Sdn Bhd to offer a co-branded myIOU KA$Hplus Visa prepaid debit card to myIOU customers in Malaysia.

IOUpay will have access to the products, features and collaborations available across Virtualflex’s suite of products and current business.

The earliest to be introduced as part of this arrangement is the co-branded myIOU KA$Hplus Card, a reloadable prepaid debit card.

The myIOU KA$Hplus Card is planned for roll out in two stages. The first stage involves issuing myIOU KA$Hplus cards to selected myIOU BNPL customers, and the second stage will involve integration with the myIOU BNPL Service.

The three-year exclusive arrangement can be renewed for three more years, subject to a mutual agreement.

Agreement terms (Source: IOU Announcement 24/06/2022)

ALSO READ: IOUpay (ASX:IOU) BNPL offering hits Shopify e-Commerce platform, shares jump

Objectives behind myIOU KA$Hplus Card

As the agreement provides for at least 10,000 cards to be ordered and issued within the initial two years, the minimum amount payable to Virtualflex for card issuance is RM200,000 (approx. AU$64,725).

For kick-starting the project works, RM50,000 (~AU$16,181) has already been paid to Virtualflex, which will also receive an annual maintenance fee of RM30,000 (~AU$9,709) in advance, commencing upon card launch with the first card application received.

The initiative aims to:

- Access merchants yet to onboard myIOU

- Offer further value to myIOU consumers

- Enhance brand loyalty and drive growth in new consumers

- Deliver further revenue streams via prospective upcoming product enhancements

- Boost myIOU product coverage to more merchants both domestically as well as internationally

MUST READ: IOUpay (ASX:IOU) beefs up myIOU BNPL service footprint with Pine Labs deal

Stage 1 of myIOU KA$Hplus Card rollout

Under Stage 1, the myIOU KA$Hplus card will be issued to customers who are presently approved for and actively utilising myIOU Credit+. This includes customers who have qualified for a myIOU BNPL credit limit of a minimum of RM3,500 (~AU$1,100).

The card will also be issued to selected customers of I.Destinasi Sdn Bhd (IDSB) as part of a cross-sell marketing initiative being advanced.

Necessary approvals for issuing the myIOU KA$Hplus Card have been received from Malaysia’s central bank, Bank Negara Malaysia (BNM).

IOU has planned Stage 1 rollout to begin in July 2022.

MUST READ: IOUpay (ASX:IOU) clocks 15% growth in mid-June quarter BNPL volumes

Stage 2 of myIOU KA$Hplus Card rollout

The rationale behind the initiative is the integration of myIOU KA$Hplus Card into the myIOU BNPL platform. This would enable customers to purchase goods or services using the card anywhere Visa is accepted and then convert the purchase into a myIOU BNPL transaction, for which a transaction fee will be charged.

Currently, this stage remains subject to BNM approval for the linkage to the myIOU BNPL service. IOU anticipates that the rollout of Stage 2 will take six months from the confirmation of BNM approval.

RELATED ARTICLE: Key Milestone! IOUpay (ASX:IOU) secures PCI compliance certification

New product under development - myIOU Islamic

The Islamic population is currently growing and exceeds 60% in Malaysia. Moreover, Islamic finance and investment include over 50% of the banking and payments market of Malaysia.

A certification from a Shariah advisor licensed by the Securities Commission of Malaysia is required for accessing Islamic financing and BNPL opportunities within industry best practices for Shariah principles in Malaysia.

IOU looks to offer its Shariah-compliant BNPL service under the name ‘myIOU Islamic’.

Given this backdrop, IOU has been looking to secure certification of Shariah Compliance for its myIOU BNPL service offering. The company has been closely engaged with an appropriately licensed, independent global Shariah advisory firm.

The Company expects to receive certification in the September quarter (Q1 FY23), clearing the way to make preparations to provide Islamic financing as well as conventional BNPL.

This would include partitioning the myIOU portfolio, integration with an Islamic Payment Gateway, separate documentation, policies and procedures, and an Islamic Bank Account for all Shariah-compliant transactions.

IOU looks to achieve the following objectives through the Shariah Compliance initiative:

- Enter the Islamic BNPL market, serving Islamic merchants and consumers

- Offer an alternative to conventional BNPL

- Boost brand standing in Malaysia and SEA

- Prepare for territory expansion into other SEA jurisdictions with large Islamic populations

At present, IOU is engaged in completing a collaboration agreement with a Shariah-compliant payment gateway and looks to complete integration within 30 days of signing.